Technology has played a great role in ensuring that the consumer and business relationship has thrived and development noticed among different societies. In such, there is a great need to make sure that the duo is well protected either from harmful business practices or criminal activities of any nature.

The Know Your Customer policy procedures have equally been a reliable instrument in ensuring the customers and the business are operating in a safe and reliable business environment.

Areas where KYC is mandatory

The KYC policies have a greater role to play in a variety of industries globally. These procedures are important in ensuring the safety of any party interested in business. I have keenly described a few of the industries where the KYC policies are mandatory.

Banking

The banking sector has a huge number of clients to attend to and at the same time the sector needs a lot of financial transactions to keep running so that the sector remains in good condition. At the time of registration, your details are captured and saved in the database for future references.

Just in case you commit a financial crime, it becomes easy for the security agencies to easily trace you.

iGaming Industry

This is yet another industry where the KYC policy procedures need to be adhered to in full as a measure of protecting the vulnerable group from any form of crime. This is a sector where huge amounts of money and transactions are greatly involved. British customers usually want to bet with no verification casino operators to stay anonymous and claim free spins on slots but after some winnings, they start having some withdrawal problems cause of not submitted documents.

The industry has used procedures to help reduce the high rates of problem gambling among players. As if not enough, it has also employed the same procedure to ensure that the right player is able to access his company with ease and not anybody else.

Electronic Payments

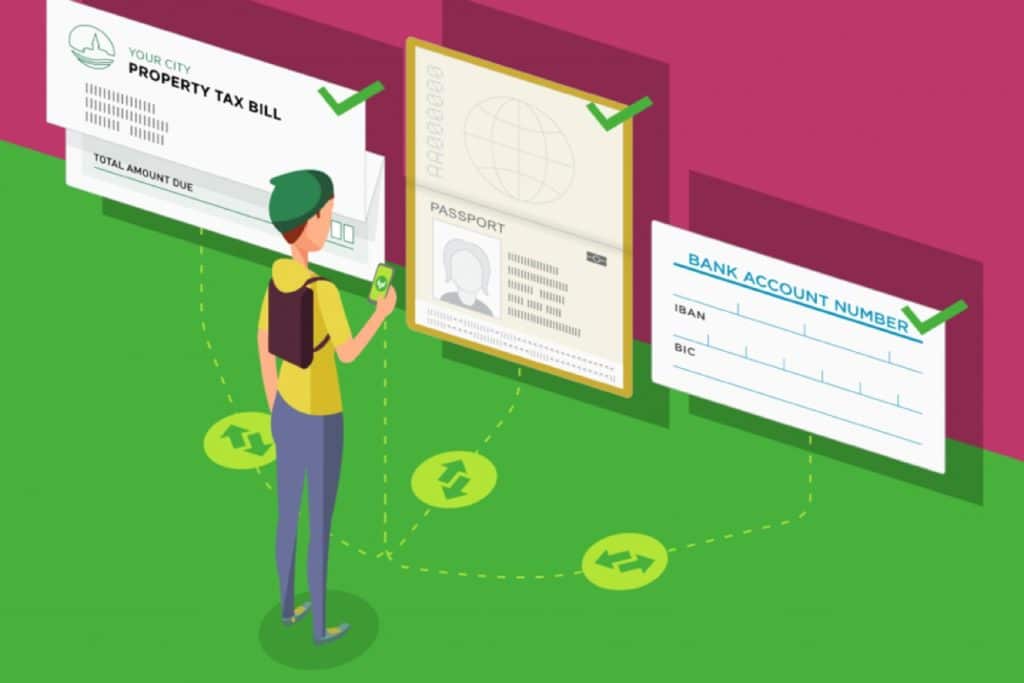

The KYC policies are still useful to the Electronic payment system. This is because the procedures are used to ensure safety in one way or the other, for this case the policies have been enhanced with the use of an AI software which is capable of identifying the rightful owner of an account together with any issues attached to the details of the account owner.

Goals of KYC

KYC policies and procedures have been designed to achieve several goals in the event of offering some solutions. Here are a few examples of the places or areas where KYC policies have played a great role.

Prevention of Scam

Know Your Customer policies require that the client of any business needs to have the right details of his clients. The details which may be gotten during the registration process are saved in the database which may be used later just in case an insecurity issue arises. In this way, it may be much easier to identify any form of the offense committed in such an account.

Anti-Money Laundering

Money laundering is an illegal activity in most parts of Europe. This involves acquiring money from an illicit activity like drug trafficking and using the cash in a way to appear as if it was gotten from the right source.

With the KYC policy procedures in place, the illicit activities may be traced and it shall help curb the laundering activity.

Terrorism financing prevention

The Financial Intelligence Unit who are the specialized government agencies with a mandate to oversee any suspicious financial activities in the financial institutions. In so doing, the agencies shall be able to trace the origin of any kind of money and suspend it immediately if it is attached to any form of terrorism activities.

This is because the use of finances to support such activities may bring about instability in the economy and the financial institution as well.

Conclusion

The KYC procedures have greatly helped reduce many chances of fraud among many European nations making it a better destination of many activities especially those attached to money in a way or the other. The policies have played a great part and this will provide a better chance for the financial sector to thrive effectively through many economic reforms.