Restaurant insurance is essential for businesses engaged in foodservice. It’s not all the time that your restaurant will operate smoothly. Accidents, fires, theft, lawsuits, revenue loss, and other unexpected adverse situations can threaten the continued operation of your business and the security of its employees and customers.

Restaurant insurance is a type of business insurance that will help cover these risks. This insurance does not refer to a specific insurance policy. It is a collection or bundle of plans protecting cafes/coffee shops, bars, fast food restaurants, fine dining facilities, full-service restaurants, and other businesses engaged in food and beverage service. Read on to know more about restaurant insurance and its significance in foodservice establishments.

Businesses That Need Restaurant Insurance

Just because it is called restaurant insurance, it does not mean it is exclusive for restaurants only. As mentioned earlier, this insurance covers businesses in the hospitality industry. It includes cafeterias, pizza shops, ice cream shops, catering trucks, nightclubs, and other establishments that serve food, beverage, and refreshments. Depending on the nature of a food service establishment’s operation, its owner or manager can project or estimate the cost of restaurant insurance they will include in its expenses. The more extensive the coverage a business owner wants, the higher the insurance cost becomes. At the minimum, make sure to cover property insurance, general liability insurance, business interruption insurance, and product liability insurance in your insurance cost calculation.

Why Do Food and Beverage Service Businesses Need Restaurant Insurance?

As mentioned earlier, businesses in the hospitality industry are exposed to risks that can threaten the continuity and stability of their operations.

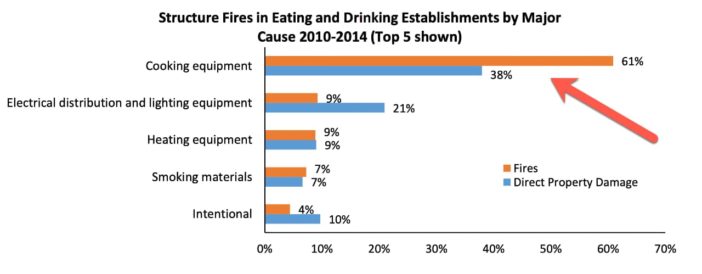

According to statistics, there are almost 7500 fires in restaurants in the US during 2010 and 2014. The leading cause is cooking equipment covering 61% of all restaurant fires and 38% direct property damage. The second cause is electrical distribution and lighting and heating equipment.

As you can see, there can be high consequences if something goes wrong. An employee suing due to getting injured on the job or a customer complaint getting hurt on business premises can affect the business. Delivery vehicles and various kinds of business equipment need insurance coverage. This is especially important when delivery drivers get involved in road accidents and machines and equipment malfunction or break down. These and other small and big emergencies that restaurants and similar businesses encounter need to be covered by restaurant insurance.

It Provides Financial Protection

Natural disasters and emergencies are unexpected and cause costly interruptions in a business operation. Most of the time, you will not be able to pay out of pocket for damage repair and payment of your employees. Insurance can help you pay for repairs and regain revenue losses. You can do this without depleting your life’s savings or risking filing for bankruptcy.

It Helps to Protect Your Employees

Worker’s compensation insurance is an integral part of a restaurant insurance package. It helps cover the medical expenses of employees or staff who get injured on the job. It also covers the compensation of employees who are out of work while recovering from their medical treatments. This insurance inclusion can help protect you from lawsuits or minimize its impact on your business as an employer.

It Helps to Protect Your Customers

In situations where a customer gets injured on-premise, your restaurant insurance can help cover the medical expenses. Insurance that covers customers helps give an added layer of protection aside from removing the safety hazards in your establishments.

As a wise entrepreneur or manager, you need to protect your business from risks and uncertainties. They can jeopardize your operations. Restaurant insurance is a neat package for those owning businesses in the food and beverage sector that can cover various areas of your business operation, including its employees and customers. Having this package may entail an extra cost for your business, but the protection it provides to keep your business running is well worth it.