Have a business but always having negative cash? Sometimes, you end up spending more, especially when you think you have a big sale. You need better finance management.

Don’t worry because this scenario is popular for many business owners, especially when you’re hands-on with your business.

Moreover, if you need more money to finance your business, loans are your go-to answer. However, what you need is better personal finance management, as bad loans are only temporary answers. If you don’t use loans well, then you’ll end up bankrupt as well.

If you’re not yet convinced that you need better personal finance management, read on blogs like Money Task Force to learn about finances. By doing so, it might open up your mind, or you may see some of these signs from your business telling you to change your financial management:

1. Unmeasurable Debts

Loans and debts are necessary for a business to run. As mentioned, they are answers to finance your business needs. They’re a lifeline you can call when you’re short on budget.

However, there’s a limit to how loans can be helpful. When worse comes to worst, you might end up losing your business. Thus, you must watch out for these signs before your debts eat up your business:

- A delay in paying older debts

- Sticking to your creditor’s due date which was already negotiated once is hard

- Having overdue of more than 30% of your debts

- Issuing bouncing checks

- Being sued by your creditors or collection agencies

- Paying your bills with your savings

So if you want to save up your business, learn how to manage your business finances well. You can do the following tips so you won’t end up in a debt trap:

Consolidate Loans

When you have more than one debt, you can pay them all at a lower interest when you consolidate them. Then, pay them every month without the need to pay them separately.

Prioritize Bills

If your business cannot cover up every expense, then know what bills to pay first. You need to pay the bills that are needs more attention. For instance, credit cards are only second to your payroll and taxes.

Get a Sideline

Especially for startups, and you must keep your finances kicking to cover your personal bills. Don’t expect your business to pay for your bills. That’s why you need a job or another source of income to avoid overwhelming yourself with debts.

Avoid More Debts

Staying away from debts is the answer to keep from accumulating your debts. Thus, keep your expenses at a manageable level.

Stick to Your Budget

Know how much comes in and out of your business each month. Then, create a budget that covers fixed expenses as well as unexpected ones. After this, you must stick to it.

2. Low Solvency Ratio

Your business’ current solvency means the number of months your business can withstand expenses in times of slow sales. Thus, the decreasing fund of your business to cover up your monthly bills is a sign that you need better financial management.

If you cannot keep your business’s solvency, then you may have to look to short-term means like debts. As a result, you might incur a higher debt rate that your capital cannot handle. That’s when a business fails.

So you must regularly check your solvency ratio to assess whether to take up loans or not. When you are updated with your solvency ratio, you can also check whether your business can pay up your loan interests aside from its principle.

If your business cannot cover your loans and other expenses, you can follow these tips:

- Increase your sales or profitability

- Don’t take more loans

- Reorganize the structure of your business

- Reinvest assets and money of your business

- Sell some assets to pay up some debts

3. Decreasing Cash Flow

Aside from your business’s solvency, it’s also essential to monitor your cash flow. Without cash flow, your business operations will stop since cash flow is your business’ driving force.

To know whether your business can still operate, you need to understand and analyze the following ratio:

Cash Flow Margin Ratio

Cash flow describes the cash accumulated from your sales and operations. When its percentage is smaller, then you may need better financial management because you lack the knowledge to convert your sales to cash flow. To get its ratio, divide the cash flow from operating cash to that of the net sales. Your net sales came from your income statement, while the cash flow from operating cash is your business’ statement of cash flows.

Current Liability Coverage Ratio

means the ability of your business to cover your debts from the sales of your business operations. You can get the ratio by dividing your net cash from operating activities by our average current liabilities.

Viability

When you know the cash flow ratio of your business, you’ll check whether your business can produce income to cover all your financial obligations. So if you don’t have a viable business, you need to improve how you manage your finances.

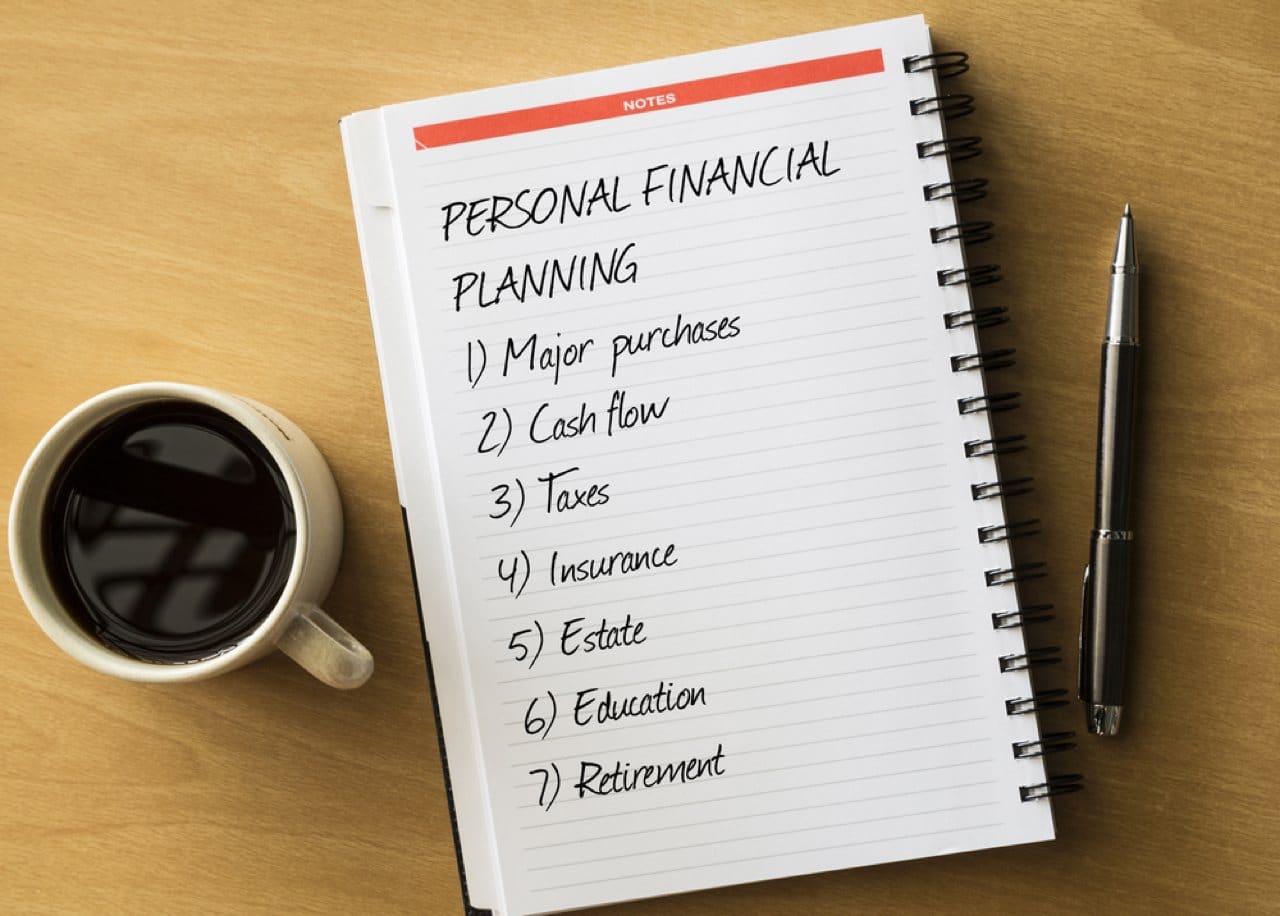

4. No Budget Planning

It may be a cliche, but budgeting is vital for a company or personal financial management. Without a budget, you won’t know how much you spend and how much it goes into your pocket. Much worse is putting your business at higher risks if unwanted situations occur.

But if you have a well-constructed plan, you allow your business to reach its financial objectives, be it long or short term. That’s why your business should have its financial plan because:

Devise a Back-up Plan

As mentioned, unwanted events can negatively impact your business. You don’t want that to happen because your business might be all you have. But if you’re financially planned and prepared, you can make wise decisions before spending.

Adapt to Changes

No matter how constant your finances come and go. The time will come when something may affect your business’s cash flow. Thus, you can use your financial plan to make changes when this happens. Also, you can use it as a guide to whether use, save, or prepare your business for the trends.

Realistic Goals

Since you have drafted your financial target, you’ll know how much effort and resources to spend to reach such goals. But if you don’t have one, then you might end up slacking off as long as you have a daily sale. Moreover, your financial plan can also show whether you have a realistic goal and if your efforts are paying off.

Expected Sales and Expenses

Although money coming in and out may vary, a financial plan will help you set financial expectations. Also, having a history of how your money flows can help you stop what keeps your business spending too much.

Benefits of Personal Financial Management

When the signs are talking to you, it’s time you level up yourself with the right knowledge on personal finance management. By learning how to manage your finances properly, you can apply it to your business’ finances.

These benefits can help your business avoid bankruptcy:

Develop Skills

If you start to manage your personal finances, you’ll master the art of saving receipts, tracking, and budgeting your finances. When doing business, you’ll find it easier to manage your finances.

Avoid Scams

Not totally scams where they run away with your money, but similarly, you’ll know whether your hired accountants are doing their job well. Business owners who are not keen on their finances end up having stolen businesses or capital since they don’t know how to keep track of their finances. But if you are well-versed with finance management, only then should you hire an accountant.

Save More Money

When you know the basics of saving your personal money, it’ll be easier to keep from borrowing money for your business. Moreover, knowing how to save keeps you from spending your business profits. So if you don’t want your business to have debts, start saving.

Maintain Credit Rating

If you can manage your finances well despite having loans, you’ll be able to pay your creditors on time. So instead of borrowing money to pay off your loans, you can use your credit rating to borrow another loan for developing your business.

Reach Financial Freedom

People talk about financial freedom as the end goal of every business. However, this is not an easy task without handling your finances well. But if you can manage your personal finances, you have higher chances of keeping your business running. As a result, you won’t need to work your butt off in a regular job when your business is already profiting more than enough to take care of your bills.

Conclusion:

If you’re planning to start a business, then you should first learn the art of managing your personal finances. Without proper knowledge and application of personal financial management principles, you may have a hard time keeping your business operating.

However, it’s never too late to manage your finances better when you’ve got a business already. As long as you’re serious about planning your finances well and you stick to it, you can save your business from failing due to poor financial management.

So if you want your business to prosper, assess, and look for the signs mentioned if you need to change your financial management strategies. Unlearning what you know may be the best to start learning new financial management techniques.