API is not just limited to integration prospects for better performance of Stock Data Applications. It’s perhaps a Demand of injecting authenticity into ordinary applications’ backend. So don’t set an odd option in choosing Finance APIs. Let’s get into the list of some top options selected to add to your Finance API cart!

There’s no denying to state this; “APIs have always been a basic requirement for the super-fast performance of applications.”

To support this statement logistically, let us throw a sight over RapidApi 2021 survey, which reveals that in 2020, the rate for API integration has been leveraged up to 61% than 2019, while the present year predicts more than 70% increase in API integrations than the recent one.

You will be agreed to know; this demand goes one step higher when it comes to integrating free stock data mining API with financial stock information-gathering applications.

It’s because of the fact that investors need undifferentiated data reports (coming from stock markets) and 100% authoritative search results when they are explicitly tracing a particular company’s financial performance in which they are going to invest.

For fulfilling this extra practical work, many stock APIs came to fill up space. But due to multiple modifications in previously grown APIs and unpredictable increases in their subscription rates, users are no more concerned about them.

However, the good news is that, with revolution and flexibility for promoting user experience, many other fresh APIs have taken up this charge to proceed with stock data navigation and extraction jobs.

If we talk about Yahoo Finance API, which is no longer in access of investors due to several complications in its usage, users have shifted their focus over suitable alternatives of yahoo finance. This apparently is the finest consideration, and we call it “the best option made by investors,” as they have more than a single way to get yahoo finance alternatives, and they can even depend on free and exceptionally sustainable stock APIs this time.

So let’s skip to the list of top Finance APIs that you (being a professional investor) can be essential for your business. These alternatives have been collected by observing their better compatibility approaches when integrated into the form of API documentation and their recent developments on which they support multiple data extraction possibilities.

Top 5 Finance APIs to Pick this Year!

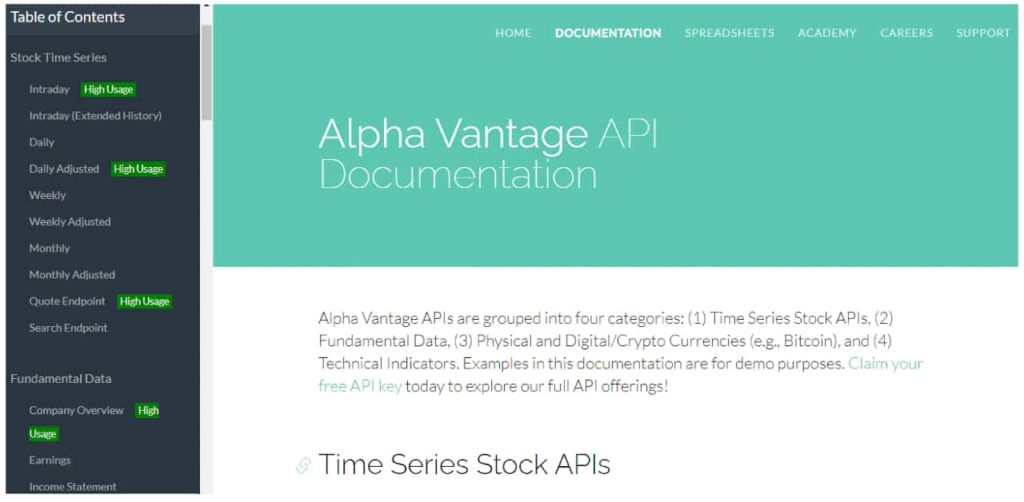

1. Alpha Vantage

Alpha Vantage keeps effectiveness at peak and performs multi-tasks without losing data, and its customary nature of always being authentic. Investors from all around the world have a dependency on this API as it presents both historical and real-time stock information, from a particular company to the entire stock market durational report.

Along with this, it offers in-depth and accurate data regarding Forex, Cryptocurrency, ETF, Technical Indicators, and Physical Currency, coming from both US and non-US stock markets. It’s the main factor for making this API a free approach to global markets.

With the heterogeneous framework of Alpha Vantage documentation, it presents running code with examples in PHP, Java, Python, and JSON. This has made developers widely converge over its capabilities, and a good range of stock applications have Alpha Vantage API integration for leveraging their performance graph.

Among its countless features, the stock data gathered can be transported in Google Sheet or Excel Files through simple clicks. It provides users the command to have an organized and well-oriented format of gained data which can further be modified and expanded over time or when required.

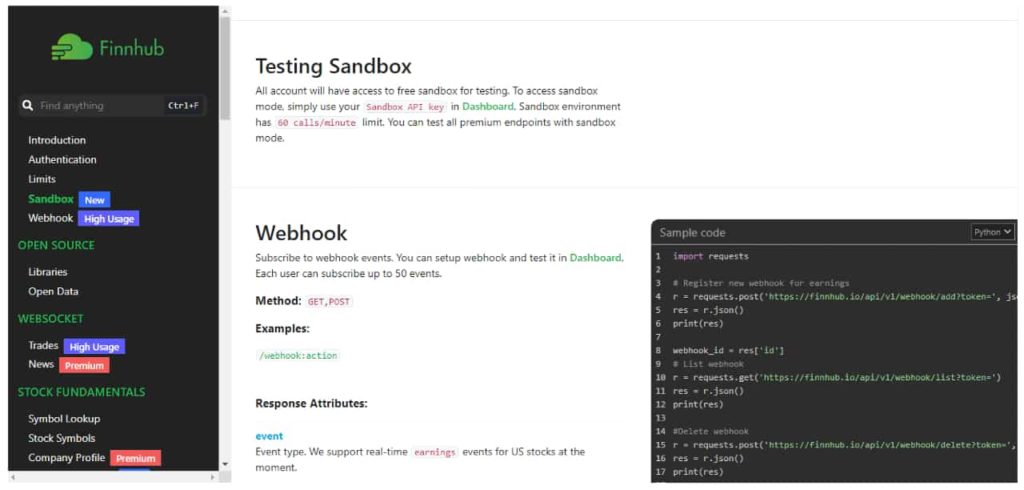

2. Finnhub

Finnhub stands out against odd versions that other financial stock APIs have, and it comes with Restful API format to support stock data.

One of the principal benefits of RESTful APIs is that they contribute an excellent chance of adaptability. Data is not bound to means or processes, so REST can manage various standards of requests, deliver several data setups and even improve structurally with the right application of hypermedia.

By moving to endpoints, Finnhubb provides more than an average number of specifications to make financial products scalable, including stock estimates, stock prices, real-time Webstock, and a long queue of essential points where an investment plan gains firmness.

Like Alpha Vantage and several free stock APIs out there, Finnhub also produces a free entrance key for integration and helps investors get their research done quickly, without getting the burden of waiting. Additionally, the API has a webhook feature that technically firms documentation patterns to add different applications at a common point from where they could run, modify, and upgrade in a pretty forward style.

Overall, if you’re waiting for an alternative to Alpha Vantage, Finnhub will be the best option to consider.

3. Barchard

Barchart OnDemand emphasizes a large collection of market data APIs that can be smoothly combined into your website.

Unlike all other APIs mentioned in this article, the Barchart is a hub of more than one stock APIs which, combined or separately, can be integrated within applications. This can be understood by seeing its Dividends, Splits, and Earnings API functionality which is only specific to support these three data types.

Apart from that, its API hub has categories in different features supporting APIs. It includes Price Data, Cryptocurrency Stock Information, Profiles, Financial Data, ETFs, Metadata, and other data APIs, mainly presenting specified area information and insights.

It presents you with adjustable and cloud-based APIs to firm your business efficiencies, outcomes, and applicability. You will get the easiest pattern to formulate and drive applications by integrating market data directly with websites, as this API encompasses Cloud Databases for transporting confidential information from one dataset to another.

We named it “hassle-free,” and it’s a versatile option for those who want specific stock information inserted in the application backend and make function-specific applications that professional investors use to operate. Broker data-providing companies also have reliability on this API market to make the decision more concise and insightful, so that organizations can be explained more comprehensively, under the context of finance.

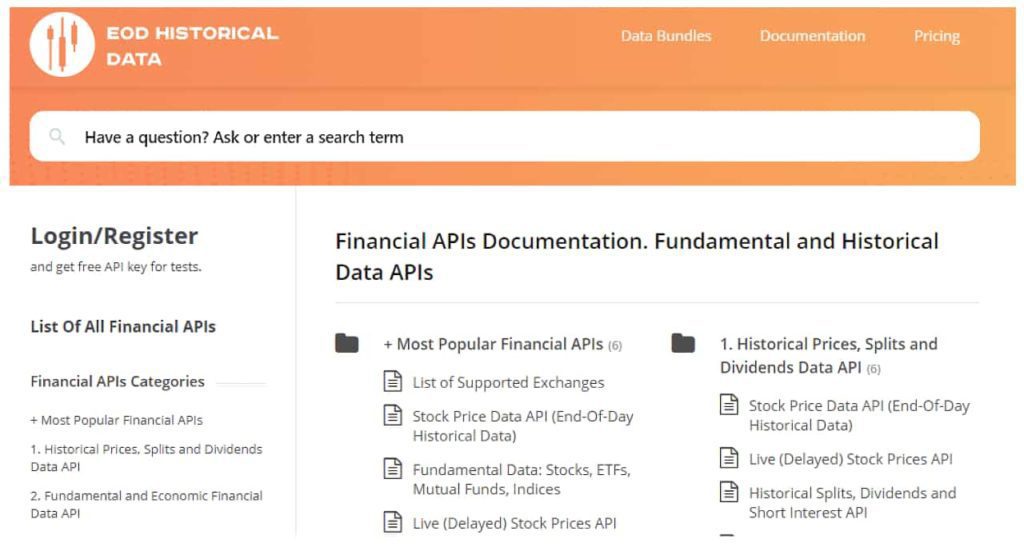

4. EOD Historical Data

Now in critically analyzing delayed and historical data from different durations of different lengths, there’s no better API market to trust on, except EOD Historical Data. This platform offers three to more in-depth categories of APIs to fetch stock data from 70+ exchanges (both US and non-US) and holds the capability to retain back the information of about 20+ years old stock rates.

There’s no “NO” for other stock APIs that can compensate with real-time and historical data presentation to show historical data, including all the nitty-gritty information. But they at many places are confined to limited years back, historical data explorers. Hence, EOD wins this peculiarity or specificity to bring investors the oldest stock information, which plays a significant role in determining organizations’ decade’s financial positions and offers investors the microscopic vision to examine whether the organization is profitable to invest in or not.

5. Financial Modeling Prep

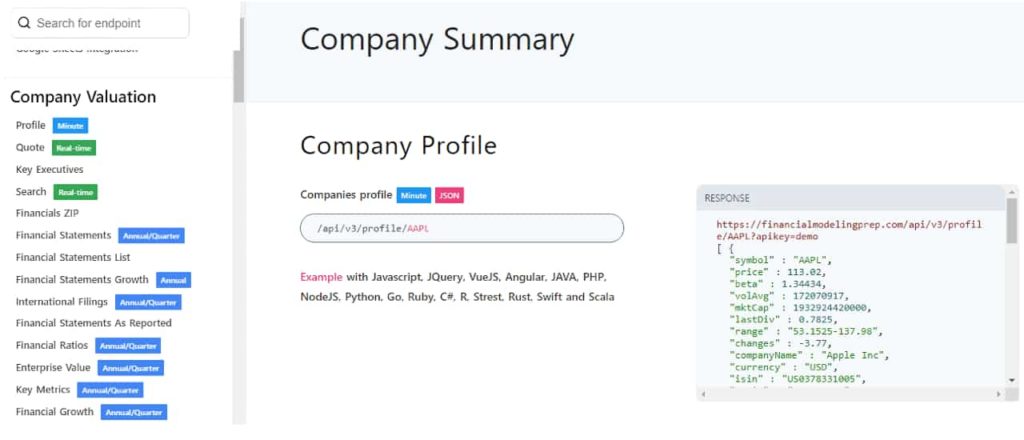

Financial Modeling Prep is specifically designed by gathering all required elements in one place, which are reasonably forming the basis of an investment plan. It’s so far a practical portal of choosing, running, storing, and driving stock data. It encourages both historical and real-time data access on multiple stock markets.

The principal goal of this API is to provide users with a comprehensive financial investigation regarding FOREX, CRYPTO, ETF, Mutual Funds, NYSE, and more. The endpoints provided, ranging from simple financial reports to complex stock time series, calendars, technical indicators, market indexes, have the capability to fill out the user’s research bucket logistically.

Your similarities with this API format will become more prominent once you’re about to make financial products. As financial products are always a major concern for investors and financial stabilizers of organizations to develop in order to retain future support in terms of assets, funds, and more similar, so right information is a must requirement. To make these financial products active, it’s mandatory to facilitate product composers with in-depth information of chosen companies. So that’s where you have a need to let in this API, and with its multi-dimensional performance in data synthesis and assimilation on Google Sheet and Microsoft Excel, your financial products will be able to chase and add productivity to the investment policy.

This API will simply let you go through multiple stock market trends and support hundreds of points to trigger fine counting of productivity in investment procedures. You should have this in the options list if you’ve got an all-in-one nature of work done.

Conclusion

There are several questions to ponder when picking a business-centered finance API, and I expect to have provided you with the ultimate features of each discussed API. Do you consider that there are things to add to applications’ infrastructure that otherwise will turn them worthless? This is where categories in APIs originated. In case you dropped some remarkably valuable ends, pay close attention to at least all these five APIs, and they’re ready to handle any sort of financial problem effectively by presenting appropriate data formats and in-depth information. We want you to stay uncomplicated while investing processes, because the more you’re focused on authenticity, the more you’ll stay authentic.

📖 Read more similar articles