A modern business plan that will lead your business on the road to success must have another critical element. That element is a part where you will need to cover possible risks related to your small business. So, you need to focus on managing risk and use risk management processes if you want to succeed as an entrepreneur.

How can you manage risks?

You can always plan and predict future things in a certain way that will happen, but your impact is not always in your hands. There are many external factors when it comes to the business world. They will always influence the realization of your plans. Not only the realization but also the results you will achieve in implementing the specific plan. Because of that, you need to look at these factors through the prism of the risk if you want to implement an appropriate management process while implementing your business plan.

By conducting a thorough risk analysis, you can manage risks by identifying potential threats and uncertainties that could impact your business. From market fluctuations and regulatory changes to competitive pressures and technological disruptions, no risk will go unnoticed. With these insights, you can develop contingency plans and implement risk mitigation strategies to safeguard your business’s interests.

This guide will provide practical tips and real-life examples to illustrate the importance of proper risk analysis. Whether you’re a startup founder preparing a business plan or a seasoned entrepreneur looking to reassess your risk management approach, this guide will equip you with the knowledge and tools to navigate the complex landscape of business risks.

Why is Risk Analysis Important for Business Planning?

Risk analysis is essential to business planning as it allows you to proactively identify and assess potential risks that could impact your business objectives. When you conduct a comprehensive risk analysis, you can gain a deeper understanding of the threats your business may face and can take proactive measures to mitigate them.

One of the key benefits of risk analysis is that it enables you to prioritize risks based on their potential impact and likelihood of occurrence. This helps you allocate resources effectively and develop contingency plans that address the most critical risks.

Additionally, risk analysis allows you to identify opportunities that may arise from certain risks, enabling you to capitalize on them and gain a competitive advantage.

It is important to adopt a systematic approach to effectively analyze risks in your business plan. This involves identifying risks across various market, operational, financial, and legal areas. By considering risks from multiple perspectives, you can develop a holistic understanding of your business’s potential challenges.

What is a Risk for Your Small Business?

In dictionaries, the risk is usually defined as:

The possibility of dangerous or bad consequences becomes true.

When it comes to businesses, entrepreneurs, or in this case, the business planning process, it is possible that some aspects of the business plan will not be implemented as planned. Such a situation could have dangerous or harmful consequences for your small business.

It is simple. If you don’t implement something you have in your business plan, there will be some negative consequences for your small business.

✋ Warning

Here is how you can write the business plan in 30 steps.

Types of Risks in Business Planning

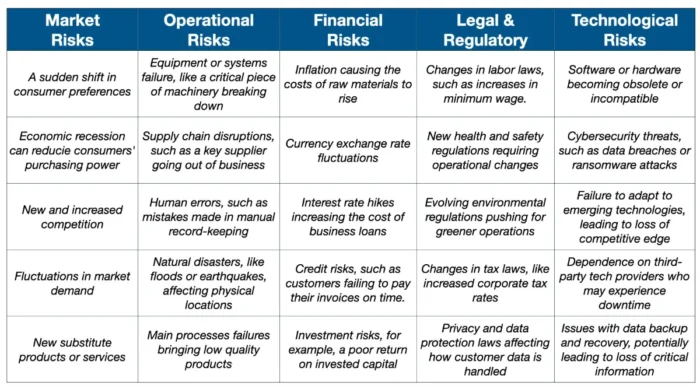

When conducting a business risk assessment for your business plan, it is essential to consider various types of risks that could impact your venture. Here are some common types of risks to be aware of:

1. Market risks

These risks arise from fluctuations in the market, including changes in consumer preferences, economic conditions, and industry trends. Market risks can impact your business’s demand, pricing, and market share.

2. Operational risk

Operational risk is associated with internal processes, systems, and human resources. These risks include equipment failure, supply chain disruptions, employee errors, and regulatory compliance issues.

3. Financial risks

Financial risks pertain to managing financial resources and include factors such as cash flow volatility, debt levels, currency fluctuations, and interest rate changes.

4. Legal and regulatory risks

Legal and regulatory risks arise from changes in laws, regulations, and compliance requirements. Failure to comply with legal and regulatory obligations can result in penalties, lawsuits, and reputational damage.

5. Technological risks

Technological risks arise from rapid technological advancements and the potential disruptions they can cause your business. These risks include cybersecurity threats, data breaches, and outdated technology infrastructure.

Basic Characteristics of Risk

Before you start with the development of your small business risk management process, you will need to know and consider the essential characteristics of the possible risk for your company.

What are the basic characteristics of a possible risk?

The risk for your company is partially unknown.

Your entrepreneurial work will be too easy if it is easy to predict possible risks for your company. The biggest problem is that the risk is partially unknown. Here we are talking about the future, and we want to prepare for that future. So, the risk is partially unknown because it will possibly appear in the future, not now.

The risk to your business will change over time.

Because your businesses operate in a highly dynamic environment, you cannot expect it to be something like the default. You cannot expect the risk to always exist in the same shape, form, or consequence for your company.

You can predict the risk.

It is something that, if we want, we can predict through a systematic process. You can easily predict the risk if you install an appropriate risk management process in your small business.

The risk can and should be managed.

You can always focus your resources on eliminating or reducing risk in the areas expected to appear.

Risk Management Process You Should Implement

The risk management process cannot be seen as static in your company. Instead of that, it must be seen as an interactive process in which information will continuously be updated and analyzed. You and your small business members will act on them, and you will review all risk elements in a specified period.

Adopting a systematic approach to identifying and assessing risks in your business plan is crucial. Here are some steps to consider:

1. Risk Identification

First, you must identify risk areas. Ask and respond to the following questions:

- What are my company’s most significant risks?

- What are the risk types I will need to follow?

In business, identifying risk areas is the process of pinpointing potential threats or hazards that could negatively impact your business’s ability to conduct operations, achieve business objectives, or fulfill strategic goals.

Just as meteorologists use data to predict potential storms and help us prepare, you can use risk identification to foresee possible challenges and create plans to deal with them.

Risk can arise from various sources, such as financial uncertainty, legal liabilities, strategic management errors, accidents, natural disasters, and even pandemic situations. Natural disasters can not be predicted or avoided, but you can prepare if they appear.

For example, a retail business might identify risks like fluctuating market trends, supply chain disruptions, cybersecurity threats, or changes in consumer behavior. As you can see, the main risk areas are related to types of risk: market, financial, operational, legal and regulatory, and technological risks.

You can also use business model elements to start with something concrete:

- Value proposition,

- Costs,

- Revenue,

- Customers,

- Customers relationships,

- Distribution channels,

- Key resources and

- Key partners.

It is not necessarily that there will be risk in all areas and that the risk will be with the same intensity for all areas. So, based on your business environment, the industry in which your business operates, and the business model, you will need to determine in which of these areas there is a possible risk.

Also, you must stay informed about external factors impacting your business, such as industry trends, economic conditions, and regulatory changes. This will help you identify emerging risks and adapt your risk management strategies accordingly.

The idea for this step is to create a table where you will have identified potential risks in each important area of your business.

2. Risk Profiling

Conduct a detailed analysis of each identified risk, including its potential impact on your business objectives and the likelihood of occurrence. This will help you develop a comprehensive understanding of the risks you face.

Qualitative Risk Analysis

The qualitative risk analysis process involves assessing and prioritizing risks based on ranking or scoring systems to classify risks into low, medium, or high categories. For this analysis, you can use customer surveys or interviews.

Qualitative risk analysis is quick, straightforward, and doesn’t require specialized statistical knowledge to conduct a business risk assessment. The main negative side is its subjectivity, as it relies heavily on thinking about something or expert judgment.

This method is best suited for initial risk assessments or when there is insufficient quantitative analysis data.

For example, if we consider the previously identified risk of a sudden shift in consumer preferences, a qualitative analysis might rate its likelihood as 7 out of 10 and its impact as 8 out of 10, placing it in the high-priority quadrant of our risk matrix. But, qualitative analysis can also use surveys and interviews where you can ask open questions and use the qualitative research process to make this scaling. This is much better because you want to lower the subjectivism level when doing business risk assessment.

Quantitative Risk Analysis

On the other side, the quantitative risk analysis method involves numerical and statistical techniques to estimate the probability and potential impact of risks. It provides more objective and detailed information about risks.

Quantitative risk analysis can provide specific, data-driven insights, making it easier to make informed decisions and allocate resources effectively. The negative side of this method is that it can be time-consuming, complex, and requires sufficient data.

You can use this approachfor more complex projects or when you need precise data to inform decisions, especially after a qualitative analysis has identified high-priority risks.

For example, for the risk of currency exchange rate fluctuations, a quantitative analysis might involve analyzing historical exchange rate data to calculate the probability of a significant fluctuation and then using your financial data to estimate the potential monetary impact.

Both methods play crucial roles in effectively managing risks. Qualitative risk analysis helps to identify and prioritize risks quickly, while quantitative analysis provides detailed insights for informed decision-making.

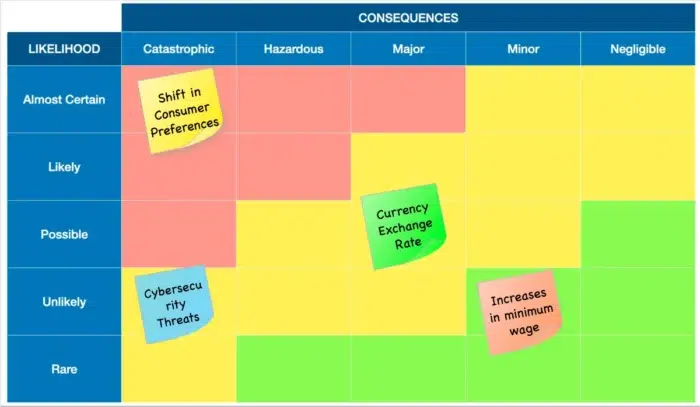

3. Business Risk Assessment Matrix

Once you have identified potential risks and analyzed their likelihood and potential impact, you can create a business risk assessment matrix to evaluate each risk’s likelihood and impact. This matrix will help you prioritize risks and allocate resources accordingly.

A business risk assessment matrix, sometimes called a probability and impact matrix, is a tool you can use to assess and prioritize different types of risks based on their likelihood (probability) and potential damage (impact). Here’s a step-by-step process to create one:

- Step 1: Begin by listing out your risks. For our example, let’s consider four of the risks we identified earlier: a sudden shift in consumer preferences (Market Risk), currency exchange rate fluctuations (Financial Risk), an increase in the minimum wage (Legal), and cybersecurity threats (Technological Risk).

- Step 2: Determine the likelihood of each risk occurring. In the process of risk profiling, we’ve determined that a sudden shift in consumer preferences is highly likely, currency exchange rate fluctuations are moderately likely, an increase in the minimum wage, and cybersecurity threats are less likely but still possible.

- Step 3: Assess the potential impact of each risk on your business if it were to occur. In our example, we might find that a sudden shift in consumer preferences could have a high impact, currency exchange rate fluctuations a moderate impact, an increase in minimum wage minor impact, and cybersecurity threats a high impact.

- Step 4: Plot these risks on your risk matrix. The vertical axis represents the likelihood (high to low), and the horizontal axis represents the consequences (high to low).

By visualizing these risks in a risk assessment matrix format, you can more easily identify which risks require immediate attention and which ones might need long-term strategies.

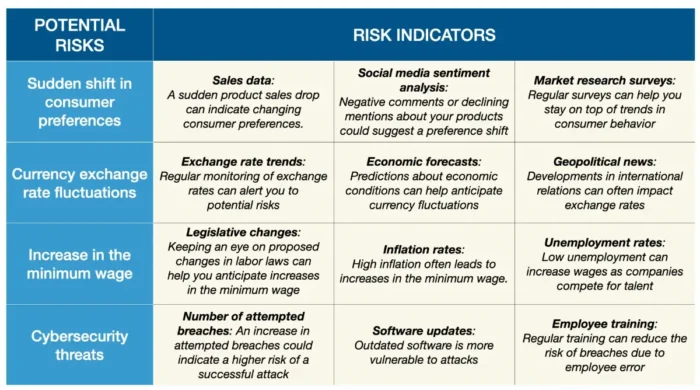

4. Develop Risk Indicators for Each Risk You Have Identified

The question is, how will you measure the business risks for your company?

Risk indicators are metrics used to measure and predict potential threats to your business. Simply, a risk indicator is a measure that should tell you whether the risk appears or not in a particular area you have defined previously. They act like a business’s early warning system. When these indicators change, it’s a signal that the risk level may be increasing.

For example, for distribution channels, an indicator can be a delay in delivery for a minimum of three days. This indicator will tell you something is wrong with that channel, and you must respond appropriately.

Now, let’s consider some risk indicators for the risks we have already identified and analyzed:

If you conduct all the steps until now, you can have a similar table with risk indicators in your business plan. You should monitor these indicators regularly, and if you notice a significant change, such as a drop in sales or an increase in attempted breaches, it’s time to investigate and take some action steps. This might involve updating your product line, hedging against currency risk, budgeting for higher wages, or improving your cybersecurity measures.

Remember, risk indicators can’t predict the future with certainty. But they can give you valuable insights that can help you prepare for potential threats.

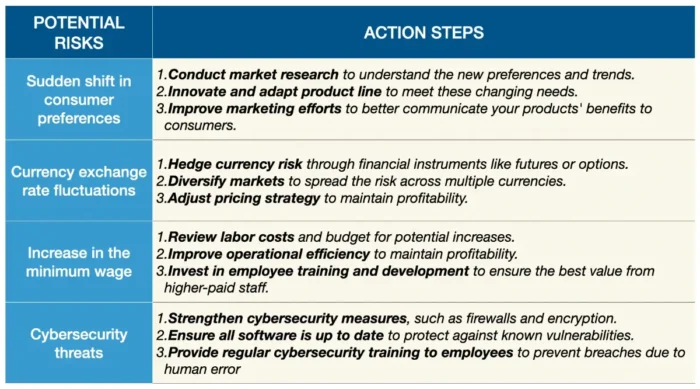

5. Define Possible Action Steps

The question is, what can you do regarding the risk if the risk indicator tells you that there is a potential risk?

Once the risk has appeared and is located, it is time to take concrete action steps. The goals of this step are not only to reduce or eliminate the impact of the risk for your company but also to prevent them in the future and reduce or eliminate their influence on the business operations or the execution of your business plan.

For example, for distribution channels with delivery delayed more than three days, possible activities can be the following:

- Apologizing to the customers for the delay,

- Determining the reasons for the delay,

- Analysis of the reasons,

- Removing the reasons,

- Consideration of alternative distribution channels, etc.

In this part of the business plan for each risk area and indicator, try to standardize all possible actions. You can not expect that they will be final. But, you can cover some basic guidelines that must be implemented if the risk appears. Here is an example of how this part will look in your business plan related to risks we have already identified through the risk assessment process.

6. Monitoring

Because this risk management process is dynamic, you must apply the monitoring process. In such a way, you can ensure the elimination of a specific kind of risk in the future, and you will allocate your resources to new possible risks.

After implementing the actions, you need to ask yourself the following questions:

- Are the actions taken regarding the risk the proper measures?

- Can you improve something regarding the risk management process? Is there a need for new risk indicators?

Techniques and Tools for Business Plan Risk Assessment

Various risk analysis methods, techniques, and tools are available to conduct an effective risk analysis for your business plan. Here are some commonly used ones:

1. SWOT analysis

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis can help you identify internal strengths and weaknesses and external opportunities and threats. This analysis provides valuable insights into possible business risks and opportunities.

2. PESTEL analysis

A PESTEL (Political, Economic, Sociocultural, Technological, Environmental, Legal) analysis assesses the external factors that could impact your business. This analysis will help you identify risks and opportunities arising from these factors.

3. Scenario analysis

Consider different scenarios that could impact your business, such as best-case, worst-case, and most likely scenarios, as a part of your risk assessment process. You can anticipate potential risks and develop appropriate response strategies by analyzing these scenarios.

4. Monte Carlo simulation

Monte Carlo simulation uses random sampling and probability distributions to model various scenarios and assess their potential impact on your business. This technique provides you with a more accurate understanding of risk exposure.

5. Risk register

A risk register is a risk analysis tool that helps you record and track identified risks and their relevant details, such as impact, likelihood, mitigation strategies, and responsible parties. This tool ensures that risks are appropriately managed and monitored.

6. Business Impact Analysis (BIA)

Business impact analysis helps you understand the potential effects of various disruptions on your business operations and objectives. It’s about identifying what could go wrong and understanding how it could impact your bottom line. So, you can conduct business impact analysis as a part of your risk assessment inside your business plan.

7. Failure Mode and Effects Analysis (FMEA)

Using FMEA in your risk assessment process, you can proactively address potential problems, ensuring your business operations run as smoothly as you planned. It’s all about preparing for the worst while striving for the best.

8. Risk-Benefit Analysis (RBA)

The risk-benefit analysis allows you to make informed decisions, balancing the potential for gain against the potential for loss. It helps you choose the best path, even when the way forward isn’t entirely clear. This tool is a systematic approach to understanding the specific business risk and benefits associated with a decision, process, or project.

9. Cost-Benefit Analysis

By conducting a cost-benefit analysis as a part of your risk assessments, you can make data-driven decisions that consider both the possible risks (costs) and rewards (benefits). This approach provides a clear picture of the potential return on investment, enabling more effective and confident decision-making.

These techniques and tools allow you to conduct a comprehensive risk analysis for your business plan.

Mitigating and Managing Risks in a Business Plan

Identifying risks in your business plan is only the first step. To ensure the success of your venture, it is crucial to develop effective risk mitigation and management strategies. Here are some critical steps to consider:

- Risk avoidance: Some risks may be too high to justify taking. In such cases, consider avoiding these risks altogether by adjusting your business plan or exploring alternative strategies.

- Risk transfer: Transferring risks to third parties, such as insurance companies or outsourcing partners, can help mitigate their impact on your business. Evaluate opportunities for risk transfer and consider appropriate insurance coverage.

- Risk reduction: Implement measures to reduce the likelihood and impact of identified risks. This may involve improving internal processes, implementing safety protocols, or diversifying your supplier base.

- Risk acceptance: Some risks may be unavoidable or negatively impact your business. In such cases, accepting the risks and developing contingency plans can help minimize their impact.

Conclusion

In conclusion, a comprehensive risk analysis is essential for identifying, assessing, and managing different types of risk that could impact your success.

Conducting a thorough risk analysis can safeguard your business’s interests, capitalize on opportunities, and increase your chances of long-term success.