Fibonacci is a mathematical series of numbers where each number is the sum of the previous two. The levels are associated with a percentage each. This percentage represents the prior move of the price retracement. The Fibonacci retracement levels are 23.6%. 38.2%. 61.8%, 78.6%, and so on. Price action is a popular strategy in trading. So, you need to learn how to use Fibonacci retracements or Fibo retracements with price action.

Fibonacci Retracement Trading With Price Action Forex

Traders can use Fibonacci as a tool in the forex markets or best forex software by taking two extreme points. The levels are usually high and low of a forex pair or stock. The vertical distance is divided into the major Fibonacci ratios. The major levels you need to concentrate on during trading are 50% and 61% levels. Keep in mind that 50% is not a Fibonacci level, but it is a level according to the ‘Dow 50% level’. As the theory states, the higher or lower move is likely to continue and get to the recent highs or lows when price moves beyond the 50% level strongly.

The 50% level acts as a key psychological level like the major support and resistance levels, as well as very big round numbers, especially when you combine them. The level is very popular. So, you can find it on your Fibonacci tool after opening it in your chart. However, you need to be careful so you do not get carried away while using Fibonacci levels and fall into the trap to try and place a Fibo tool on all markets.

To use the Fibonacci tool, you need to map the high and the low of the move that can guide you to the logical point in the trend that would be for price to reverse. These are the levels you have to look for price action triggers for getting into the trend. Remember that the trend is your best friend in trading, so, getting abroad the trend is always the ideal course of action. With the help of the Fibonacci tool, you can look at a market and have a concept of the point where the price can roll back over and keep on with the trend.

Depending on the trend, you can place the Fibonacci from the extreme low to extremely high or vice versa to mark it. For example, if it is a downtrend, you will have to mark the Fibonacci from the extreme high to the extreme low. Keep in mind that you need to put the Fibonacci tool in whichever way the trend goes.

When To Use The Fibonacci Tool

The best time to use the Fibonacci retracement strategy is when you can spot a clear trend within the market. You can always expect the trend to reverse and rotate back into the price at some point. There is no market that continues straight lower or higher without a pull-back into value or a break. Use Fibonacci when there is a clear medium or short term trend, you have a logical pullback in the trend, or the major Fibonacci levels line op with support and resistance.

When Not to Use the Fibonacci Strategy

It is also very important to know when you should not use the Fibonacci strategy if you want to avoid making trading mistakes. As mentioned earlier, you can employ Fibonacci in the most obvious markets and trends only. Never use it for just the sake of using another tool. Fibonacci can guide you if you want to look for price to get a signal of its rolling back over to the direction of the trend. You can only enter when the price is giving a clear signal like an Engulfing bar or a Pin bar or Fibonacci lines up with other support and resistance. Do not use the Fibonacci tool in every single market you find. You should not use it in choppy and sideways markets either where price whipsaws often. It should also not be used by itself but be backed by some other form of support or resistance.

An Example of Using Fibonacci With Price Action Trigger Signal

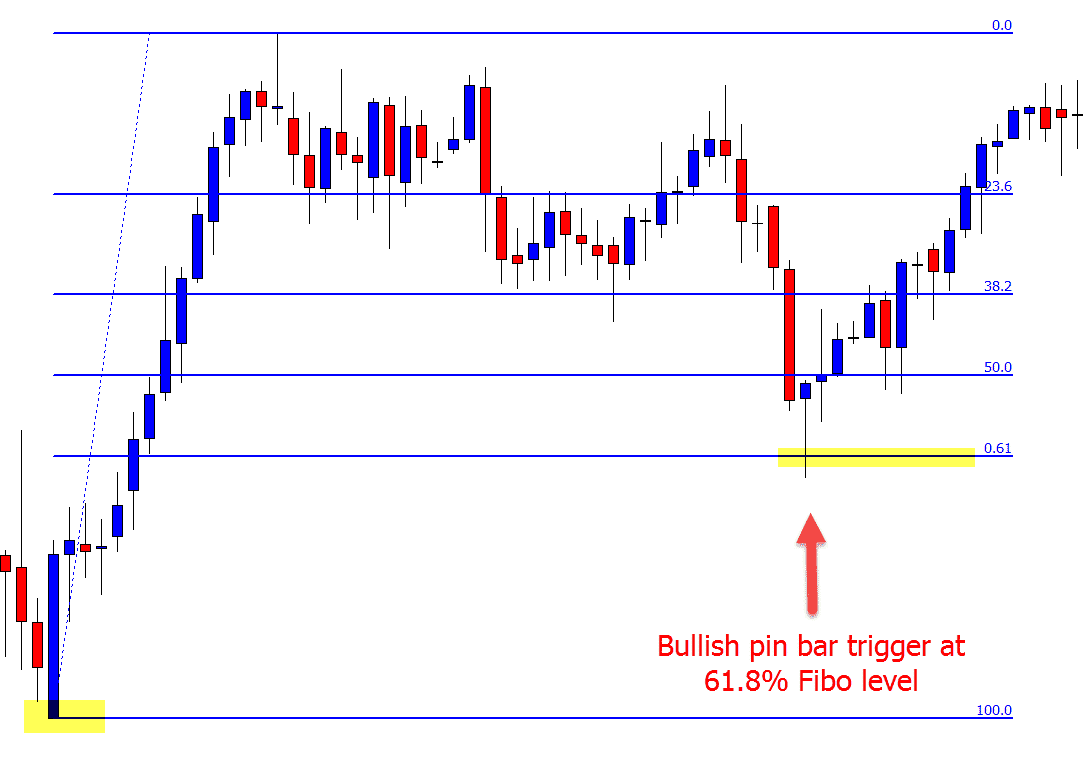

In this example, you can see a pin bar from the 61% Fibonacci level and a resistance level. This is the kind of trade you need to look for. It shows the types of obvious trends and levels you should use the Fibonacci tool with.

Now that you know how to use Fibonacci extensions, keep in mind that you must never overdo it. Making rash mistakes may cost you a huge loss in trading. So, be patient until you get an obvious trend for using the Fibonacci retracement.