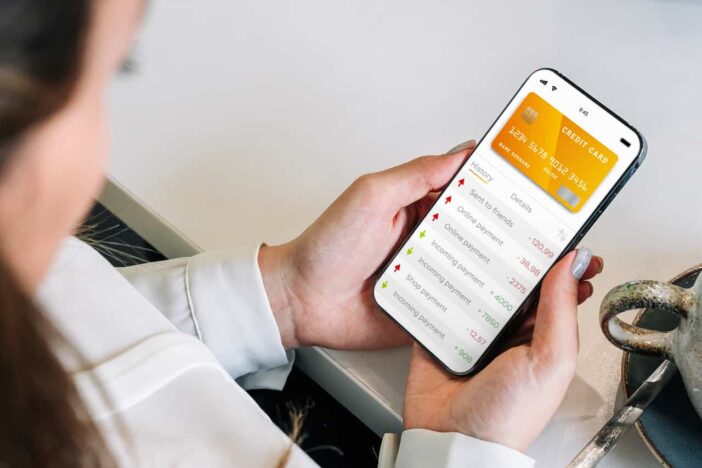

In today’s digital world, many businesses have changed how they pay their bills, make online purchases, and manage their overall finances. This is where using virtual cards enter the picture.

Generally, a virtual card refers to a debit or credit card which is used for online purposes only. It contains information such as 16-digit numbers, an expiry date, and even a card verification number. With the advent of modern technology, virtual cards have become helpful for many businesses.

Below are the six reasons businesses are switching to virtual cards:

1. They Want To Protect Their Online Transactions Against Fraud

Typically, virtual cards are designed with security features to protect business funds against the risk of fraud. For example, businesses can restrict the cards regarding the type of use and the amount available. The cards also have specific expiry dates that allow organizations to terminate the card number at a particular time, reducing the likelihood of fraud.

On the other hand, virtual cards can also be convenient when fraud happens. Unlike physical cards wherein businesses need to wait for a couple of days for the new one to arrive and begin spending again, dealing with fraud with virtual cards is much easier.

For example, when a specific virtual corporate card from a reputable vendor is victimized by fraud, organizations can quickly delete the affected card and use another one for spending. In that case, they can take advantage of improved fraud protection, which, in turn, makes the businesses’ daily financial operations uninterrupted.

2. They’re Looking For Instant Reconciliation

Manually reconciling spending can be one the challenging tasks for businesses. Because of this, many companies have started using virtual cards for instant reconciliation. Since most of these corporate cards provide relevant data tied to digital payments, organizations can easily reconcile expenses and other related financial transactions. These extra data from virtual cards usually include invoice numbers and order numbers, which make reconciliation much easier and faster.

3. They Want To Monitor Spending On Ads

Most businesses use digital marketing strategies and ad campaigns to promote their products and services. However, like other business expenses, organizations also need to spend considerable money to implement these ads and marketing campaigns successfully. This is where using virtual cards comes into play.

Businesses can set up various cards for each ad campaign to help them monitor spending on certain advertisements. Besides, some virtual cards come with applications that allow companies to view certain financial transactions, including recurring payments or spending. This setup makes it more convenient to track ad spending.

4. They Want To Keep Track Of Employee Spending

Businesses are switching to virtual cards because of their ability to provide transparency and visibility into employee spending. Generally, virtual cards can be given to various employees to facilitate company spending while preventing misuse of funds. This is because every purchase made through the virtual card can be tied to a specific employee.

As a result, organizations can determine how much and where each employee spends the company funds. This setup makes it easier for them to spot any fraudulent financial transaction committed by an employee.

5. They Want To Reduce Printing Material Costs

Businesses usually spend a significant amount of money on paper invoices, the printing of paper checks, and other related financial activities that require the use of physical records. However, this setup can be costly to most organizations. This is one reason why many of them have decided to use virtual cards for their financial transactions.

When they use digital cards, they don’t need to print physical invoices or issue physical checks to facilitate payments. Consequently, they can minimize printing material costs and reduce paper waste, making their companies greener.

6. They Want To Manage Vendor Payments More Efficiently

It’s important to know that businesses with many vendors must make various payments. Unfortunately, doing this may be inconvenient or risky for some organizations as they have to pay their vendors through different payment channels.

For this reason, many businesses are switching to virtual cards for managing vendor payments. They can generate virtual cards for their vendors to ensure they know exactly where the cards should be used.

Final Thoughts

With the advent of modern innovations today, the way businesses make payments and manage their overall finances has also evolved with the use of these cards from a reliable vendor in the market. They can be an excellent choice to grow businesses financially and make them successful in the long run.

But for companies that are still unsure about using virtual cards, they should keep the information mentioned above in mind. That way, they’ll understand the importance of virtual cards in navigating financial transactions and the company finances as a whole.