Industry analysis is a tool that helps small businesses and entrepreneurs understand their position in the market and compare it with other companies that produce the same or similar products or services.

Conducting industry analyses will help you improve your competitive strategies to position your company better in a particular industry. Industry analysis can also be a part of your business plan. Comprehensive industry analysis reports will provide valuable insights to achieve sustainable success.

As an entrepreneur, making informed decisions is the cornerstone of your success, and that’s where our compilation of 42 essential questions with subquestions comes into play.

What is Industry Analysis, and What Tools Can You Use to Conduct It?

Industry analysis refers to a market assessment tool that you can use to evaluate your company’s performance compared to others in the same niche.

The Broad Factor Analysis framework comprises six major elements related to the micro-environment: political, economic, social, technological, legal, and environmental factors – PESTLE analysis, or PEST analysis. This broad factor analysis framework is an excellent way to assess external market conditions. PESTLE or PEST analysis lets you understand the macro-environmental factors.

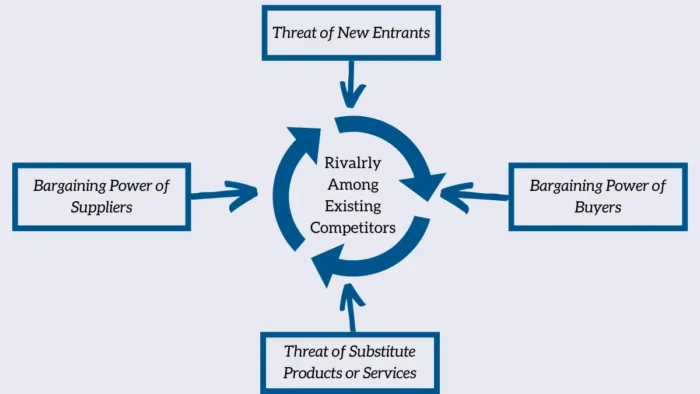

The Competitive Forces Model, also known as Porter’s Five Industry Forces, is a popular framework used for competitive analysis through different forces the industry relies on. Developed by Michael Porter, this model assesses five external industry forces that may impact a market’s competitiveness. These industry forces include the bargaining power of suppliers and buyers, the threat of new entrants, the threat of substitute products or services, and the intensity of competitive rivalry.

By analyzing these factors using the competitive forces model, you can better understand the overall attractiveness and make informed decisions on how to compete effectively. The model is widely used across various industries and has been instrumental in shaping business strategies worldwide.

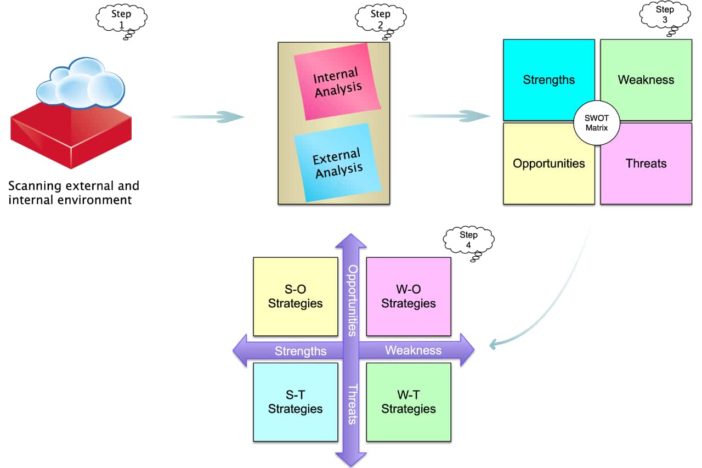

SWOT analysis can help you identify strengths, weaknesses, opportunities, and threats of your company, competitors, and suppliers. Here is how you can conduct a SWOT analysis in four steps with examples.

Identify Your Industry Questions

1. What sector is your small business in?

Start your industry analysis with what you know before you dig deeper into any industry analyses. Write down any insights you have regarding your business.

- What type of products or services does your business offer?

- Do you sell directly to consumers, or do you sell to another company that then sells to customers?

- Who are your target customers?

Data Sources: Your own knowledge of your business and customer base, industry reports, market research reports, etc.

Related: 10 Reasons Being An Entrepreneur Is Better Than Employment

2. What is your industry’s North American Industry Classification System (NAICS) code and description?

The NAICS provides a standardized system for classifying businesses based on the type of economic activity they engage in and assigns each sector a six-digit code for easy identification. You want to check the NAICS codes and descriptions to see if your small business fits into a particular category:

- What is the six-digit NAICS code that best describes your sector?

- What are the activities and products associated with this code?

Data Sources: The U.S. Census Bureau maintains the NAICS system and provides a searchable database on its website.

3. Are there some other related industries?

In this part of industry analysis, you want to find industries where are your potential competitors, suppliers, or even partners. It helps you see the larger picture – potential collaborations, diversification opportunities, and threats.

- What industries have a similar customer base?

- Which industries supply the raw materials you need?

Data Sources: Industry reports, market research, and networking events.

Overview of Your Industry

4. What is the history of the industry?

The history inside your industry analysis provides a roadmap of its evolution, illustrating how it has adapted to technological changes, market conditions, and consumer behavior over time. This part of industry analysis is invaluable in understanding current industry trends and predicting future ones.

- How has the sector evolved over time?

- What key events or changes have had significant impacts?

Data Sources: Industry reports, academic journals, news articles.

5. What affects the industry growth?

Identifying growth factors as a part of industry analysis helps you understand what fuels your industry’s expansion and can help you align your small business with the growth and capitalize on opportunities.

- What are the key trends influencing the industry’s growth?

- How do economic conditions affect the sector?

Data Sources: Economic indicators, market research reports, and news articles.

6. Who are the leaders in the entire industry?

Identifying leaders and understanding their success can offer insights into effective strategies and practices within the same industry you want to be in.

- Who are the top players?

- What strategies have contributed to their success?

Data Sources: Company websites, financial reports, and business news outlets.

7. Are there any government regulations?

The first step in understanding regulations as a part of your industry analysis is identifying the relevant governing body. For example, the Federal Communications Commission (FCC) regulates the telecommunications sector in the U.S., while the Food and Drug Administration (FDA) oversees the pharmaceutical sector.

- What are the relevant local, state, and federal regulations?

- Is there environmental regulation that will regulate the sector?

- How do these regulations affect business operations?

Data Sources: Government websites (you can find resources about government bodies on Investopedia), industry associations, and legal databases.

Industry Trends

As a part of industry analysis, the trends look at the historical data to discover specific trends to forecast the future.

8. What is the estimated size of the sector in money and products sold?

When conducting industry analysis, it’s crucial to understand an industry’s size in monetary value and the volume of products sold. This knowledge can provide valuable insights into the potential market share you can capture and will help you in strategic decision-making.

Related: Real-life Organizational Decision-Making Examples

- How much revenue does the sector generate annually?

- How many units of the primary product or service are sold?

Data Sources: Industry reports, market research databases, and government statistics.

9. What are the trends in sales over recent years?

Analyzing past sales trends can provide insights into the industry’s health and its potential future trajectory.

- Have sales been increasing or decreasing recently?

- Are there seasonal fluctuations in sales?

- Are there some demographic trends?

- Can you see some consumer behavior shifts?

Data Sources: Industry sales data, financial reports of leaders, and market research databases.

10. What is the industry’s sensitivity?

Industry’s sensitivity refers to its susceptibility to changes in economic conditions or market factors. It’s valuable as it helps you anticipate potential risks, plan strategies, and make informed decisions.

High sensitivity means that it is more affected by changes, while low sensitivity indicates stability regardless of changes.

- Which factors have the greatest impact?

- How do changes in these factors affect the sector’s performance?

Data Sources: Industry reports, news articles, and economic indicators.

11. What type of marketing strategy is usually used?

Identifying the marketing strategy commonly used in a specific sector is crucial because you will understand the tactics that drive success and inform your strategic planning.

- What marketing channels are commonly used?

- What types of messages tend to resonate with customers?

Data Sources: Marketing case studies, competitor websites, social media platforms, customer surveys, and expert interviews.

12. What are management trends?

A thorough industry analysis must include an analysis of management trends.

Management trends refer to shifts in how companies manage their operations, employees, and strategies. These trends can inform your management style and the management skills you will need to ensure effective business operations.

- Are there new approaches to leadership, employee engagement, or operational efficiency?

- How are businesses adapting to changes?

Data Sources: Business magazines, conferences, and professional networking groups.

Customers and Potential Customers

Customers and potential customers are the central element of every type of business analytics. Your business serves their needs. Knowing your customers better will give your small business a better competitive edge.

13. What is the size of the population on the market?

When conducting an industry analysis for a product or service, determining the size of the market population is a crucial step. It helps to identify potential customers, understand the competitive environment, and find growth opportunities.

- How many people could potentially use your product or service?

- Is this number growing or shrinking?

Data Sources: Census data, market research reports, and publications.

14. What is the average customer’s age on the market?

The average customer’s age can give you insights into their lifestyle, purchasing habits, needs, and preferences.

- What is the age range of your target customers?

- How does age impact buying behavior?

Data Sources: Market research data, customer surveys, and social media analytics.

15. What is the gender distribution?

The gender distribution can influence consumer preferences and behaviors and provide valuable insights to shape your marketing strategies and product development.

- What is the gender distribution of your market?

- How do different genders interact?

Data Sources: Market research data, customer surveys, and social media analytics.

16. What is the average income in the market?

The average income is important because it provides insights into purchasing power, consumer behavior, and overall market potential. For example, if the average income is high, there may be more room for premium products or services. Otherwise, a lower income might suggest a need for cost-effective solutions.

- What is the average income of your target customers?

- How does income affect purchasing behavior?

Data Sources: Census data, market research reports, and publications.

17. What is the percentage of ethnicity?

Ethnicity can influence cultural preferences, which may impact buying behavior. This information can help you ensure your products, services, and marketing efforts are culturally sensitive and appealing.

- What is the ethnic breakdown of your market?

- How does ethnicity influence consumer behavior?

Data Sources: Census data, market research reports, and customer surveys.

18. What family statuses exist on the market, and what is their percentage?

Family status refers to the composition of a household. It could include single individuals, cohabiting couples, married couples with or without children, single parents, and multi-generational families.

- What family statuses are most common in your market?

- How does family status affect consumer behavior?

Data Sources: Census data, market research reports, and customer surveys.

19. What type of lifestyle is relevant for the market?

Lifestyle factors, such as values, interests, and activities, can influence consumer preferences and buying behavior, so it will help you align your products, services, and marketing efforts with your customers’ values and interests.

- What lifestyles are common in your market?

- How do these lifestyles impact consumer behavior?

Data Sources: Market research reports, customer surveys, and social media analytics.

20. What are consumption trends?

Understanding consumption habits can help you identify trends, understand buying decisions, and anticipate changes in demand for your specific product or service.

- What products or services are growing in popularity?

- Are there any declining trends?

- Do the customers show loyalty to specific brands, and why?

- Are customers prone to impulse buying?

- Do customers tend to make purchases at specific times?

- How do these habits influence the demand for your offering, and how might they affect supply needs?

Data Sources: Sales data, industry reports, and social media analytics.

21. Where are potential customers?

Knowing where your potential customers live, work, and spend their time can help you reach them effectively. This information can guide your distribution and marketing strategies.

- How do you determine your potential customer base and their location?

- Where do your potential customers live?

- Where do they spend their time online and offline?

Data Sources: Census data, online analytics tools, customer surveys, social media listening, etc.

22. What is the Bargaining Power of Buyers?

The bargaining power of buyers refers to the ability of customers to influence the price and terms of purchase. In other words, it’s about how much control your customers have over the buying process.

A high power of buyers means customers have more choices, can easily switch to competitors, and demand better quality or lower prices, all of which can impact your company’s profitability.

- How price-sensitive are your customers?

- How much influence do they have over pricing?

- Are there substitute products so they can switch easily to them?

- What is the quality of your products/services compared with the averages?

- Are there some industry regulations that can impact the power of buyers?

Data Sources: Industry reports, customer surveys, and sales data.

23. What are customer switching costs?

Switching costs refer to the expenses (time, money, or effort) that a consumer will need to spend because of changing brands, suppliers, or products.

These costs play a crucial role in customer retention. When switching costs are high, customers are likelier to stick with your product, even if competitors offer a slightly better deal or quality.

- What would it cost customers to switch to a competitor?

- How loyal are customers?

Data Sources: Customer surveys, industry reports, and customer feedback.

Competitors

Competitive analysis through potential and existing competitors is an important part of your industry analysis to understand your competitive dynamics. Also, you can make a comparative analysis to see where you are according to the competition to gain a competitive advantage.

24. How many competitors exist there?

One of the critical aspects to consider in your industry analysis is the number of competitors for a given product or service. Knowing the number of competitors in your market gives you an idea of the level of competition.

- How many direct competitors exist?

- How many indirect competitors exist?

Data Sources: Industry reports, online directories, public records (business registrations and patent filings), market research databases, search engines, and social media platforms.

25. Who are the major competitors there?

In the post titled How to Differentiate Yourself, you can read about how to find your real competitors.

- What products or services do major competitors offer?

- What sets them apart (product quality, pricing strategy, brand reputation, customer service, and marketing efforts)?

- What are their strengths and weaknesses?

Data Sources: Competitor websites, industry reports, online databases, trade publications, social media and customer reviews.

26. How long have they been in the industry?

Understanding your competitors’ longevity can indicate their level of experience and market understanding. It provides context, reveals trends, and offers valuable insights to inform your strategic planning.

- How have these competitors evolved over time?

- What challenges have they faced, and how have they overcome them?

- What successes have they enjoyed?

Data Sources: Business registries, news archives, company websites, industry reports, press releases, interviews with industry insiders or past employees, and financial statements.

27. How much market share do they have?

Researching a competitor’s market share provides valuable insights into your competitive landscape by giving you a sense of a competitor’s influence and success in the market.

- How has their market share changed over time?

- What factors have contributed to their market share?

- How your competitor’s market share might affect your business strategy?

- Are there gaps in the market that you could exploit?

- Could you learn, and what can you learn from your competitor’s successes or failures?

Data Sources: Market research reports, financial reports, competitor’s press releases, and news articles.

28. Where is their location?

Remember, this process is about understanding the implications of these locations for your business strategy. So, it’s not just about where your competitors are but about where you want to be.

- Where are their headquarters, manufacturing facilities, or stores located?

- How does their location affect their operations and customer reach?

- Are your competitors clustered in specific regions?

- What might this mean for your business?

Data Sources: Company websites, business directories, and industry reports.

29. How easily can other businesses enter your market and become competitors?

This refers to the barriers to market entry that can protect existing businesses from new competition.

Understanding the barriers like capital requirements, regulations, brand loyalty, access to distribution channels, etc., will provide insight into new competitors’ potential threats and help you assess new competition’s risk.

- What resources or capabilities are required to enter this market?

- Are there regulatory, technological, or financial barriers?

- How might new competitors overcome these barriers?

- Are there risks posed by substitute products or services?

Data Sources: Industry reports, academic journals, and government regulations.

Suppliers

Suppliers are other companies that supply your company with raw materials or other products and services crucial for normal business operations.

30. Who are the major suppliers there?

This question helps you identify key suppliers and gives you a clear picture of where your resources are coming from. Understanding who they are allows you to assess their reliability, quality, and cost-effectiveness.

- What products or services do they provide?

- How long have they been doing it?

- What is their reputation in the market?

- How reliable are they in terms of quality and delivery?

Data Sources: Supplier websites, industry reports, and customer reviews.

31. How much power do they have over you and your competitors?

Supplier power refers to the ability of suppliers to influence prices or terms. Suppliers with significant market power can influence prices and terms, impacting your costs and overall competitiveness.

- Do they control an essential resource?

- Do they have exclusive rights to a resource?

- Can they set prices without losing customers?

- Are they the only source of an essential product or service?

- How indispensable are they to your operations?

Data Sources: Contract terms, industry reports, and financial statements.

32. Are there more than one supplier?

Having options is always beneficial. Multiple suppliers increase competition, potentially leading to better pricing power and terms. It also reduces your risk if one supplier fails to deliver.

- How many suppliers are there?

- What makes each of them unique?

- Are there benefits to diversifying your supplier base?

Data Sources: Industry directories, trade journals, supplier websites.

33. Is it difficult for your suppliers to enter your market, selling directly to your customers?

This question assesses the risk of disintermediation, where suppliers bypass intermediaries like you and sell directly to end customers.

If suppliers can easily start selling directly to your customers, they become potential competitors.

- Can they sell directly to your customers?

- How likely are they to take this step?

- Are there regulations preventing this?

- Do they have the necessary resources and capabilities?

- Are there regulatory barriers preventing them from doing so?

Data Sources: Industry reports, supplier websites, and news articles.

34. What is the portion of your business with them from their whole business?

If your business represents a significant portion of a supplier’s revenue, you may have more negotiating power over them.

- How much of their sales come from your orders?

- How would they be impacted if they lost your business?

Data Sources: Supplier financial reports, contract terms, and industry reports.

35. Can you easily and quickly switch to substitute products from other suppliers?

The ease of switching suppliers affects your bargaining power and ability to adapt to changes in supply conditions.

- Are there quality, technical, or compatibility issues with substitute products?

- What are the costs associated with switching suppliers?

Data Sources: Industry directories, supplier catalogs, internal cost data.

Products

For the products, your company and your competitor take money from customers. It is important to analyze positioning your products on the market compared with competitors and substitutes.

36. What types of products are offered?

This question helps you understand the core offerings and can help you identify market gaps and innovation opportunities through your industry analysis.

- Are the products tangible or intangible?

- What is the average quality of the products or services?

- What are the various product categories?

- What features or attributes are standard?

- Are these products/services high-end or budget-friendly?

- How are they delivered to the customers?

- What is the average pricing?

Data Sources: Industry reports, market research reports, competitor websites, and customer reviews.

37. What is the uniqueness of your products?

Identifying what sets your products apart in your industry analysis helps you establish a unique selling proposition (USP), a crucial aspect of your brand identity.

- What is the quality level of your products/services?

- What features or benefits make your product unique?

- How does your product solve problems differently than what already exists?

- How do these unique attributes meet customer needs?

Data Sources: Product specifications, customer feedback, product testing, market research, and team brainstorming sessions.

Related: The Team Effectiveness and Different Roles in Teams That Win

38. What are the products that competitors offer?

Knowing your competitors’ offerings allows you to compare and differentiate your products and also anticipate market trends. This information can inform your product development and pricing strategies.

- What are the most competitive products/services with yours?

- How do the leading competitor’s products compare with yours regarding features and quality?

- How do the leading competitor’s products compare with yours regarding price?

- What are the strengths and weaknesses of your competitors’ products?

Data Sources: Competitor websites, industry reports, market research reports, and customer reviews.

39. What products could your customers buy instead of yours?

This question in your industry analysis helps you identify substitute products, which are alternatives that can fulfill the same need as your product, and understanding potential alternatives can help you position your product more effectively.

- What other products can meet the same or similar customer needs?

- How do these products compare in terms of price and convenience with yours?

- How do these products compare in terms of customer’s problem solving with yours?

- Why might customers choose these alternatives?

Data Sources: Market research reports, customer surveys, industry reports, and social media listening.

40. Are there substitute products in the marketplace?

Substitute products serve the same purpose but through different means, threatening your product’s demand.

- How many substitutes are available?

- How popular are they among consumers?

- Is there something substitutes don’t deliver and your products/services deliver to customers?

- Is there something your products/services don’t deliver and substitutes deliver to customers?

- How much can these gaps in features and quality can impact customers purchasing decisions?

Data Sources: Market research reports, industry reports, customer surveys, social media trends, and consumer forums.

41. How do substitute products affect the marketplace?

It is essential to know how substitutes can influence the market because substitute products can influence market dynamics, including pricing, demand, and customer loyalty.

- What is the pricing of defined substitutes?

- How do these substitutes impact your product’s pricing?

- Do substitutes affect customer demand for your product?

- How sensitive are customers to the price or performance of substitutes?

- How have substitutes impacted the market in the past?

Data Sources: Market research reports, industry reports, sales data, customer surveys, customer interviews, social media listening, and customer reviews.

42. What are the key factors that affect the thread of substitution?

To manage substitution risk, understand its influencing factors, and identify ways to reduce the threat, like improving product quality or customer service.

- Does the quality or price of substitutes significantly differ from your product?

- Are substitutes easily accessible to your customers?

- How easy is it for customers to switch to a substitute product?

- What would motivate customers to switch?

Data Sources: Customer surveys, market research reports, and sales data.