Navigating the complex world of business competition can be a daunting task. Porter’s five forces model offers a powerful tool to help you understand the competitive landscape and make strategic decisions that will propel your business to success. But how can this model be applied in practice, and what are its limitations?

In this blog post, we’ll explore the ins and outs of Porter’s five forces, their real-world applications, and how to combine them with other analytical tools to comprehensively understand your company’s competitive environment.

📖 Key Takeaways

- Porter’s Five Forces Model is an analytical framework designed to help businesses gain a competitive advantage.

- Companies must carefully manage supplier and buyer relationships, identify potential substitute products, and differentiate their offerings to stay competitive.

- Applying Porter’s Five Forces involves collecting data on industry competition, identifying improvement areas, and implementing success strategies.

Understanding Porter’s Five Forces Model

Harvard Business School Professor Michael E. Porter introduced the Five Forces Model as an analytical framework for industry analysis to comprehend the intensity of competition within an industry. Porter, in a 1979 Harvard Business Review article, provides a strategic framework to assess the attractiveness of a particular industry, evaluate potential investments, and analyze the market’s competitive landscape.

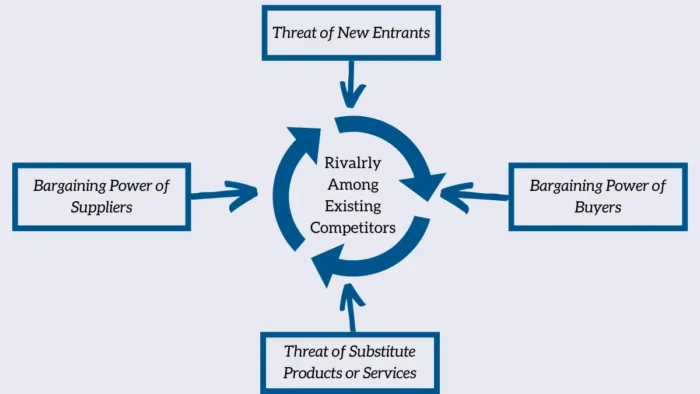

The model is designed to help businesses gain a competitive advantage by understanding the five forces that shape strategy:

- Competitive rivalry

- The threat of new entrants

- Bargaining power of suppliers

- Bargaining power of buyers

- The threat of substitute products or services.

The Porter’s Model comprises five forces determining an industry’s profitability and overall investor appeal. A comprehensive analysis of these competitive forces helps identify key factors that influence the industry’s structure and enables you to devise strategies to navigate the competitive landscape.

This business strategy lets you make informed decisions and capitalize on industry changes.

Related: Your Ultimate Guide to Competitive Research

Competitive Rivalry

Competitive rivalry, one of the competitive forces, is the first force in Porter’s Model and assesses the number and strength of competitors, their pricing strategies, and product quality. This force can significantly impact industry profitability, as it may lead to advertising and price wars, ultimately affecting a business’s bottom line.

To gain market share and establish a competitive advantage, you must focus on differentiating yourself from existing competitors and continuously innovate to stay ahead of the curve.

For example, the airline industry is characterized by intense competition, with low-cost carriers like Southwest Airlines, RyanAir, and EasyJet disrupting the market and challenging existing companies like American Airlines and Delta. To compete effectively, companies in the airline industry must constantly evaluate their pricing strategies, enhance customer service, and explore niche markets to cater to the evolving needs of their target audience.

Related: How to Beat Competition in Business? 13 Steps to Beat Your Competition

The Threat of New Entrants

The threat of new entrants considers various barriers to entry, such as:

- Economies of scale

- Customer loyalty

- Capital requirements

- Government policies

These factors can affect the competition in the industry. High barriers to entry can protect established companies from new competitors and maintain their market share, while low barriers may result in increased competition and decreased profitability.

For example, the pharmaceutical industry is known to have high barriers to entry due to high research and development costs, the requirement for regulatory approval, and the presence of well-established corporations. This makes it difficult for new entrants to gain market share and compete with existing firms.

On the other hand, industries with low barriers to entry, like food retail, are likely to face more intense competition due to the industry structure, as new entrants can easily enter the market and challenge established companies.

Bargaining Power of Suppliers

The bargaining power of suppliers is determined by their ability to increase prices or reduce the quality of their products. Factors such as supplier concentration, product uniqueness, and switching costs can influence the bargaining power of suppliers, affecting input costs and profitability. You must carefully assess their relationships with suppliers, develop strategies to negotiate favorable terms, and minimize the impact of supplier power on your bottom line.

Suppliers can gain more power in various ways, influencing the dynamics of the industry. For example, when suppliers are the only source of a critical component, have a large share of the market, or have few substitutes available, they can wield considerable power. In addition, they can gain more power if they pose a credible threat to forward integration, where they could potentially take over the role of the businesses they supply. This could be through setting up their own outlets or providing services directly to end consumers.

Understanding the power of suppliers and how they can increase it is crucial for you to manage these relationships and negotiate better terms effectively. It’s also essential for you to continuously explore alternative suppliers and substitutes to reduce the power of your suppliers and mitigate potential risks.

For example, the Volkswagen Group maintains limited supplier bargaining power by ensuring the availability of at least one or two backup suppliers for each part, enabling it to shift demand between them. By managing supplier relationships effectively, you can reduce your reliance on a single supplier and mitigate the risks associated with supplier power.

Bargaining Power of Buyers

The bargaining power of buyers in Porter’s Model is influenced by the number of buyers, availability of alternatives, switching costs, and price sensitivity. High buyer power can pressure your company to reduce prices, improve product quality, or offer additional services, ultimately impacting your profitability.

To reduce buyer power, you can focus on enhancing customer satisfaction, building a strong brand, implementing loyalty programs, and providing exclusive value propositions.

For example, in the streaming services industry, buyers have a high buyer power due to the availability of numerous alternatives and low switching costs. Companies like Netflix, Hulu, Disney+, and Amazon Prime Video must continuously innovate, differentiate their content offerings, and provide a seamless user experience to retain their customer base and maintain profitability.

Related: How to Start a Streaming Music Business: Building an App Like Spotify

Threat of Substitute Products

The threat of substitute products evaluates the availability of alternative products or services that can replace a company’s offerings, potentially affecting its competitiveness and profitability. A high threat of substitute products can constrain industry profits, as customers are more likely to switch to alternative options if they find them more attractive or cost-effective.

For instance, the rise of messaging apps like WhatsApp and Facebook Messenger has posed a significant threat to traditional email services as users increasingly opt for instant communication options.

Similarly, the emergence of online travel booking platforms has disrupted the travel agency industry, with customers preferring the convenience and transparency of booking directly through booking services.

You must continuously innovate and improve your products and services to make them less substitutable and maintain customer loyalty.

Related: Uncovering Hidden Opportunities: A Guide on How to Find a Gap in the Market

Real-world Examples of Porter’s Five Forces

To comprehend the practical applications of Porter’s Five Forces Model, we’ll delve into its application in two distinct sectors: streaming services and pharmaceuticals. In each case, the model offers valuable insights into the industry structure and competitive landscape, assisting you in identifying areas for enhancement and potential growth opportunities.

By analyzing the streaming services and pharmaceutical industries through the lens of Porter’s Five Forces, we can uncover each industry’s unique challenges and opportunities, offering a comprehensive understanding of the factors that drive industry profitability and competitiveness.

Example 1: Streaming Services

Streaming services like Netflix, Hulu, and Amazon Prime Video face intense competition in a rapidly growing market. With existing companies continually expanding their content libraries and new entrants like Disney+ and Apple TV+ entering the fray, the industry’s competitive rivalry is at an all-time high.

Furthermore, the high bargaining power of buyers in this industry demands continuous innovation and differentiation to maintain customer loyalty and profitability.

In response to this competitive environment, streaming services must focus on creating exclusive, high-quality content, improving platform usability, and offering personalized experiences to appeal to their target audience. By staying ahead of the curve and adapting to evolving consumer preferences, these companies can maintain their market share and thrive in an increasingly crowded market.

Example 2: Pharmaceutical Industry

The pharmaceutical industry experiences high barriers to entry, strong supplier power, and a moderate threat of substitutes, leading to high profitability for existing companies. With significant research and development costs, high regulatory approval requirements, and well-established corporations, new entrants face considerable challenges in gaining market share.

To maintain their competitive position, pharmaceutical companies must invest heavily in research and development, establish strong relationships with suppliers, and continuously innovate to create unique, high-quality products. By focusing on these strategies, established pharmaceutical companies can continue to thrive in a highly regulated and competitive industry.

Implementing Strategies Based on Porter’s Five Forces Analysis

Formulating a competitive strategy grounded in Porter’s Five Forces analysis can bolster a business’s competitiveness and expand its market share. A detailed examination of each force and recognition of areas for enhancement allows you to address challenges proactively and seize growth opportunities as competitive forces shape strategy.

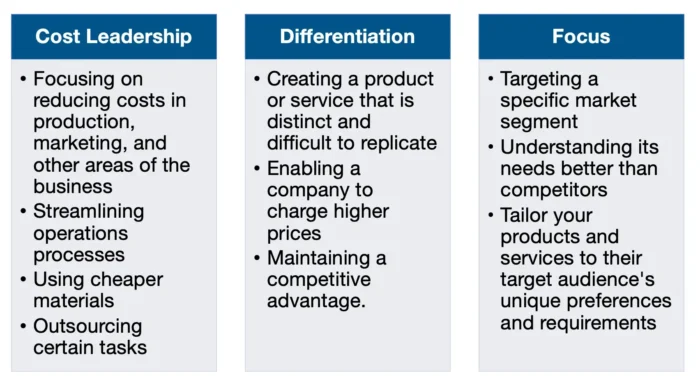

Porter’s Five Forces analysis can help you achieve cost leadership, differentiation, or focus on a specific market segment. By implementing these strategies, you can better understand your competitive environment, develop a strong corporate strategy, and create a clear roadmap for success.

Cost Leadership

Cost leadership aims to reduce costs and increase profits by offering products or services at competitive prices. You can achieve cost leadership by:

- Focusing on reducing costs in production, marketing, and other areas of the business

- Streamlining operations processes

- Using cheaper materials

- Outsourcing certain tasks

These are viable options to consider. The benefits of cost leadership include:

- Providing competitive prices

- Boosting profits

- Helping businesses gain market share

- Expanding their customer base

However, the primary disadvantage of a cost leadership business strategy is that it may reduce quality, as you may need to cut some things to lower costs. It may also lead to decreased customer loyalty, as customers may be more likely to switch to a competitor if they find a more attractive price.

Differentiation

Differentiation focuses on creating unique, high-quality products or services that appeal to a specific target audience. A differentiation strategy involves:

- Creating a product or service that is distinct and difficult to replicate

- Enabling a company to charge higher prices

- Maintaining a competitive advantage.

Implementing a differentiation strategy requires continuous innovation, as you must constantly develop new products and services that cater to the evolving needs of your target audience. By offering unique and superior products, you can differentiate yourself from your competitors and maintain customer loyalty despite the potential for higher prices.

Focus

Focus strategy involves targeting a specific market segment and understanding its needs better than competitors. By concentrating on a particular demographic or niche market, you can tailor your products and services to your target audience’s unique preferences and requirements, thereby gaining a competitive advantage over rivals and, in such a way, reducing the power of competitive rivalry.

Examples of focus strategy include streaming services aiming to reach a particular demographic, such as young adults or pharmaceutical companies concentrating on a particular illness.

However, the potential risks associated with a focus strategy include the danger of becoming too specialized and being unable to adjust to evolving market conditions. Additionally, a focus strategy can be challenging to execute in highly competitive markets.

Combining Porter’s Five Forces with Other Analytical Tools

For an exhaustive understanding of a company’s competitive landscape, merging Porter’s Five Forces with other analytical tools like SWOT Analysis and Value Chain Analysis proves advantageous. Porter’s Five Forces concentrates on external factors impacting an industry’s structure, whereas this analysis appraises a company’s internal strengths, weaknesses, opportunities, and threats.

On the other hand, Value Chain Analysis examines a company’s activities and processes to identify areas for improvement and potential competitive advantages.

By integrating these tools with Porter’s Five Forces, you can gain a holistic view of your competitive environment, allowing them to make informed decisions and develop effective strategies for success. This integrated approach can help you identify their strengths and opportunities while also addressing weaknesses and threats, ultimately leading to a more robust and more competitive strategy.

SWOT Analysis

SWOT Analysis is a powerful tool for evaluating a company’s internal strengths, weaknesses, opportunities, and threats. By identifying these factors, you can formulate strategies and plans to maximize strengths and opportunities while minimizing weaknesses and threats. This analysis can be used in conjunction with Porter’s Five Forces to gain insight into a company’s positioning in the marketplace and help develop a comprehensive corporate strategy.

For example, a company operating in the streaming services industry might identify strong brand recognition and exclusive content as its strengths, while high content acquisition costs and increasing competition might be considered weaknesses. Opportunities could include expanding into new markets or developing original content, while threats might include the rise of new entrants and changing consumer preferences.

By addressing these factors through a combination of Porter’s Five Forces and SWOT Analysis, the company can develop a robust strategic plan for success.

Value Chain Analysis

Value Chain Analysis is a strategic tool used to analyze a company’s activities and processes to identify areas of improvement and potential competitive advantages. It comprises primary activities like production and distribution and support activities like research and development, human resources, and marketing. Examining these activities, you can pinpoint inefficiencies and develop strategies to enhance their overall performance.

For instance, a pharmaceutical company might conduct a Value Chain Analysis to evaluate its supply chain, customer service, and pricing strategies. By identifying areas for improvement, the company can streamline operations, reduce costs, and enhance the quality of its products and services, ultimately increasing its competitiveness in the market.

Combining Value Chain Analysis with Porter’s Five Forces can provide a comprehensive understanding of a company’s competitive landscape and help develop a well-rounded corporate strategy.

Limitations and Critiques of Porter’s Five Forces Framework

Despite its popularity and efficacy, Porter’s Five Forces Model has its limitations and critiques. The main criticism centers on its static nature, failing to account for the perpetual evolution of market conditions and the fluctuating competitive landscape. Moreover, the model does not consider the potential implications of strategic alliances between competitors, which can significantly impact the company’s environment.

Another limitation is the potential irrelevance of Porter’s Five Forces Model in rapidly evolving industries, such as technology and telecommunications. In these sectors, the dynamic nature of the market and the constant emergence of new technologies and competitors can render the model less applicable.

Despite these limitations, Porter’s Five Forces remains a valuable tool for analyzing the competition in the industry and developing effective business strategies.

How to Apply Porter’s Five Forces in Your Business

Implementing Porter’s Five Forces in your business includes analyzing each force, pinpointing improvement areas, and crafting strategies to boost your competitive stance. The process begins with collecting relevant data on your industry and competitors, followed by a comprehensive analysis of each force to reveal potential growth challenges and opportunities.

Analyzing every force and applying strategies accordingly is essential to improve your profitability. Whether you are seeking a competitive advantage or navigating the intricate market, the Five Forces Model can offer invaluable insights to assist you in making informed decisions and achieving success in your business pursuits.

Summary

In conclusion, Porter’s Five Forces offers a powerful framework for analyzing industry competition, identifying factors affecting profitability, and developing effective strategies to strengthen your competitive position.

By understanding the forces that shape your industry and combining this model with other analytical tools, such as SWOT Analysis and Value Chain Analysis, you can understand your company’s competitive landscape and make strategic decisions to propel your business to success. Despite its limitations, Porter’s Five Forces remains an invaluable tool for companies seeking to navigate the complex world of industry competition and achieve lasting success.

Frequently Asked Questions

Porter’s Five Forces are competition in the industry, the potential of new entrants, the power of suppliers, the power of customers, and the threat of substitute products. This framework was first presented in Michael Porter’s 1979 Harvard Corporate Review essay and encourages organizations to look beyond direct competitors and consider broader environmental forces.

Porter’s Five Forces Analysis is a micro-environment framework that focuses on the factors close to the company and attempts to analyze the level of competition within an industry. This model was first published in Harvard Business Review in 1979 and contrasted with more general macro environment frameworks such as PEST.

The Five Forces framework helps businesses analyze competition, identify profit factors, and develop strategies to strengthen their competitive position, providing a comprehensive approach to understanding industry dynamics.

Its static nature limits Porter’s Five Forces, its inability to consider strategic alliances, and its potential irrelevance in rapidly changing industries.