Cryptocurrencies are digital coins that have been widely used in international trading in the last decade. These are usually incredibly safe to carry out financial transactions since they have many layers of protection from any external agent that might want to steal your investments.

Currently, many websites work with crypto deposits and payments. These are trading sites to exchange your coins, investment exchanges where you can buy and sell goods, and even online casinos, where you can multiply your capital by playing online baccarat games with cryptocurrency deposits. These sites feature high security, as they work with cryptographic means, utilizing blockchain technology to ensure safe transactions.

However, there can always be a risk, which, however low it may be, is there. That is why we will show you some ways to protect your cryptocurrencies and provide tips to increase your investments to increase your economic benefit.

Why You Need to Protect Your Cryptocurrencies Against Theft and Hacking?

The cryptocurrency industry has become fiercer in the last decade, and there is a well-known narrative in the digital currency community. It tells us that any individual who handles virtual currencies is subject to a potential malicious hack.

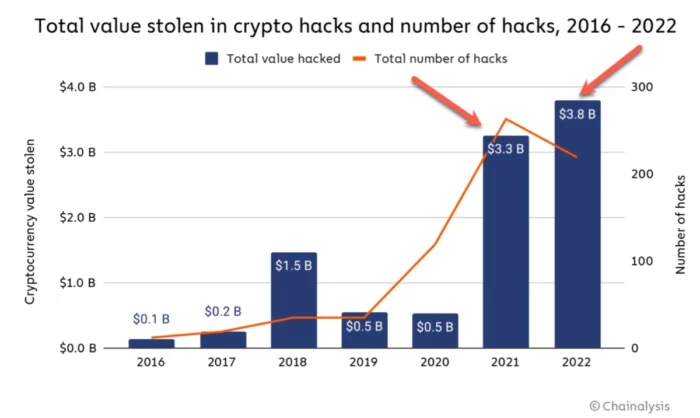

According to a Chainalysis report, cryptocurrency investors lost almost $4 billion to hackers in 2022, up from $3.3 billion in 2021. Even though there are less number of hacks, still total value lost is much higher than in 2021. It seems that the last two years were the biggest when it comes to hacking related to cryptocurrency.

The result of these attacks is evident: Your virtual currencies disappear. Hackers are like ninjas and can evaporate into the infinite network void, carrying virtual assets that are impossible to trace or recover.

To avoid this, we will give some guidelines so that you can protect your cryptocurrencies from malicious agents.

1. Cold Wallets Are Essential

Many crypto investments handle popular virtual currencies like Bitcoin or Ether on their platform. Virtual exchange sites often take security measures to prevent theft. However, they are not immune to hacking, so securing a wallet is the best way to protect your investment.

There are two main types of crypto wallets, software and hardware. Hardware wallets, known as ‘cold storage’ or ‘cold wallet,’ are the more reliable option. These wallets look like USB drives and are a physical medium for coins or tokens storage.

There is no hacking chance since they do not depend on an internet connection. Each hardware wallet has a personal use key that decrypts it, thus granting access to the coins it stores. While hardware wallets are incredibly effective against theft, they carry the additional risk of losing your wallet’s contents if you lose your password.

2. Use Different Wallets

Those skeptical about trusting a physical device that anyone can steal or lose to store virtual currency can use an online wallet. Like cold wallets, online wallets often use unrecoverable personal passwords, so keeping them in a safe place is vital. Over time, people opted for different measures to protect their passwords, storing them in safes or as encrypted codes in graphic files.

You can also use online paper wallets generated by internet platforms such as Wallet Generator or Bit Adders. These platforms manufacture cryptocurrency addresses and private passwords that you can print on paper. When you print it, the network deletes the paper wallet password.

Another option that you can use is desktop wallets. There is no direct interaction with the Internet. However, some viruses can retrieve information for these wallets from a desktop computer, making these wallets not as secure as other options.

3. Implement Two-Factor Authentication (2FA)

Two-factor authentication (2FA) is a security measure that adds an extra layer of protection to your accounts. By implementing 2FA, you are required to provide two types of identification before gaining access. Typically, this involves a combination of something you know, such as a password, and something you have, like a mobile device, to receive a unique code.

This dual verification process significantly enhances the security of your online accounts, providing you with peace of mind and safeguarding your sensitive information from unauthorized access.

4. Make Digital Currency Exchanges

The majority of transactions that have to do with cryptocurrencies go through a virtual currency exchange. We can access these platforms using a web browser or a mobile application. They allow users to obtain tokens and virtual currencies using a fiat currency or a different cryptocurrency.

Crypto security experts advise against holding virtual currencies on exchanges for two primary reasons. First, if the transaction gets hacked, you will lose your holdings. And secondly, if they pull off the process for some reason, you may not be able to get your holdings back either.

Exchanges have a system that combines precautions and security hedges to safeguard your cryptocurrency holdings. Although many savvy cryptocurrency investors typically take their holdings off once they complete a transaction.

5. Be Careful with Online Services You Use

It is crucial to exercise caution when dealing with online services, particularly ones that promise free coins, ICOs (Initial Coin Offerings), or airdrops.

Before sharing personal information or transferring funds, take the time to thoroughly verify the legitimacy and authenticity of these services. This includes researching the company, reading reviews, and ensuring that the website or platform is secure and reputable. In such a way, you can protect yourself from potential scams and fraudulent activities.

Only use platforms that have a good reputation and robust security measures. Look for features like cold storage, insurance, 2FA, and encryption.

6. Keep Software Up to Date

To ensure the security of your crypto assets, it is crucial to keep all software on your devices updated. This mainly includes the operating system, antivirus software, and wallets. Regularly updating these components can protect you from potential vulnerabilities and allow you to enjoy a more secure crypto experience.

Remember, taking these proactive measures can go a long way in safeguarding your valuable digital assets.

Conclusion

There are multiple ways to increase your profits safely and not lose your capital. The first thing we must do is select the most reliable virtual currency to invest in since one of crypto’s main characteristics is its market volatility. Values can fall more than 50% or rise to more than 100%.

Selecting a safe cryptocurrency to invest in can seem complicated. However, the ones that usually present the most benefits, and therefore the safest, are Bitcoin and Ethereum. These are investor favorites due to their incredible reliability and security.

The next thing is to create a wallet, preferably hardware, since these are usually much more secure than online ones. You need a wallet if you want complete control of your investments. They offer more security against hacking or any external manipulation, thus helping you secure your gains.