If you’re looking for a quick way to turn a profit, penny stocks may have caught your eye. While it’s true that you can make money fast with these low-priced stock options, you can also lose your investment just as quickly. As with any trading venture, there’s a certain amount of risk involved. Penny stocks are particularly risky because they’re usually offered at a bargain price for a reason. Penny stocks are highly speculative and are often offered by floundering companies who don’t have a strong financial footing.

Before you purchase penny stocks, you should understand what you’re investing in. Look for a company with a strong balance sheet. Startups that aren’t well-established may offer penny stocks, though they’re poised for success. If a major company is selling penny stocks, this is often a red flag that something is amiss. Though you may have a strong feeling about the profitability of a particular stock, it’s still smart to diversify. Following these trading strategies will help you increase your chances of success with these stocks.

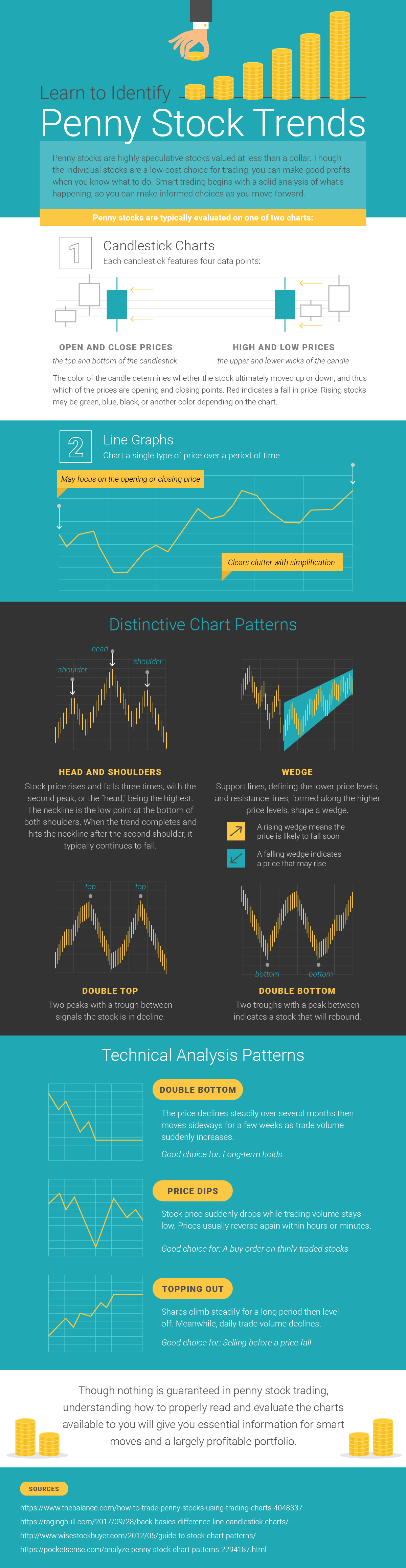

Another important part of trading penny stocks is following the trends. Learn to read candlestick charts and line graphs so you can interpret the data accurately and use it to make informed decisions about the trajectory of a particular stock. A wedge or head-and-shoulders pattern can help you evaluate penny stock trends more effectively. Learning about key indicators on these charts will help you place your money wisely for the greatest chance of success with this type of investment.