While many people are familiar with this term, few know exactly how they’re calculated or what goes into creating a credit score. This score helps determine whether you’ll be approved for a loan and how much you’ll be charged for it.

In today’s time, when we are heavily dependent on credit, we need to prove our credibility to lenders. And credit score is the best way to demonstrate your financial health. Whether you are applying for a loan, requesting a credit card, or even setting up an internet connection, the lenders will pull out your score to gauge your creditworthiness.

What is a credit score?

A credit score is a three-digit number that summarizes how a person is at managing their credit and finances. Lenders look into these scores to determine how likely a person is to pay the bank or creditor its money back on time. A higher score means you are less of credit risk to a lender.

Banks and lenders readily offer better products and services to such individuals and provide them with favorable interest rates.

However, if you have a bad or below-average credit score, a potential creditor or bank is more likely to deny your credit request or offer you a loan at a higher interest rate.

Thus, before applying for a credit card, you should ensure that you are eligible for a credit. You can use a credit card eligibility checker available online to review your credit eligibility status.

Given how crucial a credit score is in one’s financial life, it’s natural to wonder how exactly this score is calculated.

But before jumping on to the answer, let’s first understand who calculates these scores.

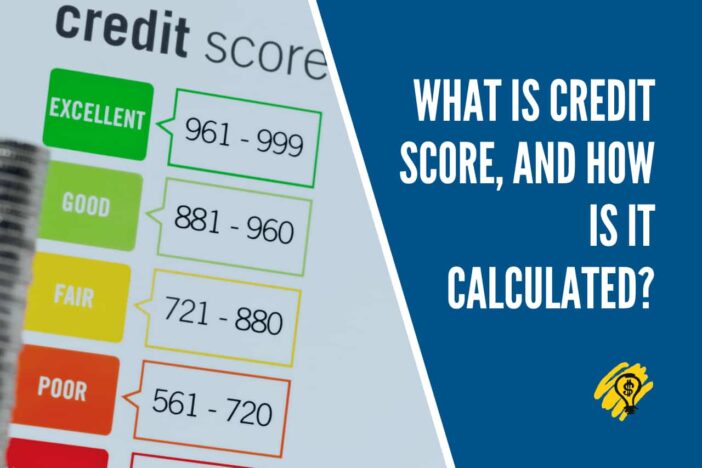

The credit bureaus or nationwide consumer reporting agencies calculate the credit score. Such agencies look through a person’s credit history to gauge their credibility and score them anywhere between the range of 300 to 900.

Different countries have different credit bureaus. Equifax, Experian, and TransUnion are some of the three major credit bureaus. Each of them has a different system and algorithm to calculate credit scores. Thus, these scores furnished by different credit bureaus may vary.

However, in general, credit scores are usually divided into five categories.

- 300-579: Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very good

- 800-850: Excellent

How is credit score calculated?

Various factors can influence your score. Some of them are detailed here.

Payment History:

Before extending credit to a person, the lender wants to ensure they will get their money back on time. They do so by looking at the applicant’s payment history. The payment history shows how the person is at paying their credit bills and mortgage. Payment history may include information about various loans a person has taken as well as utility accounts.

Payment history will also reveal if a person has missed payments, filed for bankruptcy, or has wage attachments. The algorithm takes into account how timely a person pays his/her dues, how much credit they owe, and how many times they have missed payments.

Clearly, your payment history has a high impact on your credit score.

Credit Limit:

Besides payment history, another factor that significantly impacts your credit score is the Credit Utilization Ration CUR. This ratio is the total amount of credit you have utilized against your total credit limit. This ratio is derived by dividing your cumulative outstanding balance by your overall credit limit. Lenders will only consider your credit application once they ascertain that you will pay off their money on time without any delay. If you have too many maxed-out credit cards or used your maximum credit limit, your overall credit score may dip. Aim to keep the CUR at 30% for a high credit score.

Type of credit:

Some credit bureaus also keep a tab on different types of credit accounts a person has. The types of credit accounts considered for calculating credit score can range from credit cards, mortgages, home loans, auto loans, personal loans, education loans, etc.

Besides this, they will also check how many of these accounts you have. After all, lenders would want to know how credit applicant manages multiple accounts and whether they are regular with their repayments before considering their credit request.

Newly issued credit:

If you have recently taken a loan or opened a new credit account, it will reflect on your credit history. This can have an impact on the length of your credit history.

Length of credit history

Lenders can assess your creditworthiness by looking at the length of your credit history. Your credit score will be good if you have a history of handling your credit responsibly and making timely payments. Since reputed lenders only prefer extending credit to people with good repayment history, ensure you keep credit cards with a long credit history.