Day trading is serious business. Ask any professional trader, and they will readily attest to the challenges of managing a diversified financial portfolio comprising scores of stocks across multiple sectors. Nowadays, information is flying thick and fast, and accurate, real-time pricing is absolutely essential to successful trading.

Often, the difference between profit and loss is determined by timing. Most day traders today cannot rely solely on themselves to pick stocks, watch stocks, sell stocks, and manage stocks on a daily basis. The sheer glut of information out there makes it virtually impossible to effectively manage a financial portfolio without using sophisticated tech tools like portfolio trackers, and stock screeners.

What is a Portfolio Tracker?

As its namesake suggests, the portfolio tracker is a powerful resource used by day traders and investors to gauge the viability of the components of your portfolio a.k.a. your stocks. This type of sophisticated software is designed to provide an overall summary of the performance of your portfolio at any given time.

There are plenty of tools to help you manage your portfolio better, notably stock screeners for selecting individual components to add to your portfolio, or to divest from your portfolio. Portfolio trackers give you a snapshot of your portfolio at any given time.

Recall that portfolios are dynamic, with ever-changing values from minute to minute. The greater and more diversified your asset accumulation, the bigger the fluctuations you can expect. Sometimes, a mix of assets in a portfolio has the effect of balancing poorly performing equities with strong performing equities.

This creates a sense of equilibrium which negates the volatility inherent in financial markets. For example, equivalent investments in tech stocks and gold ETFs may give the impression of a neutral collection of assets with a portfolio tracker.

Utility Value of these Trading Tools

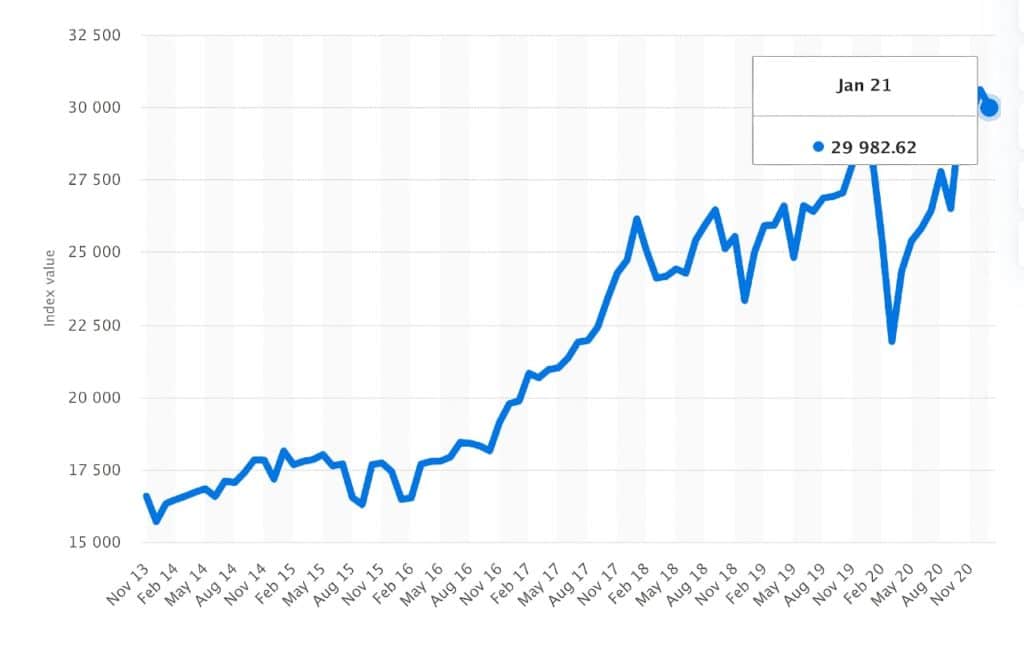

Early in 2020, markets nosedived before rebounding spectacularly towards the end of the year. Nobody could have predicted the size and scope of a market crash with any degree of accuracy. Yet, the recovery began in earnest, with the passage of multiple massive economic stimulus packages.

This year, in 2021, the Biden administration is poised for the imminent roll-out of another stimulus to the tune of $1.9 trillion. This will provide direct assistance to those in need of it most, including minorities, low income earners, and small and medium-sized enterprises.

If a sustained recovery takes place as anticipated, then traders will be eager to cash in with stock purchases to add to their portfolio. Portfolio trackers provide a complete overview of all of your investments. They encompass all asset classes, profits, and losses. The utility value of the portfolio tracker is beyond reproach. Traders can get an instant snapshot of strongly performing equities, poorly performing equities, and the overall performance of the portfolio.

In all instances, it’s important to keep things simple, albeit sophisticated. The functionality of a stocks screener is either its saving grace or its Achilles heel. A stock screener with easy-to-use features and functions is worth its weight in gold. A complicated stock screener is worthless, since it’s difficult to use. Fortunately, beneficial portfolio trackers can provide accurate information regarding returns, holdings, earnings, gains, dividends, and stock splits.

Still not Convinced About the Merits of a Stock Screener?

Once you start trading, you should be on the lookout for the best stock scanners out there. Whenever real money is moving from your back pocket to a brokerage you want to be as safe as can be.

Take a look at any major index that you are familiar with. The S&P 500, the NASDAQ composite index, the Germany DAX 30, the France CAC 40, the NYSE, the Dow Jones Industrial Average, or even the Johannesburg Stock Exchange.

One thing all of these markets have in common is a substantial amount of information on listed equities. Stock scanners or portfolio trackers, or stock screeners as they are known in trading parlance are precisely the types of tools needed to effectively make that trade.

At any given time, the prices of financial instruments will be moving up, down, or sideways. The only way to keep it straight as a day trader is through the use of stock scanners to assess market variables meeting your criteria. In trading, the experts say the trend is your friend.

Stock screeners and portfolio trackers are the best tools you need to stay abreast of the latest trends, price movements, and market behavior. You can set the criteria based on your parameters – that’s the beauty of a stocks screener.

You plug in certain criteria and you receive a batch of potential options for you to trade. A portfolio tracker goes above and beyond the performance of a stock screener in the sense that it gives you an overall assessment of the performance of your portfolio. These powerful resources provide real-time records of individual transactions, including the attendant gains or losses that have resulted.

Should You or Shouldn’t You Pick a Stock Screener?

When technology is employed to make our lives easier, it should be embraced with open arms. Nowhere is this more pertinent than in trading where so much information is changing hands at lightning speed. Ultimately, if you trade based on gut instinct, emotion, or expectation, you are emotionally trading. This automatically puts you at a disadvantage when picking stocks.

It is strongly advised that traders take emotion out of the equation and focus on the bare-knuckle facts. Which equities are performing well right now? Which financial instruments meet your trading requirements? What status is asset price updates? It’s not always a case of picking the most cost-effective stock to trade, since those may be associated with minimum volatility or lack of interest.

In much the same fashion, you certainly don’t want to pick a stock screener that is dirt cheap, or heavily overpriced. That defeats the purpose of using technology to make your life easier, and better. Remember, the acquisition of knowledge will invariably help you to make more informed trades more often. Pick a stock screener that is trusted by many traders, and try it with paper trading options (demo accounts) at a reputable stocks trading platform.