Over the last few months one name has appeared again and again in the business pages as a buyer of low-performing and distressed brands but why is Tai Lopez suddenly looking at deficient companies?

Alongside fellow investor Alex Mehr, Lopez has used their investment vehicle Retail Ecommerce Ventures to search out problem businesses and turn them around.

With the issues caused by the recent COVID upheavals, there are certainly plenty of candidates, so what is it about these businesses that are proving so attractive?

Achieving success through restructuring

At first sight, the idea of looking at distressed businesses such as Dressbarn and Modell’s seems a little off-beam but look a little closer and these targets make sense.

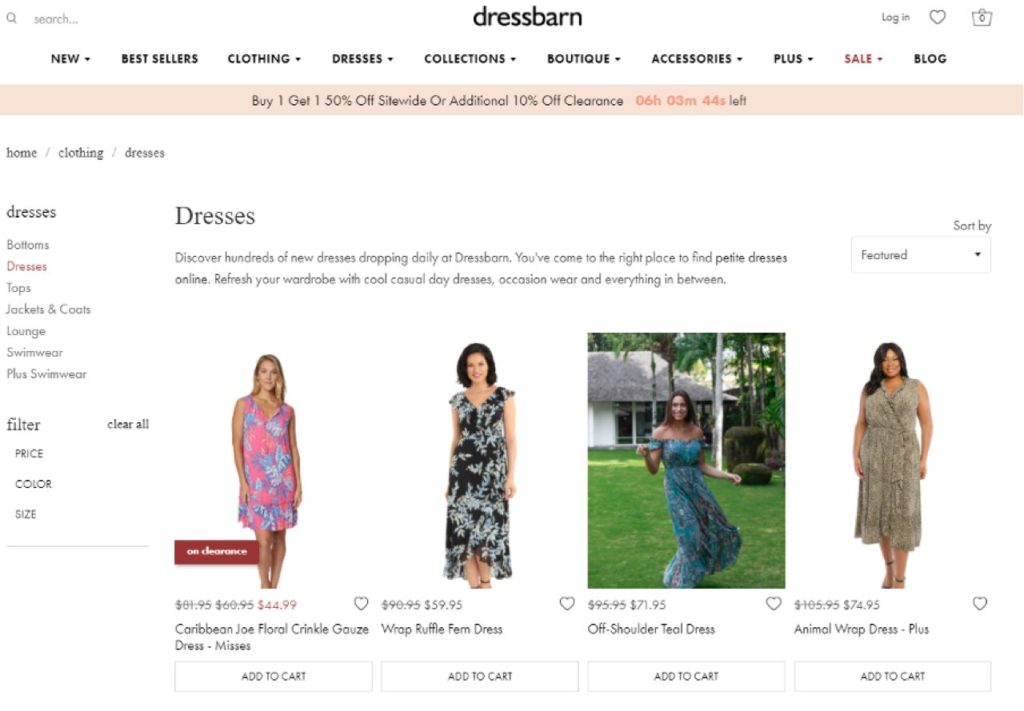

Dressbarn is an excellent example of a business that had latent potential that its previous management failed to capitalize upon.

Snapping up the traditional retailer back in November 2019, the REV group set about redefining the business as an online-only operation.

What they identified was that although Dressbarn was in a downward trajectory as a bricks-and-mortar retailer the company did have superb intellectual property assets and it was these assets that formed the cornerstone of the transformation.

Mehr and Lopez then set about restructuring the business, using these brand assets to produce a completely new website whilst leveraging the massive awareness that Dressbarn had built up over the years.

Has it been a success?

Dressbarn is now experiencing a 165 percent increase in turnover and is forecasting sales of $165m and as it has now shed its expensive leases the future looks bright for the once-moribund company.

Consumers stay loyal to older brands

One of the key benefits of buying an older business like Dressbarn is that it has spent many years building up a loyal and committed customer base.

In a recent survey by the Direct Marketing Association (DMA), it was found that 40% of consumers tend to stay loyal to their brands even if they could get a cheaper deal elsewhere.

For marketers, this is an incredibly important statistic because it means that they have consumers that are ready and willing to listen to their message.

Compare that to a start-up that would need to spend potentially millions on developing that kind of brand recognition with no guarantee of success and you can see why buying an established brand makes sense.

Older businesses that have a brand that is widely known and has other valuable IP assets such as an engaged email list, loyalty card customers, logos, straplines, and other useful marketing tools suddenly look much more attractive.

The value of these types of brands isn’t in the bricks and mortar stores as much as the intellectual property that goes with them.

The signs of a likely prospect

For investors that are looking for an excellent target, there are a number of things that signpost a revivable brand.

The first thing to look for is a well-known and loved brand.

Modell’s sporting goods fall into exactly that category as the 131-year-old company has become a staple of every town in the U.S. and has a brand that has exceptionally high awareness.

When they purchased the assets of Modell’s back in August for a reported $3.64m this was the key aspect that Mehr and Lopez looked for.

As Lopez himself said “By buying Modell’s, the real value we’re paying for is that little bit of trust where people go ‘Yeah, I’ll put my credit card in on that website because I’ve heard of Modell’s, my Grandpa went there. I’ll put my credit card in to buy this soccer ball’”

The second attractive element for a distressed brand is where the operating model can be radically switched.

This means that old-fashioned methods of delivering what customers need can be ditched and newer, leaner models adopted such as drop shipping and direct to consumer deliveries.

Thirdly the business needs to have a management that has lost its way somewhat in the face of either greater competition or failing to move to online.

A revitalized (and leaner) management can bring a greater spirit and enthusiasm to the operation and in a turnaround situation where the staff has spent months in a state of depression, this is exceptionally useful.

Turnaround isn’t easy

As Tai Lopez and Alex Mehr have shown over the last few months, it is possible to pick up an excellent bargain from a liquidation situation but that doesn’t mean that the work stops there.

Whilst it is the initial purchase that hits the headlines, it is the internal restructuring that brings real benefits.

Reducing the workforce, streamlining the sales and delivery process, and revitalizing the marketing function are all key components in the turnaround.

None of this is easy and it has to be said that the directors of REV do have a great deal of business experience with shareholdings in Farmers Box (Lopez) and building and selling Zoosk (Mehr).

With coronavirus taking its toll on business all around the world it is fair to say that the flow of companies ripe for restructuring is likely to continue for some time to come.