Even if you don’t have perfect credit or a steady income, you may be accepted for certain loans, such as emergency loans, payday loans, and bad-credit or no-credit-check loans. They can supply you with the finances you need to cover any expenses that may arise.

However, just because these loans are simple to get does not imply that they are appropriate for you. Some have exorbitant interest rates and costs that may devastate your budget.

The Simplest Loans And Their Associated Dangers

If you need money to meet any unforeseen expenditure, consider getting an emergency loan, a payday loan, a bad credit, or guaranteed installment loans for bad credit no credit check. While these loans are often straightforward to get, they are not without danger.

Loans for Emergencies

An emergency loan is a kind of personal loan that is intended to pay unforeseen needs such as medical bills or automobile repairs. Lenders usually allow you to get 100 dollar loans or more, and some even transfer the cash into your account the same day you sign the loan agreement. The interest rate on an emergency loan is determined by various criteria, including your credit score, income, and debt-to-income ratio.

Interest rates will range between 5.99 and 35.99 percent. The greater the interest rate, the worse your credit score. If the lender imposes origination costs, you could expect to pay between 1% and 8% of the loan amount.

Risks: If you do not have a decent to exceptional credit score (at least 670) and a steady source of income, your loan may have high-interest rates and fees.

According to a survey done by the Federal Reserve, almost 40% of American adults could not cover a $400 unexpected expense without selling something or borrowing money. This suggests that many people are living paycheck to paycheck and do not have any cushion in case of an emergency.

The same survey found that only 26% of respondents said they would cover the expense by using cash, credit cards, or savings. Loans can be helpful in these situations, but there are some risks to consider before taking out a loan.

If you do not have a decent to exceptional credit score (at least 670) and a steady source of income, your loan may have high-interest rates and fees. You should also consider whether you will be able to repay the loan within the specified time frame.

If not, you may end up paying even more in interest and fees. Therefore, it is important to weigh all of your options before taking out a loan for an emergency.

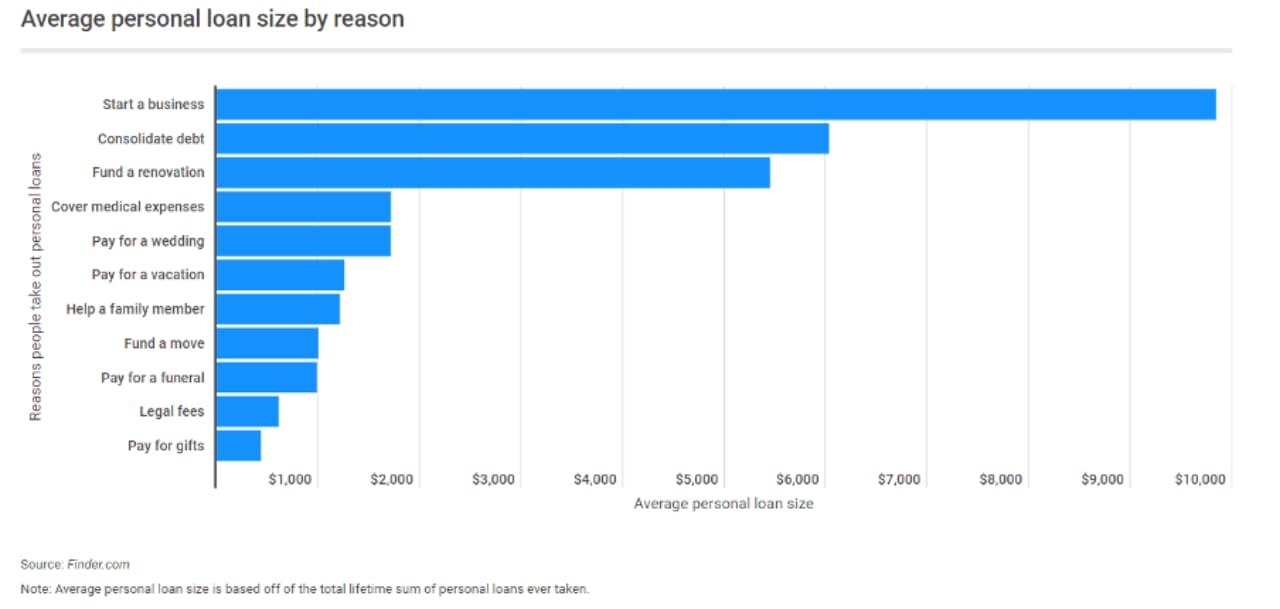

Some 131.0 million Americans, or 51.3 percent of all Americans, reported having taken out a personal loan at some point in their lives. So it’s a common practice that you don’t have to be afraid of. The main thing is to always carefully check the conditions.

Payday Advances

Payday guaranteed installment loans for bad credit or no credit check are short-term loans that must be repaid within two weeks of taking out the loan or by your next pay period. These are simple loans to get since most payday lenders do not verify your credit. However, they have significant negatives in the form of high-interest rates and fees.

In fact, in certain areas, the average interest rate on a 14-day, $300 payday loan is more than 650 percent. If you are unable to return the loan before the due date, you may be charged rollover costs (assuming payday loan rollovers are permitted in your state).

Risks: Because these loans have high-interest rates, they should only be utilized as a last option. If you can’t return the loan before the following pay period, you risk digging yourself a bigger financial hole.

Loans for Those with Bad Credit Or No Credit Check Loans Guaranteed Approval

Bad credit can make it difficult to qualify for a personal loan from a bank or credit union. However, there are lenders who specialize in bad credit loans, also known as subprime loans. These loans are designed for borrowers with poor credit or no credit history.

Although minimum credit score requirements vary per lender, a credit score of at least 580 is usually required to qualify. Interest rates on bad credit loans are typically higher than those of conventional loans, but by shopping around and comparing offers, you may be able to find a competitive rate.

In addition, repaying a bad credit loan on time can help improve your credit score. As a result, taking out a bad credit loan may be a good option if you need financial assistance but don’t qualify for traditional financing.

If you do not satisfy the lender’s minimal credit score criteria, a no credit check loan guaranteed approval is an option. The disadvantage of a no credit check loans same day is identical to that of a payday loan: it has high APRs and costs.

Risks: If your credit score is really poor, you may be charged a large interest rate and costs – some personal loan lenders charge maximum interest rates as high as 35.99 percent.

Following Steps

Make sure you look into all of your borrowing possibilities before taking out an easy loan. This may help you pay the least amount of interest or get the finest terms. If an emergency loan is your only way to get cash fast, prequalify for a personal loan to compare rates, fees, and conditions from several lenders. Whether you have a credit union or bank membership, contact it to check if you qualify for a personal loan.