The longer you spend as an insurance agent, the more interesting your list of contacts and clients becomes. Getting your contacts’ email is an urgent task as such a database of leads is a goldmine.

By segmenting your list by classifying by type of insurance and different needs, you are guaranteeing yourself results.

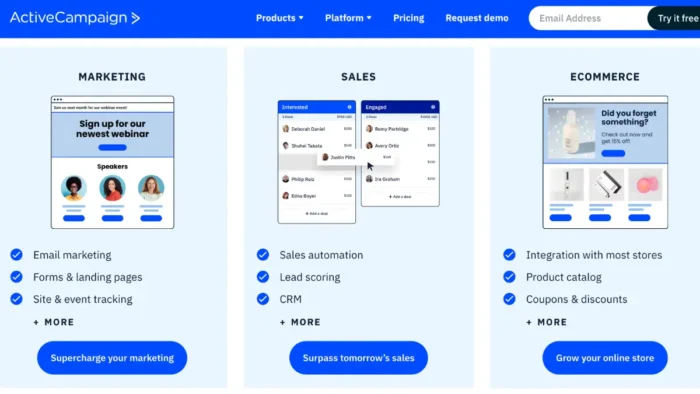

It is a common practice nowadays to send policies to your clients by email. Suppose you use this email marketing for insurance agents to stay in contact with your clients. Use these tips to keep them choosing you and using your services.

Keys to Insurance Email Marketing

Permit Management

The first decisive step is to obtain the consent of these people and companies before sending the emails.

You can do this simply by asking if they want to receive frequent information on the best management of their insurance policies and tips to be better insured. People normally accept, especially if they are already clients or if you have sent them proposals.

Permission is very important to ensure they don’t feel bombarded by your emails, and that they will take advantage of your offers. Part of your success is having good communication with your contactees.

Ensure your email marketing campaign contain valuable information to avoid ending up in the spam box, and therefore, losing customers.

Segment Your List

Segmenting your list means classifying your contacts by one or more details that distinguish them. If you classify your clients or prospects according to their service preferences, you will have a better idea of what information and promotions to send them.

A good segmentation will help you remember the important dates related to your clients, such as the expiration of their policies and even their birthdays.

Thanks to this system, you will know which of your clients would be interested in receiving information about their contracted coverage and the new products they may need. In addition to generating sales, you will be able to retain them and keep them choosing you as their insurance providers as par excellence.

Keeping important information like this is key to reaching your goals. Sending retirement insurance information to 20-year-olds won’t be very effective, but what about prospects 50 and older?

Humanize Your Service

Having your assets insured can ensure that money matters take a back seat in the face of an unfortunate moment in life. This is where you can take advantage of such a situation.

A mistake often made in the insurance industry is distancing yourself from potential clients. Using technical terms is one such mistake. Such errors can be detrimental to your business.

If you want to maintain a relationship of trust with your clients, you must speak to them in a language they can understand and allow them to identify with your company. Try to connect with the person through personalized and constant communication. This will help you improve your results and build a close bond with your audience.

You can schedule emails according to criteria defined as Special Dates (for example, the birthday of your users).

The effectiveness of this type of campaign is more than proven. In fact, according to our statistics, the Open Rate of Birthday Emails reaches an average of 60%. Start putting this into practice!