Your business operates in highly uncertain environments. This uncertainty brings a high level of risk to your company. So, you will need to use this business risk management guide to manage your business risk.

Risk management is an important part of your entrepreneurial journey. When you understand this quickly, you will be on the right path to success as an entrepreneur. As you know, it doesn’t matter in which industry or market your business operates. You will always have a high level of uncertainty. This high level of uncertainty brings a high level of possibility for some risk. Because of that, it is important for you to use this risk management guide to progress toward achieving your goals by working on eliminating or minimizing possible business risk types.

My interest in risk management started when I was the head of the risk management department of the Customs Administration. This was the first time when I realized that appropriate risk management principles would improve the overall efficiency and effectiveness of the whole organizational system. I studied, implemented, and measured the efficiency of different risk management principles related to customs matters at that time.

After this period, I started working in my consulting company with many “would-be” entrepreneurs and small business owners. In this period of time, in most cases, I have implemented risk management principles into the everyday operations of these companies and startups. The results that they achieved from implementing these principles were really amazing.

Considering my personal experience regarding this topic, I decided to share a comprehensive risk management guide to help you better manage your business risk. Here, I will explain the basic principles you must incorporate into your company with examples from real-life companies. So, stay tuned. It will be an interesting journey.

What is a Business Risk?

You already understand that owning and running a business requires accepting some level of risk. This can be a risk that you may not succeed. You will lose investments in the form of money, time, and effort. There will always be some degree of risk, but the amount of risk can vary between different businesses, industries, and markets.

The risk is the chance or probability of some dangerous or bad consequences for your small business.

The main features of the business risk are the following:

- The risk is partly unknown. Running the company would be too easy if everyone could easily predict the possible business risks. The biggest problem is that it is partly unknown because risk refers to the future. Something that will happen in the future.

- The business risk will change over time. Because your company operates in a highly dynamic environment, you can not expect the risk to be standard. The only standard thing in business is that business risks will always exist.

- The business risk can be predicted. When you look at the other side, the risk is something that, if you want and know, you can predict through a systematic process in your company.

- The risk can and should be managed. If you analyze specific business elements, you can easily devote specific resources to eliminate or reduce business risk in the relevant area where it is expected to appear.

What is risk management?

Risk management is a set of strategies for analyzing potential risks and defining appropriate policies and procedures to deal with those risks.

The Institute of Risk Management defines risk management as:

the process which aims to help organisations understand, evaluate and take action on all their risks with a view to increasing the probability of their success and reducing the likelihood of failure.

So, if you want to implement an effective risk management process in your company, you will need to:

- Understand the risk of failure for your company, systems, or processes.

- Evaluate and follow possible risks using different measurement techniques so you will know when and where it can happen and increase the possibility of failure.

- Take action to minimize its effect and increase the probability of your company’s success.

As you can see, risk management is a process for minimizing or eliminating risk in different business areas that may have a negative impact or the failure of your business operations.

But, the risk management process is not only related to minimizing and eliminating the negative effects of risk. This concept is a deeper concept that will also include future prevention of the same risk. Your job is to deal with the current risk and ensure that some risks will not appear in the future.

The Importance of Measuring in Risk Management Process

From the beginning, I want to be clear that you must be skilled to work with numbers.

Why numbers, you will ask?

You will easily classify the possible risks if you have the numbers and know how to manipulate them. When you succeed in classifying the risk, or in simple words, when you can say that the chance of risk to appear is 10% and does not appear to be 90%, you can make the right business decisions.

So, the risk management process will require some skills related to measuring something and analytical skills to analyze and make appropriate decisions.

How Can You Measure Risk?

When it comes to measuring, most entrepreneurs think that the risk is something outside their control and they cannot measure it. But the reality is different. You need to understand that you can measure anything you want.

Douglas W. Hubbard, in his excellent book How to Measure Anything – Finding the Value of “Intangibles” in Business, says that

there are just three reasons why people think that something can’t be measured. Each of these three reasons is actually based on misconceptions about different aspects of measurement.

1. Concept of measurement. The definition of measurement itself is widely misunderstood. If one understands what “measurement” actually means, a lot more things become measurable.

2. Object of measurement. The thing being measured is not well defined. Sloppy and ambiguous language gets in the way of measurement.

3. Methods of measurement. Many procedures of empirical observation are not well known. If people were familiar with some of these basic methods, it would become apparent that many things thought to be immeasurable are not only measurable but may already have been measured.

He defines measurement as a quantitatively expressed reduction of uncertainty based on one or more observations.

The often-asked question is, how can you measure the business risk? Is there a unit of measure for the risk?

Most companies classify the risk as high, medium, and low risk. Some use a scale from 1 to 5, where 1 is the lowest risk, while five the highest risk.

Use Systems Approach to Measure Risk

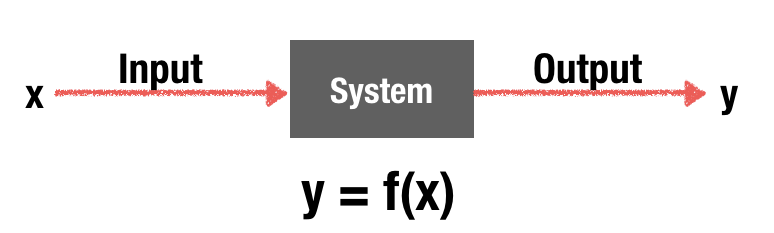

If you simply use a systems approach, you can really measure anything. You must understand that your business is a system composed of many other subsystems, processes, procedures, etc. All of them are in place to help you achieve a specific goal. Each system, process, or procedure has some inputs into them, activities inside them, and outputs or results from them.

When you look at your business and its elements in such a way, you can easily see that you have input variables – x, a process in which you manipulate input variables, f(x) to produce the right output – y. In such a case, the simple equation will be the following:

y = f(x)

If you change input parameters and some procedures inside your processes that manipulate inputs, you will have different results.

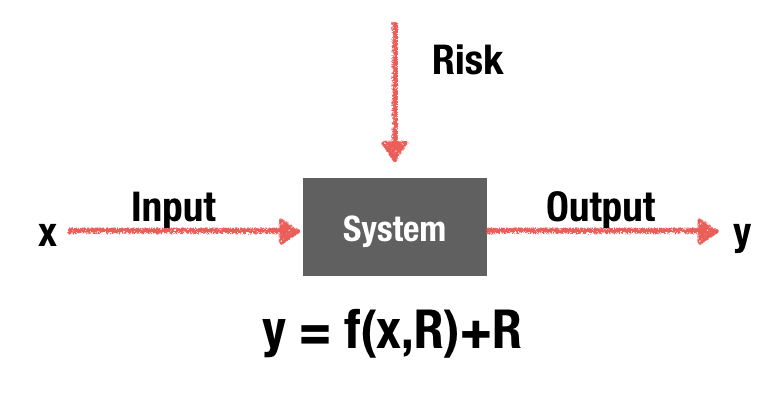

But, as I have mentioned at the beginning of this post, your business operates in highly uncertain environments. Such an environment produces a large level of risk. So, we need to include the risk factors in this equation.

As you can see, we now include the following risk factors:

- Environmental risk factors. For example, competitors’ measures can be part of environmental risk factors. You will probably ask how you will know what the competitors will do. But, again, you have tools you can use to predict and quantify these things using the game theory (But this can be a topic for the future).

- Input variable risk factors. Additionally, there will always be the risk related to input indicators. For example, late delivery can cause a problem for the whole system. Or the price of the raw materials and supplies can vary. Again, you already have a tool to quantify, measure, and analyze these things using ranges. For example, Monte Carlo analysis is something that can be used when it comes to risk related to ranges of data. This will be explained in more detail in some of the next posts.

Related: Everything You Need to Know About Financial Risk

Risk Management Guide: The Process of Risk Management

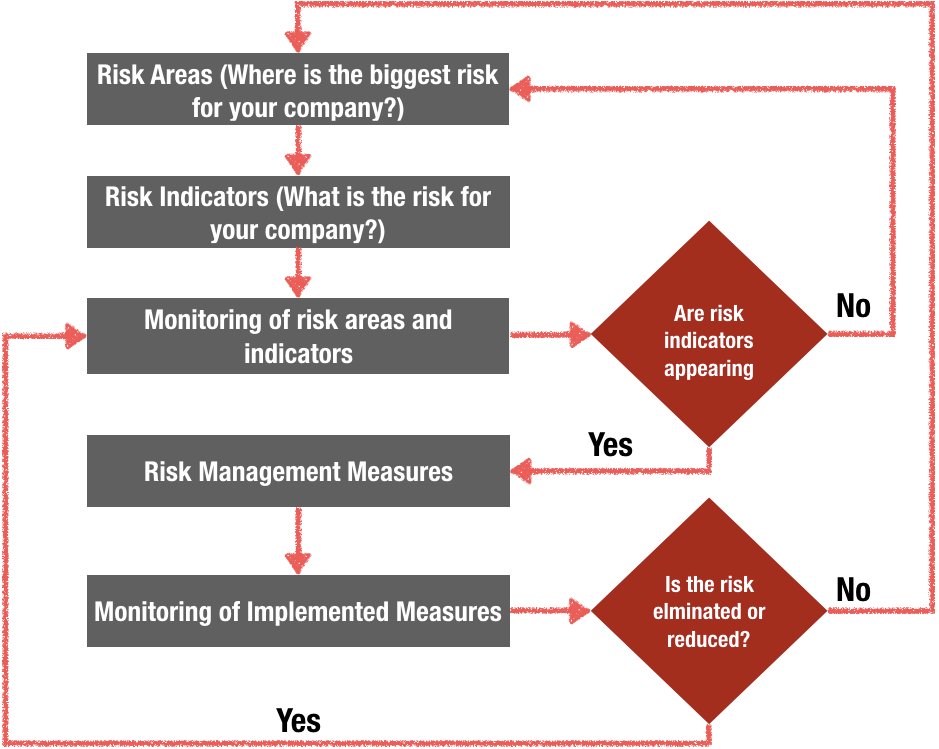

The business risk management process will include the following stages:

1. Definition of business risk areas: Where is the biggest risk for your company?

For most of the companies, the business risk areas can be defined in different ways. But, as a basis to start you can use the following classification:

- The business risk in terms of the value that your business offers (products and/or services),

- The risk in terms of costs and revenue,

- The risk in terms of customers,

- The risk in terms of customer relationship,

- The business risk in terms of distribution channels,

- The Risk in terms of some of the key resources and

- Risk related to key partners for your business.

If you want to implement a customer relationship management system in your company, follow this CRM implementation guide.

It is not necessary that there will be a business risk in all areas that you will define. Also, the business risk in different risk areas will not be with the same intensity in all areas. Therefore, based on your business environment, on the industry in which your business operates, and based on your business model, you will need to determine in which of these risk areas there is a risk to bring undesirable effects for your company.

2. Identification of business risk indicators – What is the risk for your company?

The risk indicator is a kind of measure that should tell you whether the risk appears or not in the specific risk area.

Let’s take an example from a specific risk area. The business risk in terms of distribution channels can use a risk indicator such as delivery late for a minimum of 3 days. This risk indicator will tell you that something is wrong with that specific distribution channel, and you must react in a certain way.

3. Monitoring defined risk areas – Is there some specific risk indicator that appears in some of your business operations?

The goal of this stage of the risk management process is to monitor defined risk areas through risk indicators in order to be sure that something is not as it should be.

For example, if the delivery is more than 3 days late, you know that the risk appears, and you need to move on to the next step. In this section, you will need to establish a monitoring system for each risk area for each risk indicator.

4. Taking concrete measures to deal with the business risk – What should you do?

Once the risk has appeared and is located, it is the right time to take concrete action steps so it will be reduced, eliminated, and will not appear in the future. Some action steps will be to minimize or completely eliminate the impact of the risk on the business operations.

To continue with the example of the business risk related to distribution channels when the delivery is late by more than three days, possible activities can be as follows:

- Apologize to the customers for the delay,

- Define the reasons for the delay,

- Analysis of the reasons,

- Removing the reasons for the future,

- Finding some alternative delivery channels…

At this stage for each risk area and risk indicator, you should try to standardize all possible activities. You cannot expect that they will be final. The specific situation will lead you to concrete action steps. Because of the need for a quick and successful response when the risk appears, it is enough to have some structure for possible activities and responsibilities. However, you don’t want to be in a situation where nobody in the company will know what to do and who should do something when the risk appears.

5. Monitoring of the implemented measures: Have you taken the right measures to deal with the specific business risk?

Because risk management is a dynamic process, it must include the monitoring stage to eliminate that kind of risk in the future appropriately. In such a way, the resources would be directed to new risks in the future. If we use the same example, here we should address the following questions:

- Did customers accept the apology?

- Are there cases of delay again after we eliminate the causes?

- Are new delivery channels much better?

6. Auditing: If you take the right measures, do you successfully deal with the risk?

Can anything be better? Is there a need for new indicators? The last step that you should plan ahead is who, how, and when to conduct the audit of the risk areas and risk indicators.