It’s good news that consumers are protected against defective products that could cause them harm, thanks to product liability laws.

However, it can be difficult for business owners to ensure they are legally protected against product liability claims, including bodily injury or property damage caused by defective products. Therefore, they can often feel like they are constantly putting small businesses at risk.

Still, you can take measures to provide as much protection against product liability claims as possible. One thing is to select the right insurance company for this coverage, but there are also other things, despite business insurance, you can take to protect your small business.

What is Product Liability?

Product liability refers to the legal responsibility that manufacturers, distributors, suppliers, and retailers face when their product causes consumer harm, injury, or loss.

This area of law ensures that your business is held accountable for ensuring that the products it brings to market are safe for public use. A product failing to meet safety standards can lead to significant financial and reputational damage for a company.

Product Liability Insurance VS General Liability Insurance

Some of the most used business insurance policies are product liability and general liability policies. Let’s first see what the difference between them is.

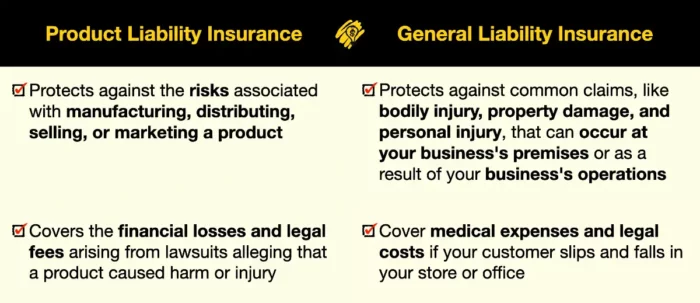

Product liability insurance protects against the risks associated with manufacturing, distributing, selling, or marketing a product and covers the financial losses and legal fees arising from lawsuits alleging that a product caused harm or injury.

This form of business insurance is important for you if your company is directly involved in the product lifecycle because it addresses claims of manufacturing and design defects, as well as improper warnings or instructions.

For example, if your customer is injured from using a defective product, product liability coverage would protect your company by covering the costs related to legal defense and any awarded damages, such as medical costs.

On the other hand, general liability insurance provides much broader coverage because it protects your small business against several common claims, like bodily injury, property damage, and personal injury, that can occur at your business’s premises or as a result of your business’s operations.

For example, general liability insurance would cover medical expenses and legal costs if your customer slips and falls in your store or office.

Product Liability Insurance as a Protection

It’s not compulsory, but it makes sense for businesses and companies that make and sell products to have product liability insurance. Make sure you get yours. Product liability insurance can also be offered as part of a general liability insurance policy or as a standalone policy, catering to companies with varying levels of product risk.

The coverage will be a lifesaver in times of litigation. Factors such as the industry and specific business activities can significantly affect the cost of product liability insurance, with average annual fees for small businesses varying widely.

Suppose someone files a claim against your business because he or she was injured due to product defects. In that case, your small business insurance policy will award the cost of damages the person receives if the court rules against you. This is crucial in protecting your business from product liability lawsuits that arise from injuries or damages caused by your products.

Strict liability is a legal principle where a small business can be held liable for damages even if it took all possible care in manufacturing or selling a product. Product liability insurance offers vital protection against claims under strict liability, ensuring you are covered if your products fail to meet consumers’ reasonable expectations.

To find the best insurance coverage for you, you should check the terms and conditions of different product liability insurance policies and consider any extras you may want to add.

What Does Product Liability Insurance Cover?

Product liability insurance covers legal defense fees and any settlements or judgments arising from product-related lawsuits. This can include compensation for medical expenses, property damage, and even lost wages due to injuries caused by the faulty product.

In addition to physical harm, product liability insurance may also cover damages related to financial losses generated by a faulty product, such as loss of income or business interruption. It also covers the costs of defective product recalls from the market.

Product Liability Insurance Cost

Various factors, including the type of business, the products sold, the volume of sales, and the perceived risk associated with these products, significantly influence the cost of product liability insurance.

According to Forbes Advisor, the average premium for manufacturing businesses is $1,146 annually, ranging between $736 to $1,854. On the other side, wholesale businesses pay an average of $1,159 annually for general liability insurance, which includes product liability insurance. The premiums can range from $751 to $2,431 a year.

Types of Product Liability Claims

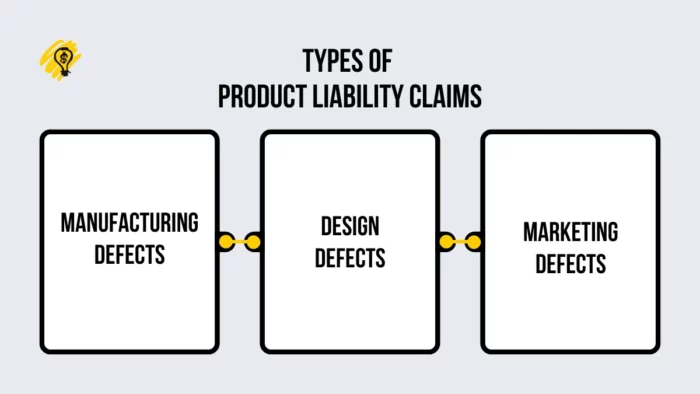

There are three plus one main types of claims related to product liability that this business insurance may cover:

1. Manufacturing defects

This type is when product defects occur during manufacturing, making the product dangerous even if the design is safe.

A manufacturing defect may result from using lower-quality raw materials, some chronic or casual errors on the production line, or simply a failure in quality control checks.

2. Design defects

A design defect involves a product that, despite being manufactured correctly, has an unsafe design that poses a risk to users.

What is important here is that these defects are not isolated incidents but affect every item with the same design.

3. Marketing defects (Failure to warn)

Marketing defects, also known as failure to warn claims, involve products that are potentially hazardous in some way that is not obvious to the user or require the user to exercise special precautions or diligence when using them.

This category includes:

- inadequate instructions,

- failure to provide safety warnings or

- misleading marketing that de-emphasizes the risks associated with a product.

The core issue is the lack of adequate information, which results in unsafe product use.

Some experts in this legal field also mention breach of warranty as a basis for the lawsuit.

This contains situations where a product fails to meet the standards or promises stated by the manufacturer or seller, either through express statements (express warranty) or by implication (implied warranties).

Who Needs Product Liability Coverage?

Any business involved in producing, distributing, or selling consumer goods should consider getting product liability insurance. This includes manufacturers, wholesalers, retailers, and even online sellers.

Even if your company does not directly manufacture products, you could still be held responsible for any harm caused by a faulty product.

For example, if your business imports and sells products from another country, you could still face legal action if one of those products is found to be dangerous or defective.

Other Steps You Can Take to Avoid Product Liability Lawsuits

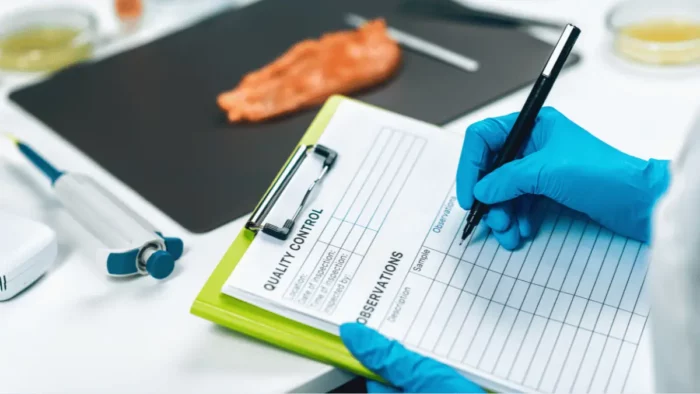

1. Test, Test, and Test Again

The first solution is what any reputable business should already do: thoroughly testing products. Quality management is the best way to protect yourself from lawsuits because of product liability.

If you only perform necessary tests and cut others in an attempt to get to market quicker, it could soon backfire. If a low-quality product is on the market, it can potentially cause harm to a consumer. In turn, you would not only face a product defect or liability claim. Your whole business reputation could be ruined.

So, ensure your products undergo rigorous testing procedures to prevent defective products from occurring.

Also, make sure you document the testing process well. Suppose a faulty product arrives on the market even after thorough testing. In that case, minimizing the impact of a product liability claim will be easier when you can prove the product went through the correct testing procedures.

It will increase your internal quality costs but will impact possible external quality costs.

2. Hire a Legal Expert

Don’t wait to hire a lawyer until you face a product liability claim, especially considering the potential legal fees associated with such claims. It’s a good idea to keep a lawyer on retainer to help manage these fees and consult regarding product liability concerns at any time.

With a good lawyer, you can minimize risks, fees, and other costs and gain guidance on product manufacturing practices.

A good lawyer has a wealth of experience in cases involving defective products, general liability, and other practice areas, such as white-collar crimes in which professional licenses can be taken away, workers’ compensation, and motor vehicle accidents.

3. Perform a Safety Review

During your product’s design and testing stages, you will identify many defects, risks, and hazards and then take action to solve them.

But to make it even more certain that you don’t face a product liability claim, you should take preventative safety measures that meet and exceed industry standards.

So, an additional safety review should be performed at the end of the product creation and testing process to determine whether warning labels or safety instructions are needed.

Furthermore, you must always be aware of the latest hazards, industry guidelines, and legalities to ensure your product and customer safety is always in line with legal requirements and best practice standards. You may need to periodically update things like warning labels.

Summing Up

The more you pay attention to every part of your product’s journey, from conception to manufacturing to testing, the less likely it is the product will be defective or cause harm.

However, you should ensure you get product liability coverage if your product injures anyone and always have a legal expert on standby. Keep testing and performing safety reviews until you’re happy that your product is safe, even if you have a product and general liability insurance claims.