While most parents try their best to plan for the future by saving money and spending wisely, some find it difficult to ensure that they are financially ready for their children’s future expenses.

No one would ever know the feelings and emotions of a parent, right? Even before you can become one, the one thing you think about would be – how to secure them financially.

Everyone plans in different ways and aspects to secure the future expenses of their kids – because honestly, we all know them beforehand, and we know they are a great deal on the whole. For instance, saving up for college or a wedding.

This list could go on, but here are some ways you would want to know about different ways to do this.

Ways to Start Planning Around your Child’s Future

a) Your Public Provident Fund

You presumably already have a PPF in your name if you are a salaried person. You may not be aware of this, but you can create a different account in your child’s name. A maximum of INR 1.5 lakhs can be deposited into the child’s account each year. Section 80C of our Income Tax Act permits tax deductions for contributions made to your child’s PPF. The funds accumulate over time and give your child a safety net of money to rely on in difficult times.

b) Child Investments with the Waiver of the Premium

A child plan is a fantastic additional long-term investment option for your child. These regulations encourage you to invest in building a corpus for the future expenses of your kids. Additionally, they offer you life insurance. If you pass away (god forbid) while the policy is in effect, your kid is paid the death benefit right away.

Investing in a child plan will give you more flexibility to plan for your children’s future. It helps you achieve financial security and peace of mind.

When you go for a child plan, you will need to pay the premium for a set period of time. This can range from one to five years. The duration of the premium payment depends on the age of the child. After this period of time, the policy is expected to be matured. The major advantage of investing in a child plan is that it offers you an additional long-term investment option.

Additionally, the remaining premiums are waived. The insurer contributes money to the investment on your behalf and keeps accumulating funds for your child. Your child will get investment returns once the plan reaches maturity.

When do you need to start investing in a child plan? The earlier you start investing in a child plan, the more time you have to save.

The majority of individuals think that these insurance policies are the ideal way to invest in a child.

c) The Sukanya Samriddhi

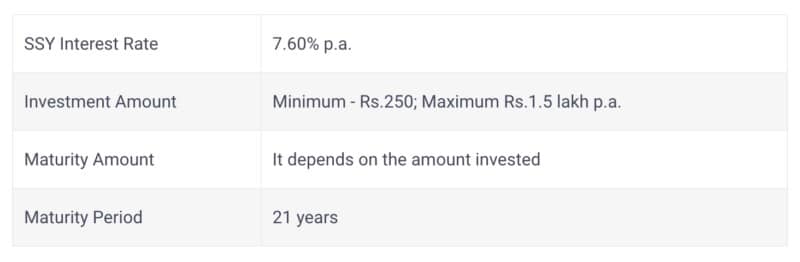

If you are from India, you can check the Sukanya Samriddhi account if you have a daughter who is younger than ten years old. You can open a bank or post office account for your daughter using this government program. You must fund the account with deposits each year.

The annual minimum deposit amount is INR 250, and the annual maximum deposit amount is INR 1.5 lakhs. These regular deposits must be made for a minimum of 15 years and a maximum of 21 years. If you choose SSY for your daughter, who is five years old, and choose the maximum duration of 21 years, the plan will mature when she is 26 years old. When your daughter turns 18, you can use the money you’ve saved to help pay for her future college expenses.

d) Gold ETFs

The purchase of gold is conceivably the only inflation-proof investment you can make for your child. Inflation is the most common problem with fiat currencies, and this is because they are not backed by anything. With a gold ETF, however, the value of the gold is based on the value of the currency in which it is traded.

These days, you can choose gold exchange-traded funds, which let you buy paper gold.

You don’t take the priceless metal into your possession. You manage an account where the value of money is equivalent to the real value of gold instead. When using a gold ETF, you can choose to buy as little as 1 gram of gold whenever you have the money and gradually increase your reserves. The gold can then be sold whenever you need to raise funds for your child.

With gold ETFs, you can get into the precious metal market at a low cost while simultaneously being able to control the price you pay for your gold. You can hold on to the gold for many years, or you can sell it as soon as you need the cash. The gold ETF market is growing at a very fast rate.

e) A recurring deposit to secure future expenses

Recurring deposits are a good option for parents seeking a low-risk investment strategy for their children’s future because interest rates are at an all-time high. Locking the RDs allows you to make plans for the child’s future. In India – both the banks and the post offices provide recurring deposits. For instance, a monthly investment of Rs. 1000 can earn you Rs. 2 Lakhs after ten years. You can use a tool on the Indian Post Office’s official website to examine the returns you might anticipate based on your monthly investment. As far as child investing programs go, this is a safe approach to accumulating a corpus.

f) The national savings scheme

The National Savings Certificate, or NSC, is the best and most reliable way to set money aside for your child’s education. Five-year national saving certificates are available for purchase, and when they mature, they can be reinvested. One can purchase a certificate for as little as Rs. 100 at the current interest rate of 8.10%. Section 80C of our Income Tax Act allows for an IT rebate on investments made up to Rs 1 lakh annually.

g) A mutual fund

Deposits made to equity mutual funds rank highly in the Children’s Investment Plan. The availability of investment options and the extended time horizon of 10–15 years are the two key justifications for the same. Equity funds have historically produced between 12% and 15% annual returns.

h) Use ULIP

Even though many people do not favor ULIP plans, they are the best option for low-risk investors. Any ULIP scheme can yield returns ranging from 4% to 6% per year. However, keep in mind that when compared to the other accessible kid investing plans, ULIP schemes must be the last resort.

Keep in mind not to limit your investment to one plan. Additionally, avoid being duped by insurance brokers who could entice you to engage in bad schemes by promising larger profits. Parents should invest in their children’s skill development in addition to making financial investments. Encourage your kids to save for their own objectives by teaching them about money.

Final Note

There are more than 100 ways to start this – but the key is to start it in the first place. It could be better to have something on your back for the kids, which will leave them secure and less burdensome on you.