Almost every industry had been adversely affected by the coronavirus pandemic. This has led to a drastic fall in most of the securities in the global stock market. However, this hasn’t been the case for gold which has continued to rally upwards since the start of the pandemic. As an investor, this continued rise in this precious metal’s price must have you thinking about investing in gold.

But, if you’re uncertain about your decision to invest in gold during this coronavirus pandemic, you’ve come to the right place. Here’s a guide on why gold is the perfect asset to buy during this coronavirus downturn.

1. Gold Safeguards You From Counterparty Risk

The counterparty risk is the danger that the party facilitating your investment isn’t in a position to pay you back upon your request to make a withdrawal. This was prevalent during the 2008 financial crisis when several banks couldn’t cope with the increased request by depositors to withdraw their money. To address this issue, bank regulators have put in place strict measures to prevent this issue from happening in the event of another financial crisis.

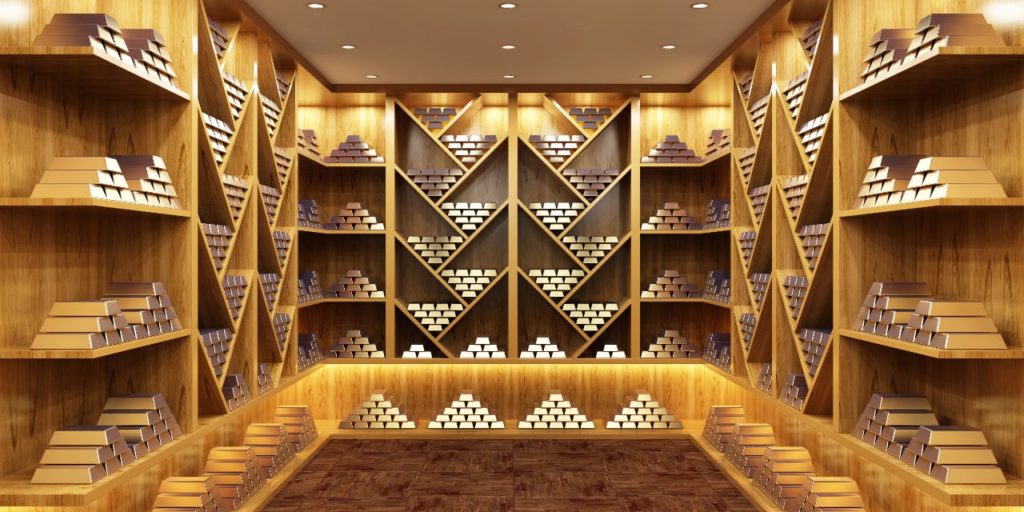

However, you can never be too sure how successfully this will be achieved, and a safe alternative would be to invest in gold. By investing in physical gold, you take your money from the global banking system, so you don’t have to deal with counterparty risk. The only cost you’ll incur is the insurance risk. Another excellent option would be storing the gold in a trustworthy bullion vault facility or with dealers such as Goldco, which is wholly segregated and allocated. Doing this ensures all the gold you bought is separated from that of any other client and is stored in your own vault or account.

2. Gold Is A Safe Haven Asset

Gold always maintains its intrinsic value even when there’s an economic downturn such as that caused by the coronavirus. The nature of this precious metal has made it the go-to choice for investors looking for an asset that will still retain its value regardless of whether the whole economic system does crash. Therefore, its demand during these troubled times has increased as it’s considered a safe haven asset. This is usually the case despite the value of gold changing with changing levels of demand.

3. Gold Is An Excellent Hedge Against Inflation

One significant effect of the coronavirus is the shrinking of the global economy. In an attempt to stimulate the economy, many governments across the world have resorted to implementing stimulus package techniques such as quantitative easing or lowering interest rates. As a result, this increases the economy’s money supply, thereby lowering a currency’s value.

The increased money supply then results in a fall in your purchasing power. This happens because devaluing the currency leads to greater prices for goods and services. Therefore, one dollar can’t buy as many goods or services as it would have in the past.

If you wish to avoid these negative inflationary effects, the best thing to do would be investing in gold. This is because the value of gold rises in the opposite direction to that of the dollar. Therefore, whenever the dollar is falling in value, gold, on the other hand, is increasing in value. This makes it the perfect hedge against inflation, safeguarding your purchasing power in the future.

4. Gold Helps You To Prepare For Stock Market Crash/Correction

As a wise investor, it’s advisable to diversify to lower your exposure to financial risk. If you invest in the stock market, this is especially crucial in times of economic downturns, as this one was caused by the coronavirus pandemic. A safe way to protect your hard-earned money would be buying gold to protect yourself from a possible stock market crash or correction. By doing this, you safeguard yourself from incurring a loss that leads to billions of assets lost in the stock market.

Therefore, the use of gold to hedge your investment in the stock market is advised should any geopolitical instability cause a correction or a full market crash.

5. Gold Is A Tangible Asset

The shiny and beautiful look of gold has made this precious metal since the ancient days very valuable. It also is a tangible asset, and it’s this feature in today’s modern society that has made it a go-to asset during times of economic uncertainty. With your gold bars and coins, you enjoy greater peace of mind than you would have with fiat currency. This is the case despite its value being subjective as it changes depending on the market conditions and demand. Therefore, many investors run to it during times of economic uncertainty. Hence, gold’s value has constantly been rising the past year.

Takeaway

Investors are always looking for ways to safeguard their investments. During times of economic downturn, finding the right investment to protect you from financial loss can sometimes be quite challenging. If you’re in a similar situation and wondering whether gold is the ideal asset to act as insurance, this in-depth guide has provided you with all the useful insights you need to know. Knowing this, you can now comfortably go ahead and invest in gold.