Managing personal finance is really challenging today. Between managing debts, saving for the future, and making your money work for you, there’s a lot to keep track of.

Here, we’ll explore practical and actionable advice on managing your personal finances. These nine pieces of financial advice can guide you through various stages in your financial life. Whether you’re just starting out or looking to optimize your financial health, you can always build a strong financial foundation and make informed decisions that move you toward your goals.

1. Start Early and Save Consistently

The concept of saving isn’t revolutionary or something new when it comes to personal finance. However, the timing and consistency of your saving efforts can make a difference.

One of the most impactful terms in the financial sector is compound interest. When time works in your favor, compound interest can have a great impact on you. Compound interest begins gradually and accelerates with time. If you reinvest your interest, your savings have the potential to increase significantly.

Long-term financial security begins with consistently increasing your savings. Experts recommend accumulating away at least 20% of your income, split between short-term goals like a vacation and longer-term needs like retirement.

Adopting the philosophy of living under your means is a cornerstone in establishing financial stability. This principle requires you to spend less than what you earn and avoid some lifestyle inflation, a practice that can otherwise lead to debt accumulation. In such a way, you can create room for increased savings, opportunities for future investments, and emergency funds.

2. Budget Wisely and Track Expenses

Living in a globalized world today, you have limitless purchasing options, and your income can easily escape your wallet and impact your personal finances. So, a budget is your most powerful weapon in your personal finance stability.

A budget is essentially a plan for spending your money each month in order to ensure you can cover your basic needs while working towards your financial goals. It is because your budget is a means that can help you avoid overspending, reduce your probability of increasing debt, and develop a strong foundation for saving, investing, and other financial efforts.

However, at the same time, your budget must be adjusted to the lifestyle you want to accomplish.

If you want to create a budget, first, you must track your income and expenses. When you start recording your income and expenses, you can set the limits for each spending category based on your own priorities and goals.

Remember that your budget should reflect your financial goals and adjust your spending habits. The 50/30/20 rule is an excellent starting point:

- 50% of your income should go to necessities,

- 30% to discretionary items, and

- 20% to savings and debt repayment.

You can use traditional paper and pen to budget each month, or you can use simple MS Excel or Google Sheets to record and track your income and spending. Today, many applications can help you budget. Popular tools like Mint, You Need a Budget (YNAB), and EveryDollar offer different levels of insight and automation to help you stay on track.

3. Borrowing Hard Money

Borrowing hard money can be an extremely beneficial strategy, particularly for investors seeking to finance real estate transactions that traditional banks may shy away from. This type of lending focuses on the asset itself rather than the borrower’s creditworthiness, offering a faster approval process and quicker access to funds.

To find the best financial support for real estate investments, it’s crucial to research and choose the best hard money lenders who align with your investment strategy and goals. Hard money loans are ideal solutions for investors looking to complete transactions quickly, rehab properties, or finance projects that require immediate action.

Although the interest rates are typically higher than those of traditional loans, the ability to act swiftly can outweigh the costs, making them a valuable tool in a real estate investor’s arsenal.

4. Save for an Emergency Fund

An emergency fund is the basis of your financial safety. It means saving three to six months’ worth of your living expenses to be ready to overcome the impact of unexpected events in the future.

The emergency fund is a strong financial buffer you can possess, protecting you from unexpected costs such as sudden medical bills, job loss, or urgent car repairs. By consistently setting aside funds equal to three to six months’ living expenses, you proactively prevent the need to borrow or spend your long-term savings to handle unexpected financial challenges.

Beginning with modest contributions and consistently growing, this fund can deliver significant benefits over time. It will ensure financial stability and offer you peace of mind by preparing you for life’s unpredictable happenings.

5. Invest in Your Future

Remember that investing is not just for the wealthy. In fact, it’s a crucial step for anyone looking to grow their wealth and secure their financial future. But it’s essential to approach investing carefully because it will not always bring you money. Making mistakes can be costly for your personal finances when you invest your money in the future.

While investing does have risks, educating yourself on the subject and seeking guidance from a financial advisor can help you craft a well-diversified portfolio that aligns with your risk tolerance and financial aspirations.

One great strategy you can use is diversification, which means spreading your investments across various asset categories to minimize risk. Stocks, bonds, and real estate are traditional avenues. Index funds and ETFs offer diversified portfolios within a single investment.

The earlier you start saving for retirement, the better. Channeling contributions into retirement vehicles like a 401(k) or an IRA allows your investments to burgeon through the magic of compounding interest. Even minor financial inputs can accumulate into substantial savings, underscoring the significance of prioritizing retirement planning within your financial blueprint.

6. Understand and Improve Your Credit Score

Your credit score is not just a number; it reflects your borrowing habits and reliability and plays a crucial role in determining your borrowing capacity, the interest rates you are offered, and even potential career opportunities that may come your way. Maintaining a strong credit score can lead to better loan terms and even employment opportunities.

Your payment history, debt balances, credit history length, new credit, and credit mix are just a few of the variables that determine your credit score. Understanding these components can help you make targeted improvements.

To ensure the security and enhancement of your credit score, it is vital for you to:

- Always pay your debt bills on time,

- Try to keep your credit card balances low, and

- Regularly monitor your credit report to address any inaccuracies quickly.

7. First Pay Off High-Interest Debt First

You must implement a strategic approach to reduce your high-interest debts without overwhelming your finances.

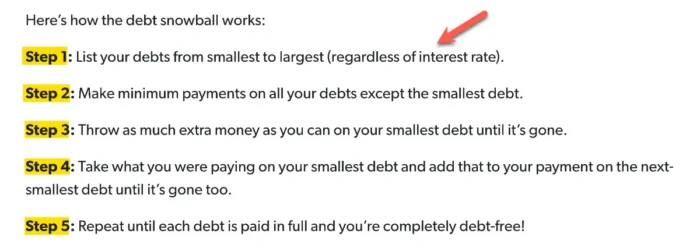

The snowball method, developed by financial expert Dave Ramsey, recommends paying off your smallest debts first. The goal is to give you a psychological boost that will motivate you to keep paying until you become debt-free. This method requires you to make a maximum payment for the smallest debt and a minimum payment for other debts regardless of the debt’s interest rates. After you pay fully the smallest amount, you can repeat the process for the next smallest amount on your list.

In most cases, that smallest amount will be on credit cards with a higher interest rate. I have experienced a similar case where several credit cards burned out my cash on high monthly interest rate payments. After calculating the total interest payments from all the cards, I saw that I could cover one higher monthly credit debt payment.

On the other hand, you can also use the avalanche method. With this approach, you first start with the highest interest rates, regardless of the amount. The logic behind this approach is that it will save you more money from high interest rates when you pay those debts in the long run. So, this method will ask for minimum payments to all debts except the one with the highest interest rate, where you should pay an additional sum of money first. Once that debt is paid off, you move on to the next highest interest rate, and so on.

In my case, I have combined a snowball effect, starting with higher payments on small debts but with higher interest rates. After several months, when I paid the smallest debt, I continued to the next smallest with a higher interest rate. Thus, month by month, I have accumulated more money because of interest rates on already-paid debts to pay for the largest debts.

8. Educate Yourself Continuously

The more financially knowledgeable you are, the better equipped you’ll be to make strategic financial decisions. The continual emergence of new products, strategies, and regulations characterizes personal finance. It is a linchpin for making informed and wise financial decisions if you are up-to-date on these developments and continuously increase your financial knowledge.

Books like “Rich Dad Poor Dad” by Robert Kiyosaki, “The Total Money Makeover” by Dave Ramsey, and “The Millionaire Next Door” by Thomas Stanley provide valuable insights.

Also, keep in mind that financial markets and regulations continually evolve. So, regularly follow financial news to help you keep updated with these changes and make informed and timely decisions.

9. Seek Professional Advice When Needed

DIY financial management is OK, but many complex situations require the expertise of a professional.

Financial advisors can help you with everything from investment strategies to estate planning. They offer personalized advice aligned with your unique financial situation and goals.

If you’re facing significant life changes such as marriage, the birth of a child, or retirement, or if you simply feel out of your depth, it’s likely time to seek the counsel of a professional.

Conclusion

The path to financial security is not always clear, but these nine pieces of advice provide you with strong ground to walk upon.

Remember, financial success is not about perfection; it’s about consistent progress and the willingness to adapt. Equip yourself with knowledge, plan diligently, and never be afraid to course-correct along your financial voyage.

Searching for financial success is a continuous learning, adapting, and growing journey.