In today’s world, customers have more options than ever when choosing a bank. With the advent of online banking and mobile apps, customers can open accounts and conduct transactions with just a few clicks. Banks must do everything possible to enhance the customer experience in this competitive landscape. One powerful tool for achieving this is Customer Relationship Management (CRM).

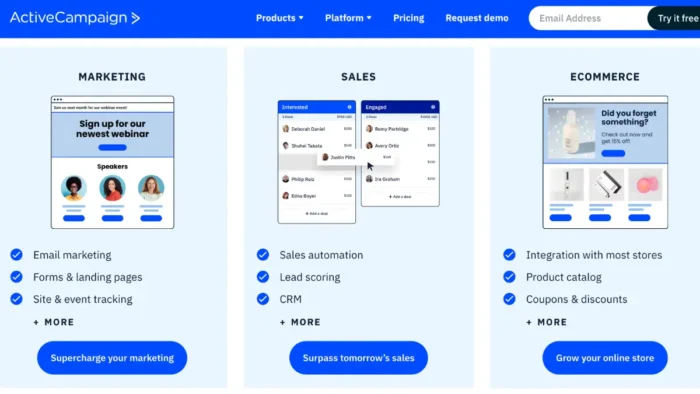

CRM is a strategy that allows companies to manage their interactions with their current and potential customers. It involves using technology to organize, automate, and synchronize sales, marketing, customer service, and technical support processes.

In the banking industry, CRM for banks can help provide better customer service, improve customer retention, and increase revenue.

Key ways that CRM can enhance the customer experience in the banking industry

Personalized Service

CRM allows banks to collect and analyze customer data, including transaction history, preferences, and behavior. With this information, banks can tailor their services to each customer’s specific needs. For example, if a customer frequently makes international transfers, a bank can offer them special rates or promotions on those transactions.

Improved Communication

CRM allows banks to communicate more effectively with their customers. Using automated messaging, banks can send personalized messages to customers on their preferred communication channels, whether email, text message, or social media. This can help banks keep customers informed about products and services that may interest them.

Related: 7 Amazing Communication Tools You Can Use With Clients

Enhanced Customer Support

CRM can also improve customer support in the banking industry. Banks can identify common problems and quickly address them by tracking customer interactions and issues. For example, if multiple customers are having trouble logging into their online accounts, a bank can quickly investigate and resolve the issue for all affected customers.

Cross-Selling Opportunities

CRM allows banks to identify cross-selling opportunities based on customer behavior and preferences. For example, if a customer frequently uses their debit card for purchases, a bank can offer them a credit card with rewards points for purchases. This not only benefits the customer but also increases revenue for the bank.

24/7 Accessibility

With CRM, banks can provide customers with 24/7 accessibility to their accounts and services. This means that customers can conduct transactions and access their accounts anytime, anywhere in the world. This not only enhances the customer experience but also increases customer satisfaction.

Future Trends in CRM for Banking

The banking industry is constantly evolving, and there’s no doubt that technology has played a significant role in shaping it. One of the most significant developments in recent times has been the advent of Customer Relationship Management (CRM) technology.

CRM software has revolutionized how banks interact with their customers, providing valuable insights into customer preferences and behaviors. However, as with any technology, CRM is not static, and new trends are always emerging.

Here are some future trends in CRM for banking that you should watch out for:

Personalization

Customers today expect a high degree of personalization when interacting with their banks. CRM technology can help banks meet this demand by providing detailed customer profiles, including transaction history, preferences, and behavior patterns. With this information, banks can deliver personalized service to each customer, enhancing customer satisfaction and loyalty.

Integration with other systems

Banks use various systems to manage their operations. Banks can create a seamless experience for employees and customers using CRM technology with other systems. For example, integrating CRM with call center software can help customer service representatives provide better customer support.

AI and automation

Artificial Intelligence (AI) and automation are transforming the banking industry, and CRM is no exception. Banks increasingly use AI-powered chatbots to interact with customers, providing quick and accurate responses to their queries. This not only helps banks save time and money but also enhances the overall customer experience.

Mobile Optimization

More and more customers are accessing banking services via their mobile devices. As such, banks need to optimize their CRM systems for mobile devices. This includes ensuring the user interface is intuitive and easy to navigate on smaller screens.

If you want to explore these trends further, why not consider a free CRM trial? Many CRM vendors offer free trials, giving you the opportunity to test the software before you decide to purchase. In such a way, you can get a feel for the software and see how it could benefit your bank and your customers.

Conclusion

In conclusion, Customer Relationship Management (CRM) technology is a powerful tool to help banks deliver exceptional customer service. By providing valuable insights into customer behavior and preferences, CRM software enables banks to personalize their services, create a seamless experience across different systems and channels, and streamline their operations.

As we have seen, several emerging trends in CRM for banking are worth watching out for. From integrating CRM with other systems to using AI and automation, banks that embrace these trends will be better equipped to meet their customers’ evolving needs and expectations.