Today, technology plays a massive part in our daily lives. It is linked with almost every field of work, and all the industries follow it to measure the development of new technologies. So, it is crucial to do a technology evaluation before starting your startup or building your innovative product.

Here we will cover two concepts:

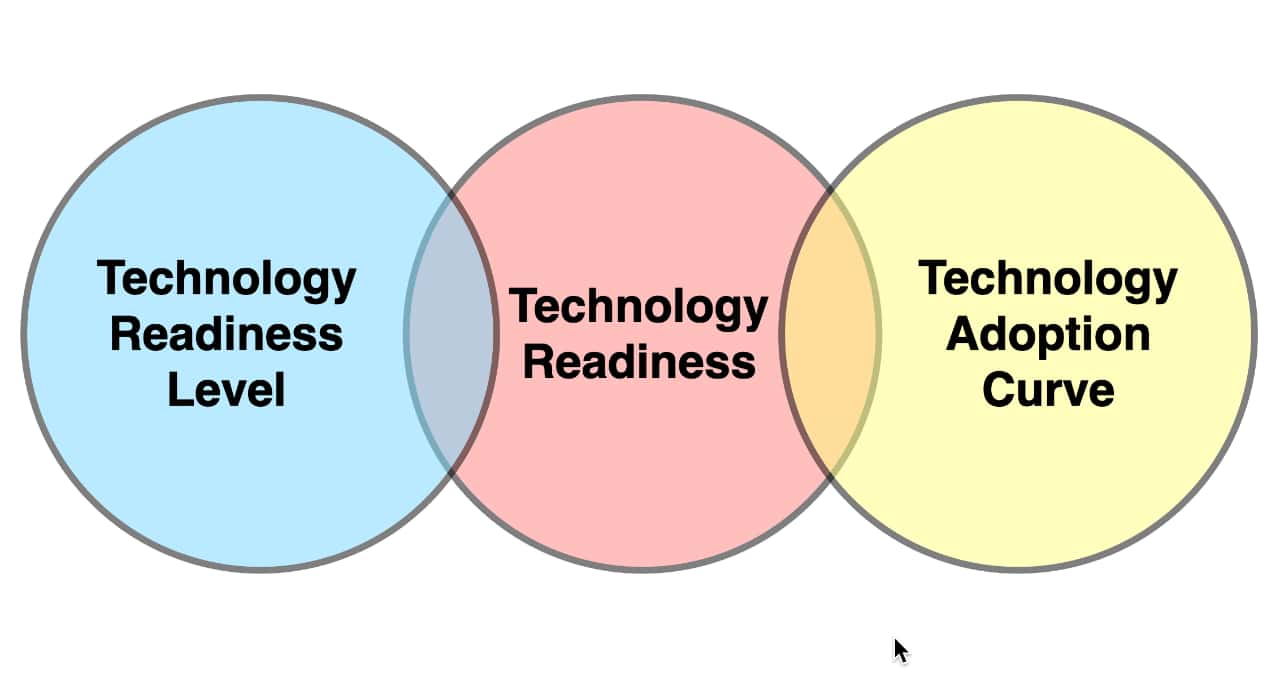

- Technology Readiness Level (TRL). We will use this tool to evaluate the readiness of the company and technology to bring innovation to the market. This will tell us how close the company is to the customers with their new innovative products and services.

- Technology Adoption Curve (TAC). We will use this tool to evaluate the readiness of the market to accept and adopt the innovation itself.

Company’s Readiness and Market Readiness for New Technology

There is no job today that cannot be done better with the help of technology. Today, our cell phones are phones and radio, TV, writing tool, productivity tool, and so on. Today, smartwatches are more than a watch that will tell us what time is. We use watches for many other things.

Development and bringing innovative products on the market require a specific technology used to produce an innovative product. The innovative product itself is also new technology for the market. So, we have an organization that innovates at the beginning of the process. This organization, which in many cases is a startup, will need to use different technologies and processes inside their innovation process to make the innovative product possible from one side.

Then we will have the market on the other side that will evaluate our innovation as new technology through acceptance and adoption. Startup companies, when they start talking with potential customers about their products learn that they need to change something in the design or anything else. This is a requirement from the market. After implementing changes, they find that they will lose something in their features. For example, they can lose efficiency in power production if we talk about the gadget that will need to produce power.

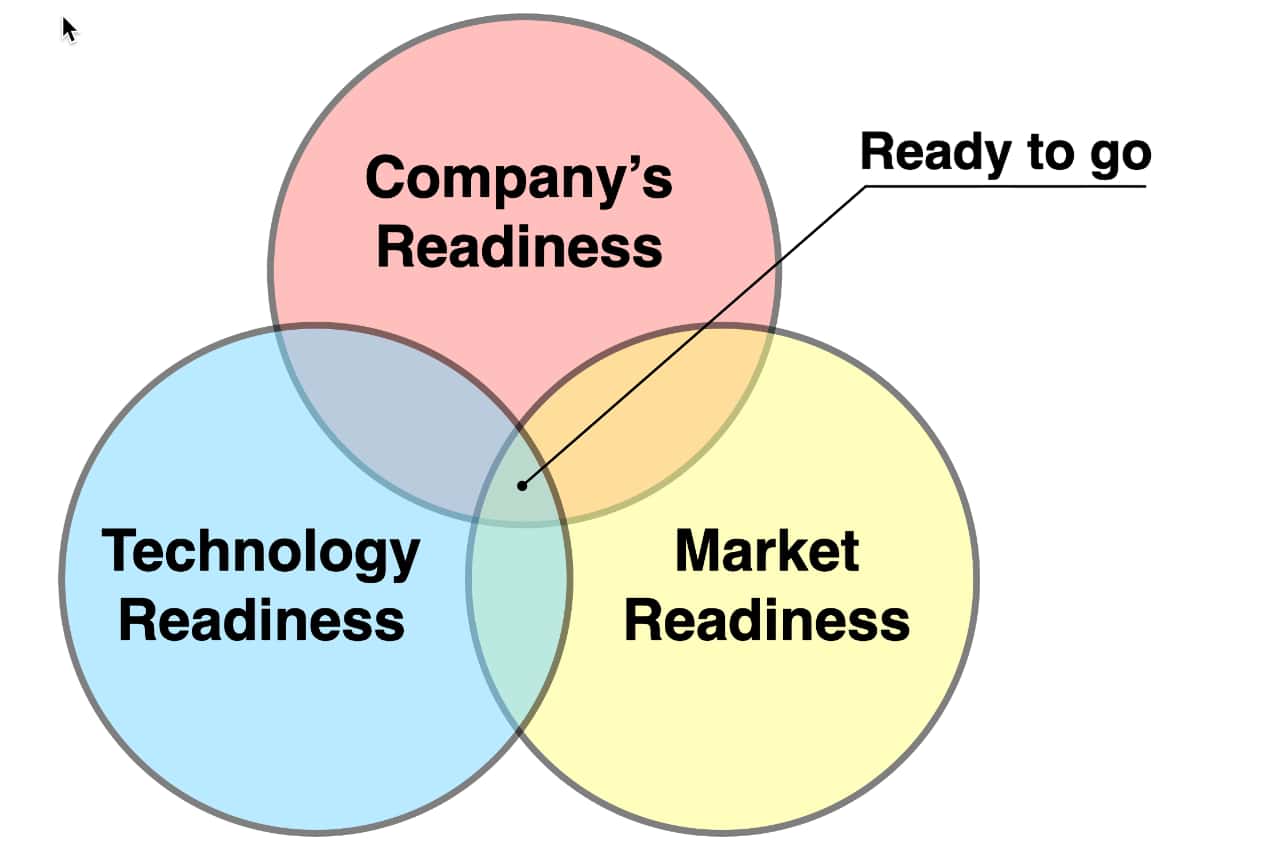

So, when it comes to technology, we need to pass two crucial things:

- Our company’s readiness for technology like expertise, knowledge, skills, technical equipment and so on.

- Market readiness, or how much is the market ready to use some specific new innovative technology.

The main question here is how technology can be evaluated before it is ready for development or prepared for commercialization? The answer is with the technology readiness level for the company’s readiness and technology adoption curve for the market readiness.

What is Technology Readiness Level (TRL)?

Technology Readiness Level was first developed in NASA for space exploration and related technologies.

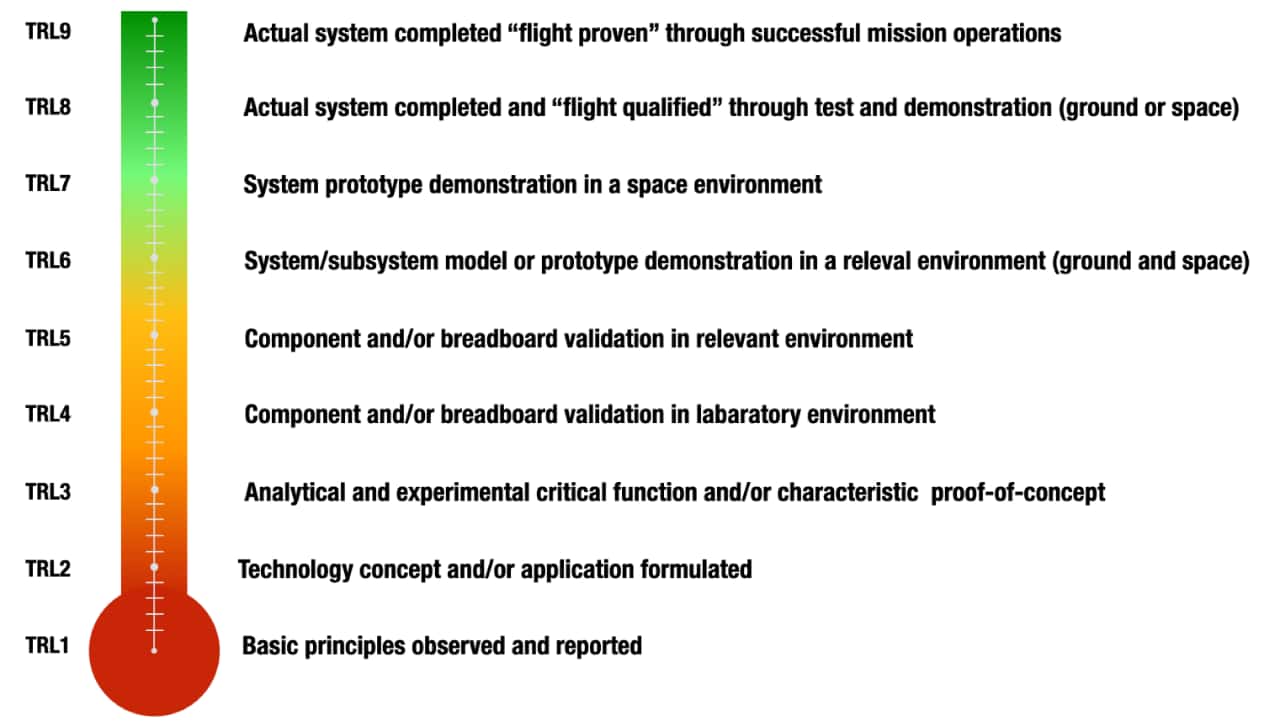

You can use this process for technology evaluation on a scale level, from the idea about technology’s invention towards its commercialization and extensive application. In the simplest words, TRL is a tool for measuring the development of something from an idea and basic research to the shipment of the product in commercial use or market-ready product.

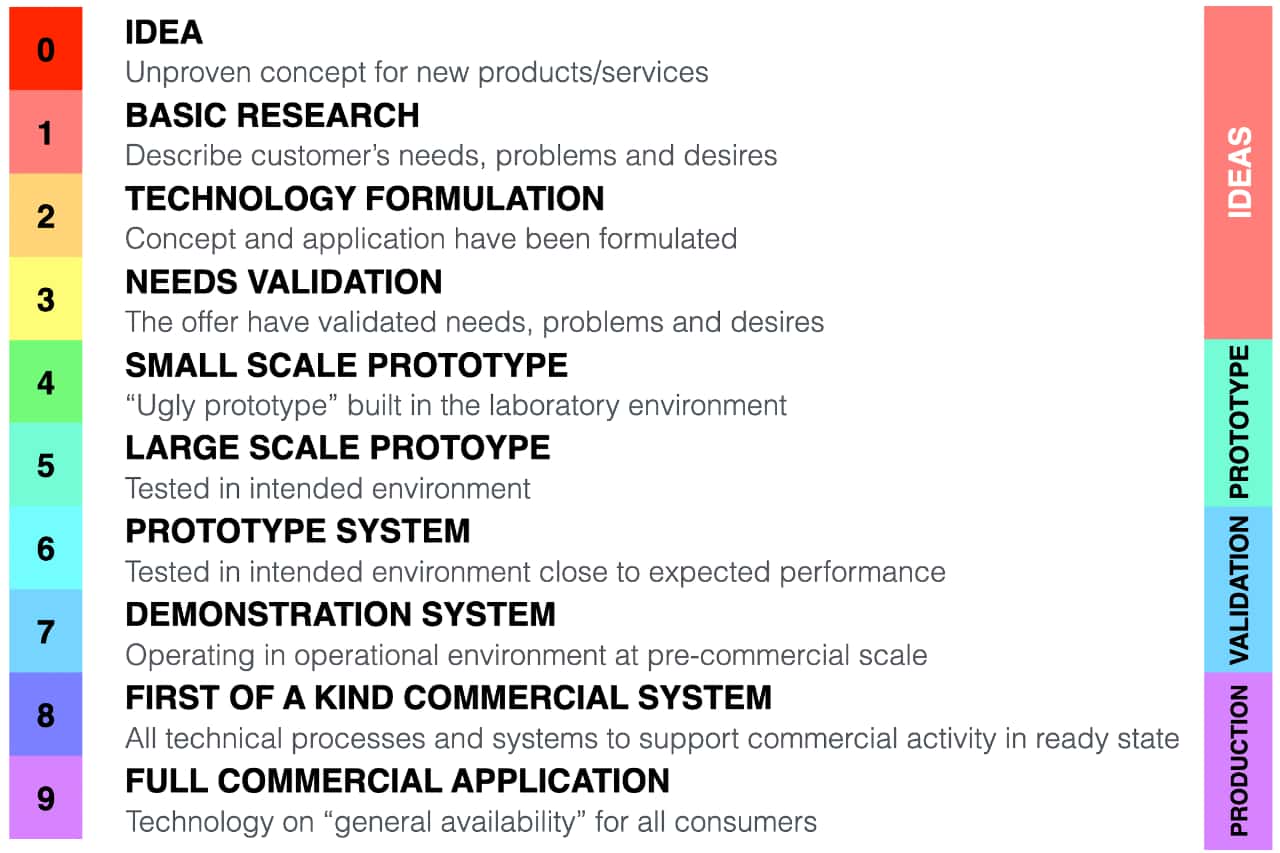

Using this approach, we assign a technology readiness grade during technology development. So we can evaluate technology using the rating system to determine the extent of how it is near or far from its deployment to the market. The rating system can be from one to nine, where TRL9 is the highest level and TRL1 is the lowest level of technology readiness.

Different industries can have different timeframes used in TRL. For example, software development may take just eighteen months to progress from an idea. On the other side, medication development in the pharmaceutical industry may take over ten years to progress from TRL level 1 to TRL level 9 because of a high level of required testing.

One of the biggest problems with TRL is uniformity because the scale was developed with the space industry in mind. Although the nine technology readiness levels can be implemented in different industries, it is much better to customize the scale per your requirements instead of following the standard model.

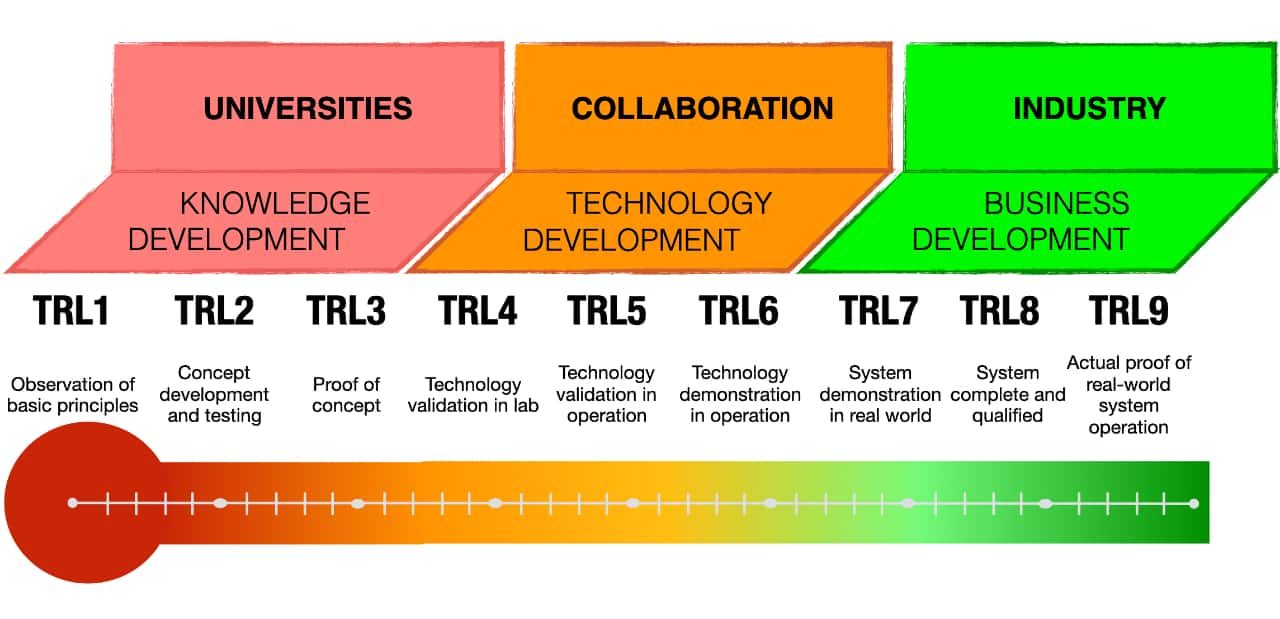

If we look at the levels of technology readiness in totally different ways, we will see that the first three are related to knowledge creation. In large part, universities are the ones that can contribute to starting the development of innovative technology. From the fourth to the sixth level is the development of technology and here the cooperation with other stakeholders is essential using the principles of open innovation. And finally, there is business development where everything should already be functional in actual conditions.

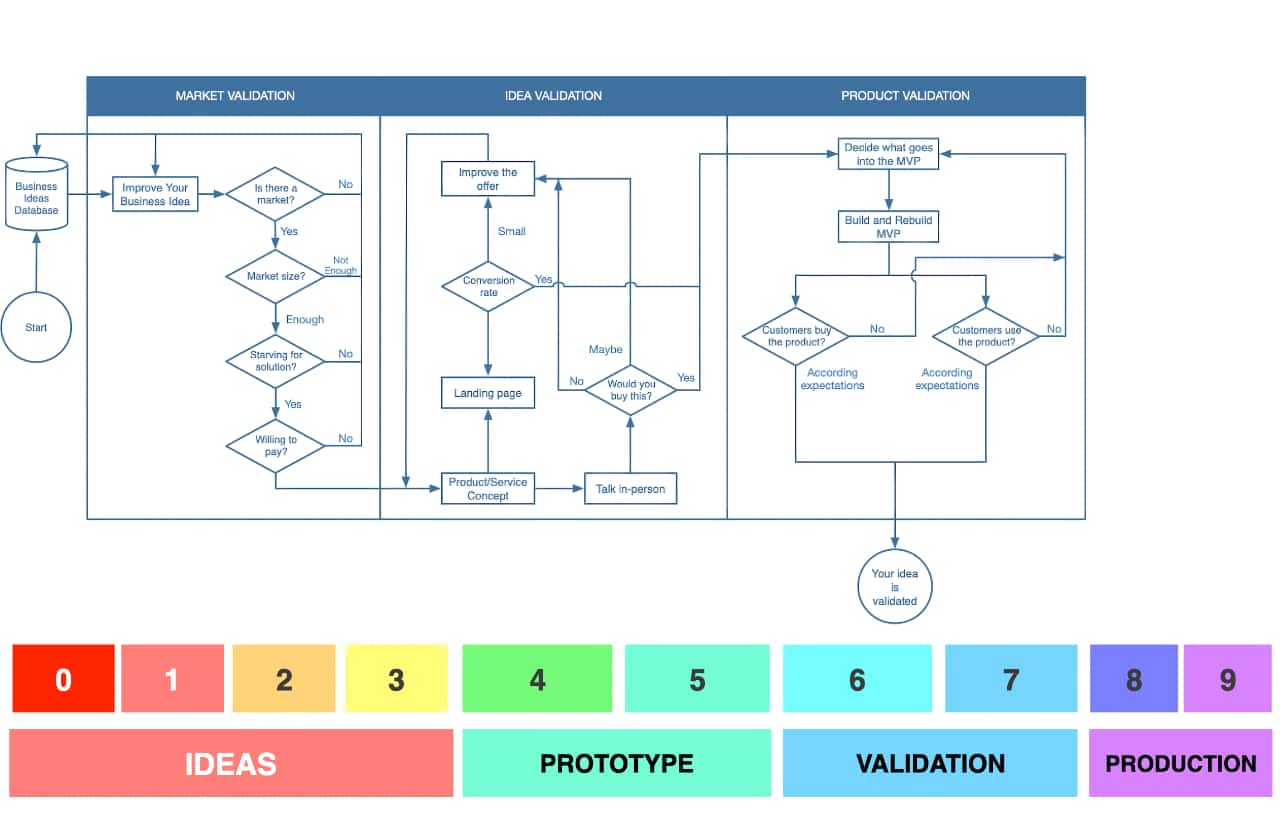

Let’s look at a case of how CloudWatch redesigned this tool to make it more usable for startups. Here we start from 0, where we have only an idea for a product or service and an idea that has not been tested and proven, and we end with nine which is the complete commercial application of the product or service for the market.

If we put this inside our workflow related to product validation, you can quickly develop ideas on using this vital tool inside your processes.

What is Technology Adoption Curve (TAC)?

Let’s see the other side of the technology evaluation, the technology adoption curve that we can use for technology evaluation, but from the market side.

The development of new technology depends not only on innovative organizations but also on the market and how much the potential customer will accept the new technology.

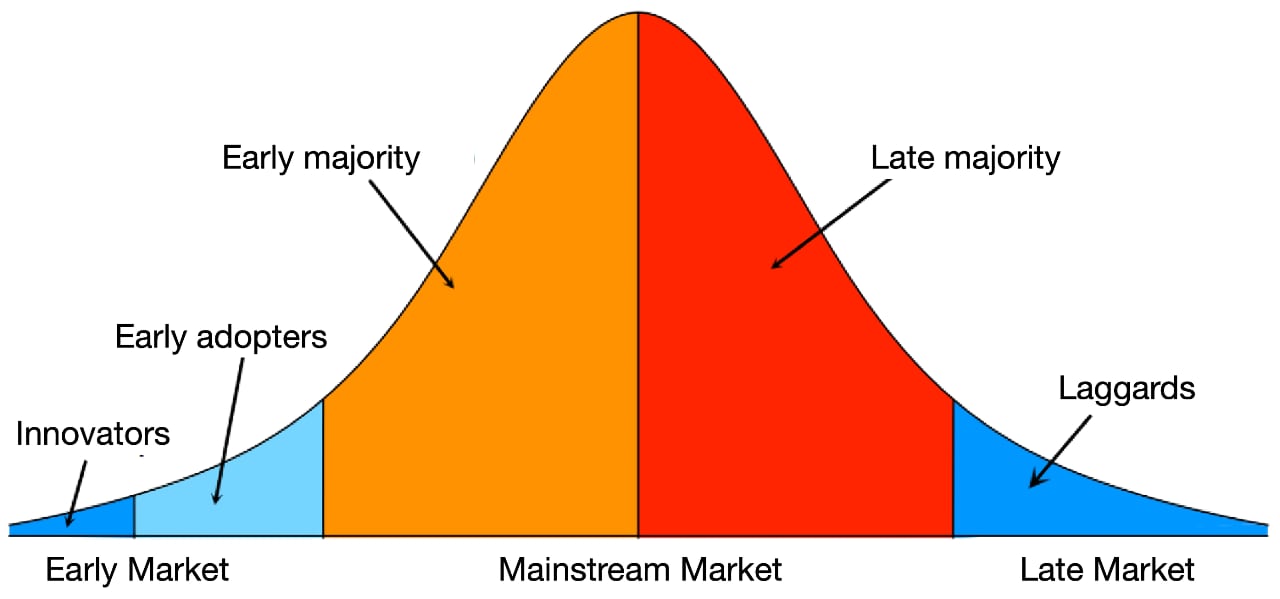

The most important question is when the customer will buy one specific new technology, product, or service? The answer is the model called Technology Adoption Curve, or Technology Adoption Life Cycle. The model describes the market penetration of any new technology product in terms of a progression in the types of customers it attracts throughout its useful life. So, in simple words, TAC is a model for understanding the acceptance or adoption of new products. This helpful tool can help you understand technology adoption in the market. But also, the tool can help organizations that develop new products to boost their customers’ growth.

The model breaks the market for new technology into five segments based on how quickly the market will adopt the new technology.

Innovators.

We can see that the first customers for a new technological product in the early market are innovators. They are enthusiasts, people with an understanding of technology. They love new things, want to experiment with new technologies, own them, use them, and are happy because they have access to such a product. Also, they are aggressive in searching for new technology even before developers start with marketing activities because, in their life, technology has a central place regardless of the function of that technology. They are buying new technology for the pleasure of exploring, testing, and experimenting.

These innovators are not many on the market, but finding and using them can significantly help startups pass to the following TAC stage – finding and increasing the second group of customers, early adopters. Once innovators experiment, test, and use new technology, they are the biggest spreaders of the message that something new is working, paving the way for another group of customers and a second stage of the cycle. As shown here, when innovators are the only customers of a new product, the sales volume is still very low.

Early adopters.

Like innovators, early adopters buy a product quite early in the life cycle, but they are not people of technology like innovators. This group of customers quickly succeeds in understanding and appreciating the benefits they receive with the new product. Whenever they have a substantially new technology overlap with some of their needs, they decide to buy it.

Although this group of customers is still small for the product’s success on the market, and the sales volume is still low, these customers are the ones who will further push the product to go to the following TAC stage. So, early adopters are the key to opening up any high-tech market segment.

If someone is a person who wants to have the first electric car in his street or city or the latest cell phone, then this person is probably in the group of innovators or early adopters.

Early majority.

Early majority customers also like new technology but are driven by a new product’s or service’s practicability. Because they know that most innovations end up like failures, they will wait to see how other people that already bought the product use it and do the work with them. They will buy new technology only if they are convinced of the practicability and usefulness of the products.

So before making a purchase decision, they want to look for evidence. On the other hand, the product’s success in convincing these customers of its quality and benefits will bring high success for the company. This segment of customers simply represents almost one-third of all customers on the technology adoption life cycle and provides a large sales volume, growth, and profitability.

If someone answers that he is waiting to see how electric cars are driven without any problems and there are enough services, he is probably part of this segment of customers.

Late majority.

This segment has almost all the characteristics of early majority customers. The only difference is that this group of customers are not so much comfortable with the new technology. Therefore, these customers are waiting for new technology to become the standard in use. They want exceptional support and a high reputation and credibility of the companies they will buy from.

Like the early majority, the late majority covers almost a third of all customers on TAC. They ensure the company’s high profitability, although as the product ages, the profit margin decreases.

If someone says that he will not buy an electric car until most people buy and use it and driving a gasoline car is becoming too costly, he probably belongs to this customer group.

Laggards.

At the end of the TAC are “laggards,” or people who simply do not want to have anything with new technology, whether for personal or economic reasons. They are the last ones who will decide to buy or not. We can see that the sales have already dropped drastically, and the number of customers in this segment is much smaller.

If someone says that he will not buy an electric car, whatever happens, he is probably in this group of customers.

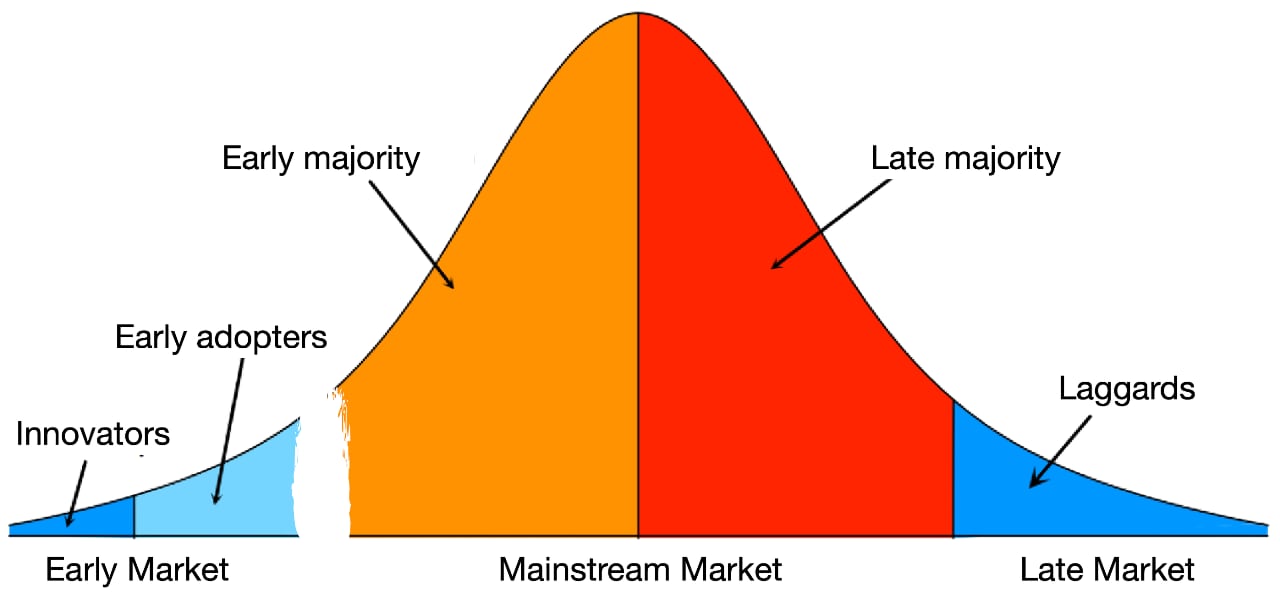

Crossing the Chasm

You need to take into consideration one important thing. It is the gap between early adopters and the mainstream market. Geoffrey Moore, in his book when talks about this gap, illustrates why so many companies fail. The answer is that they fall into the large gap between the tech-savvy early adopters and more unadventurous, mainstream customers. Many startup companies are simply unable to cross this gap.

In the past two decades, we have seen many startups grow quickly, becoming market leaders in industries that have not even existed before. The timeframe for new product development because of shortened product life cycle becomes shorter and shorter. Many promising high-tech products and services, even the whole market, can disappear overnight. That means that customer acquisition strategies for the early market will need to be adopted to industry-specific approaches.

Clayton Christensen, the author of many books related to disrupting innovations, recognizes sustaining and disruptive technologies. The first type of technology improves the performance of established products along the dimensions of performance that mainstream customers in the market have valued before. On the other side, disrupting innovation underperform established products in the mainstream market but has some features for new customers from other markets.

Big-Bang Disrupters

The availability of many different disruptive technologies that are cheaper to manufacture and install gives innovators and startup entrepreneurs opportunities to explore new applications at small risk to investors, abandoning prototypes that do not quickly demonstrate success. For example, today, developing and publishing an application for cell phones can quickly succeed through application markets like the Android Play Store and Apple’s app store.

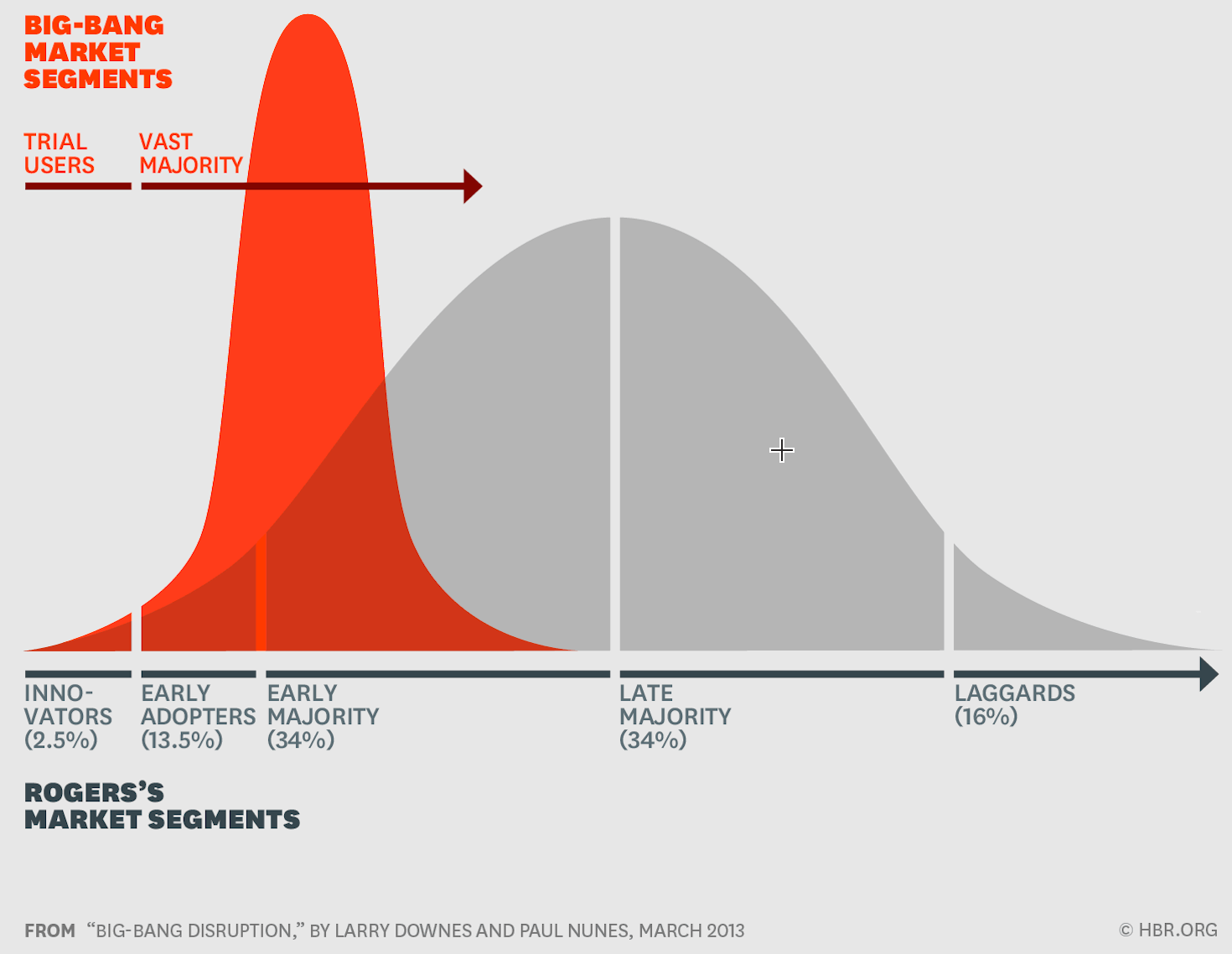

These disrupters are called “big-bang disrupters” that change the product life cycle and technology adoption cycle we know.

So, these five segments we talk about will become two segments in “big-bang disruption,” – trial users, who participate in product development, and everyone else. In such a situation, the adoption curve has become closer to a straight line that heads up and then falls rapidly when saturation is reached, or a new disruption appears.

We cannot use Moore’s approach to make the giant leap from targeting early adopters to marketing to the early majority with this change. However, big-bang disruptions can be marketed to every segment concurrently, directly from the beginning of the product life cycle.

4 Stages of Technology

We are witnesses to so many technological innovations in the past. More and more new technologies become available to all of us. But, what is important to you is what you need to think about technology and how to time an innovation in your business. This is a perfect TED talk in which Chris Anderson talks about the four stages that technology needs to go through to become viable. It’s worth your time. You will learn many useful tips.